Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Netflix reported another strong quarter after a downbeat report last time, earning the second spot in the trends list this week. Computing giant IBM took the first position as the company posted disappointing earnings. Blackstone Group was in the news for its business ties to the Saudi Arabian government. Johnson & Johnson reported solid financial results and took the last spot in the list.

Check out our previous Trends edition here.

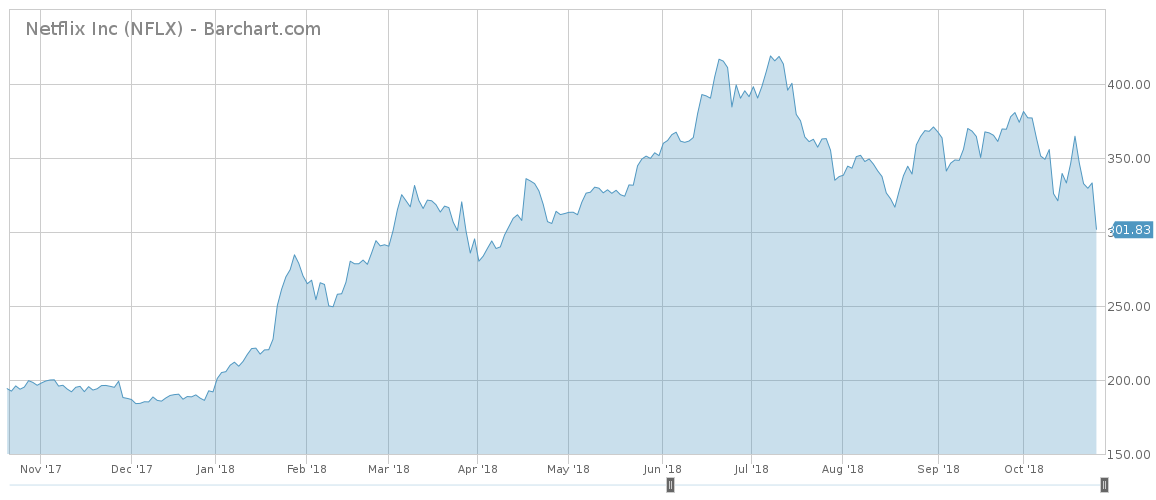

Netflix Whipsaws as Uncertainty Grows

Netflix (NFLX) has been on a roller coaster of late, as the firm combined a spate of both good and bad news. The technology and media company took the second spot this week, with a 55% rise in viewership.

Last Tuesday, after the company reported net subscriber numbers well above analysts’ expectations, the stock surged as much as 15%. However, the stock resumed its decline from that high and is now down as much as 12% over the past five days.

One reason for the decline is the rising level of debt as the company is continuing its investments in content creation to beat the competition. Netflix’s debt rose above the $10 billion mark for the first time in history after the company announced it would issue a fresh junk bond offering worth as much as $2 billion. The proceeds will be invested in content creation, technology and potential acquisitions, among others. Investors began to worry that Netflix’s rising debt may become unsustainable if the pace of borrowing continues at the current pace, particularly as interest rates head up. The benchmark 10-year Treasury yield has risen to 3.2% from as little as 1.3% in mid-July 2016.

Last April, Netflix issued a $1.9 billion bond at 5.8% and a year earlier it raised money at an interest rate of 3.6%. The company is still negotiating the interest rate on the current bond, but it is expected to be above 6%.

The company is investing heavily in new content now as competition from Amazon (AMZN) and others is growing. Disney (DIS) is expected to withdraw its Netflix content in order to create its own streaming service, while AT&T (T ) may bet big on HBO Go, which it recently acquired as part of the Time Warner acquisition.

