Lockheed Martin Corporation (LMT ) is the world’s largest defense contractor and is engaged in the research, design and manufacturing of aeronautics, missiles, rotary and mission systems and space systems. The company is based out of Bethesda, Maryland, and has over 100,000 employees and over 400 facilities located across the globe.

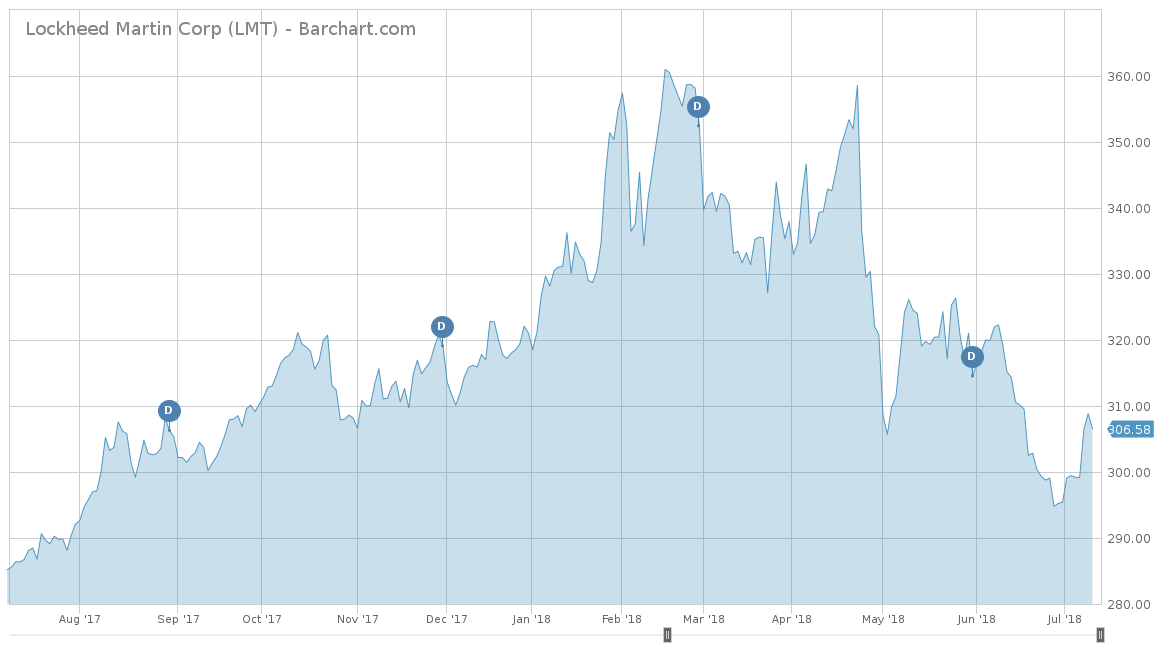

For 2018, Lockheed Martin has underperformed and is down 4.51%. For the trailing one-year, Lockheed is up a lackluster 7.04%, but for the trailing five-year, it has a stellar track record of 171.07%. Northrop Grumman Corp. (NOC) is a major competitor of Lockheed Martin and by comparison, NOC has outperformed in all three time frames.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Lockheed Martin has had very consistent revenue growth of 1.6%, with its last negative year in 2013. In 2017, Lockheed saw its total revenues grow 8.0% to over $51 billion, thanks to a 13% increase in the aeronautics division that was primarily attributable to higher net sales of $2.0 billion for the F-35 program. In the first quarter of 2018, Lockheed exceeded expectations with revenues of $11.64 billion versus $11.24 billion, again thanks to the aeronautics division got a nearly 7% boost over the same period last year, largely due to $185 million in sales related to F-35 fighter jets. However, analysts don’t see a stellar sales year for Lockheed in 2018, with estimates of only $51.33 billion, an increase of 0.6%. For 2019, analysts are more optimistic and expect a 4.70% increase to $53.77 billion.

From an earnings-per-share perspective, Lockheed Martin does not look good on paper with a negative five-year average growth of 4.5%. However, this was solely attributed to a 60.6% drop off in 2017, which was all due to the fourth-quarter earnings of negative $2.20 per share. This was attributed to the corporation recording a net one-time charge of $1.9 billion related to the estimated impacts of the Tax Cuts and Jobs Act. This dropoff looked to be a one-time event, as the first quarter of 2018 easily beat expectations of $3.40 per share with $4.02 per share. Analysts expect 2018 to finish out with a total of $15.47 per share, an increase of over 76%. Analysts also predict the 2019 earnings to total $18.03 per share, which is an increase of nearly 16.5%.