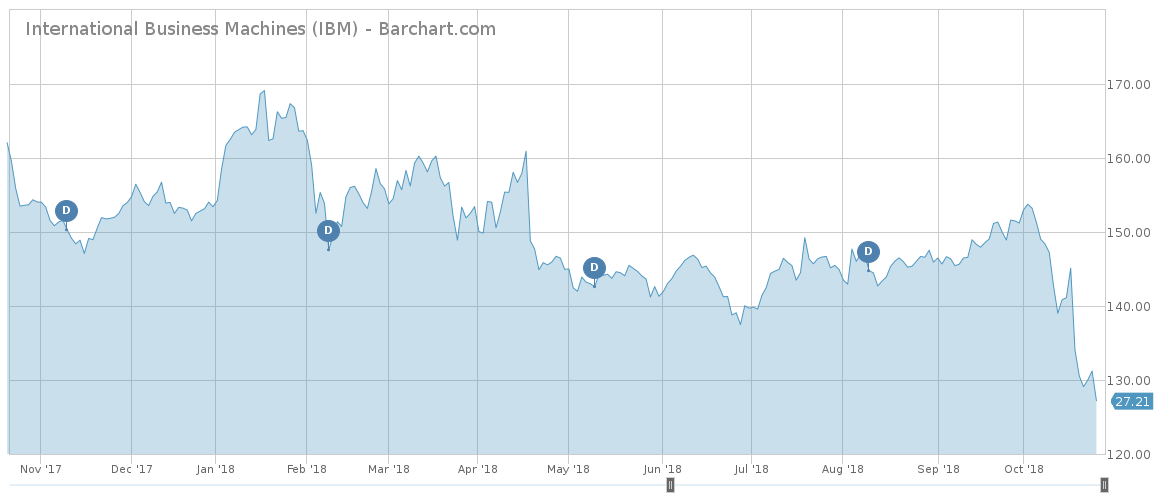

IBM Falls on Lower Revenues

Giant computing firm IBM (IBM ) has reported another disappointing quarter, seeing its stock tumble and viewership surge by 102% as a result. The company beat expectations for earnings but revenues fell woefully short of estimates. Shares in IBM have dropped 14% for the past 30 days, extending year-to-date losses to nearly 16%.

In the third quarter, IBM had revenues of $18.76 billion compared with $19.04 billion expected by analysts. Earnings per share, meanwhile, came in at $3.42, higher than estimates of $3.40. IBM reaffirmed its earnings guidance for the full year of at least $13.80 per share versus consensus of $13.81.

The results are not terrible overall, but investors were worried about the company’s Technology Services & Cloud Platforms division, the sales of which declined amid a booming market for cloud services. The cloud division is expected to be the future driver for the company’s growth but apparently the heavy spending is not proving its worth.

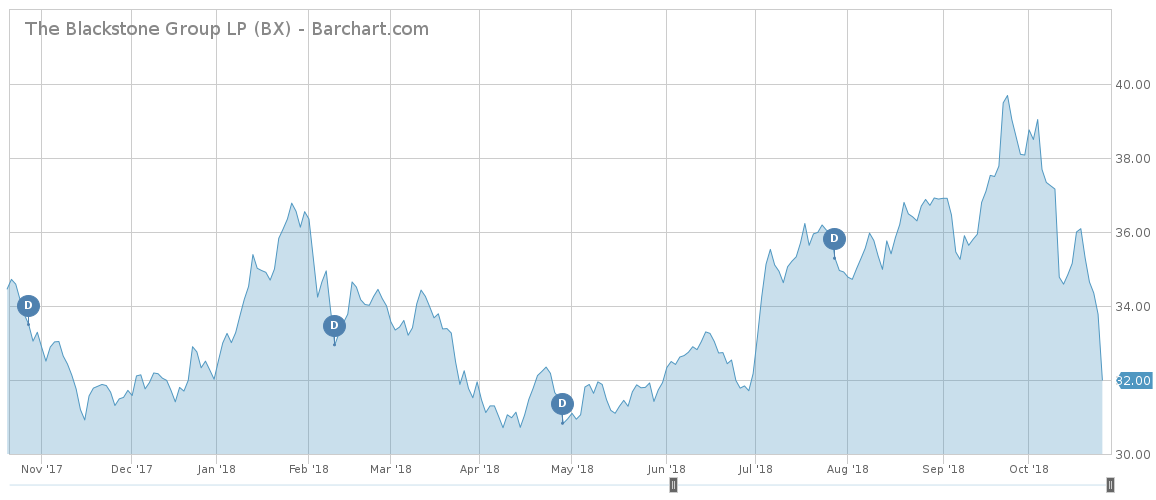

Blackstone Questioned Over Ties to Saudi Arabia

Blackstone Group (BX ) has made the headlines recently for its investment connections to the Kingdom of Saudi Arabia, with investors worried that business may suffer as a result of the backlash against the disappearance of a journalist who expressed criticism of Riyadh’s policies. Blackstone has seen its viewership rise 31% for the week.

The private equity firm, which has $457 billion in assets under management, is relying on Saudi Arabia for half of the money for a $40 billion planned infrastructure fund. The disappearance of Jamal Khashoggi, a U.S. resident and Washington Post columnist, sparked backlash from international media and U.S. organizations.

Riyadh denied any involvement in Khashoggi’s disappearance, but a host of business leaders, including Blackstone Chief Executive Stephen Schwarzman, withdrew from a planned investment conference in Saudi Arabia, also dubbed Davos in the Desert.

Yet Blackstone, which yields 8%, will not fully sever long-cultivated ties with the Saudi Kingdom, with Chief Operating Officer Jonathan Gray saying recently that the firm takes a long-term approach to business relationships.

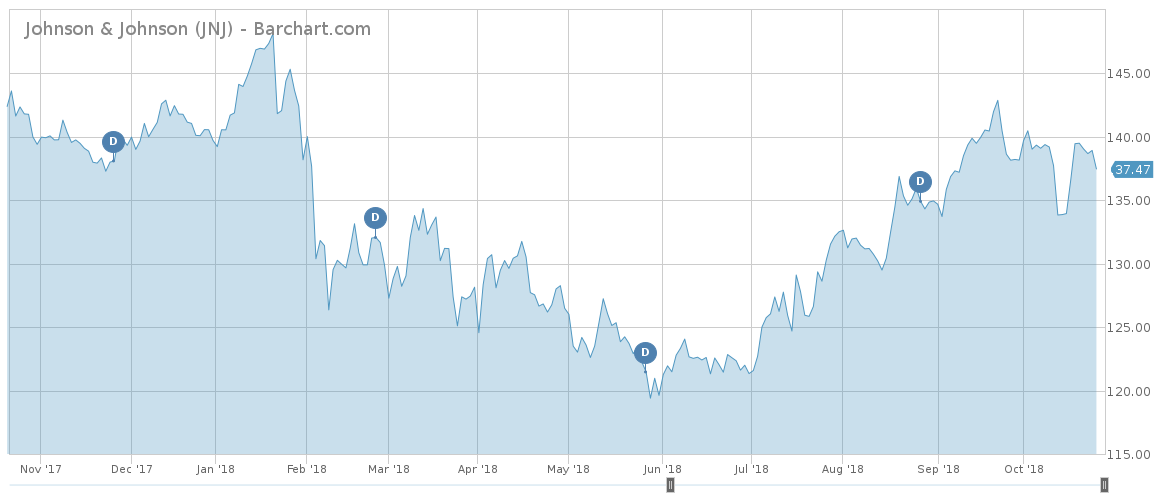

Johnson & Johnson Beats Estimates

Personal care company Johnson & Johnson (JNJ ) has reported strong earnings for the third-quarter, taking the last spot in the list with a 30% rise in viewership. Earnings per share came in at $2.05 compared with $2.03 expected by analysts, while revenues of $20.3 billion surpassed estimates of $20.05 billion.

The strong results came largely on the back of strong sales of cancer drugs and a turnaround in Johnson & Johnson’s baby care unit. Despite the strong revenues, the stock has headed down over the past weeks, amid a broad market sell-off. Shares in Johnson & Johnson, which has a dividend yield of 2.6%, have declined 1.5% during the past five days, extending monthly losses to more than 2%.

The Bottom Line

Netflix stock whipsawed in recent weeks as strong subscriber growth for the latest quarter was tempered by rising debt levels and Treasury yields. IBM continued to disappoint, with its cloud computing business declining amid a strong market. Private equity group Blackstone garnered attention for its ties to Saudi Arabia after a journalist critical of the Kingdom disappeared. Johnson & Johnson reported strong earnings last week but the stock declined due to a market sell-off.

Check out our complete list of Best Dividend Stocks.