Strengths

Lockheed Martin derives 60% of its sales for the U.S. Department of Defense, 20% from other U.S. government agencies and 20% from other international militaries. The largest segment of Lockheed is its aeronautics division that comprises of 37.7% of total sales. This segment includes fighter aircraft like the F-22 Raptor, F-35 Lighting II and workhorse F-16 Fighting Falcon. This segment also includes other flying vehicles like the Sikorsky helicopter line and mammoth-sized planes like the C-130J Super Hercules.

The second-largest segment is the Rotary and Mission Systems (RMS), which accounted for 27.7% of total sales in the first quarter of 2018. This segment focuses on combat ships and naval electronics, thanks to its 2015 acquisition of Sikorsky. The Aegis System is a combat system that is the most-advanced, most-deployed combat system in the world. It can simultaneously attack land targets, submarines and surface ships while automatically protecting the fleet against aircraft, cruise missiles and ballistic missiles. The Aegis Combat System has evolved into a worldwide network, encompassing more than 100 ships among eight classes in six countries across the world.

The other two segments, missiles & fire control and space, represent 14.4% and 20.0%, respectively. The missiles & fire control segment will continue to benefit with increasing investment into missile defense systems. Its space division continues its Mars heritage when the InSight spacecraft launched on May 5, 2018, aboard a United Launch Alliance Atlas V 401 rocket. InSight has officially begun its six-month long journey to Mars and is scheduled to arrive November 2018.

Growth Catalyst

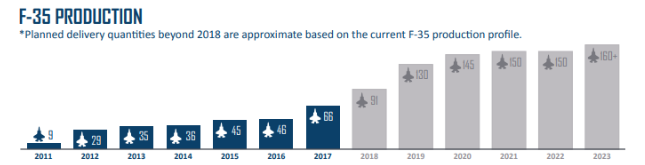

The F-35 Lighting II airplane seems to be the primary driving force for Lockheed Martin in the future. With stealth technology, advanced sensors, weapons capacity and range, the F-35 is the most lethal, survivable and connected fighter aircraft ever built, according to Lockheed Martin. So far, Lockheed has delivered over 305 aircrafts to date, deployed at 15 bases worldwide. In 2017, the company produced and delivered 66 F-35 aircraft and expect 91, 130 and 145 aircrafts to be delivered in the next three years. By 2020, analysts see the F-35 being responsible for 70% of Lockheed’s aeronautics segment. With the exponential growth of the F-35, which is priced at the starting price of $94.3 million, expect Lockheed to see its sales continue to steadily rise.

Dividend Analysis

From a dividend perspective, Lockheed Martin has a respectable dividend yield of 2.55%, equal to $8.00 per share on an annual basis. Comparatively speaking, this is significantly higher than the average of the Best Aerospace-Defense Products & Services Dividend Stocks, which is yielding 0.95%. Lockheed has an excellent track record of raising its dividend, as it has every year for the last 15 years. If the company exceeds expectations in the second quarter of 2018, expect its 16th year of dividend hikes to happen soon.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 10 consecutive years on our 10-Year Dividend-Increasing Stocks page.

Risks

The biggest risk to Lockheed has always been its dependency on U.S. governmental defense budgets. If the defense budget goes down, so does the revenues of Lockheed. Although most defense contractors and government agencies use long-term contracts with Lockheed, the contracts are dictated by a percentage-of-completion method. This uses a costs incurred to date to calculate the amount of revenue recognized. This method also factors in judgement of revenues, costs, and governmental incentives. So with this method, contracts may not accurately reflect the future cash flow that was originally intended.

The Bottom Line

Flying on the wings of its F-35, Lockheed Martin looks primed to see some upswing in the near future. After bouncing back from a dismal 2017 year in earnings due to the one-time tax charge, analysts predict Lockheed to see a new earnings high. The new tax plan is another boost in its growth potential, as the company has a new 14.9% effective tax bracket. If earnings and revenues come in higher than expected, Lockheed will undoubtedly raise its dividend for the sixteenth year in a row. This should cause an immediate uptick, paired with the rising production of the F-35.

Check out our Best Dividend Stocks page by going Premium for free.