Ford Motor Company (F ) is one of the major automobile manufacturers in the world, with its popular brands like the iconic Ford Mustang, its F-Series pickup trucks and Lincoln luxury models. Ford was founded in 1903 by Henry Ford, who started the company on the back of the Model T. The Model T was the first car that took the world by storm, as Ford was the first company to successfully mass produce this industry-leading automobile.

On April 25, 2018, Ford announced that the company will no longer make passenger cars in North America, except for the Ford Mustang and the upcoming Ford Focus Active. In the quarterly press release, management stated that Ford will be “focusing on products and markets where Ford can win.” In this case, Ford plans on 90% of the products in North America to be trucks, utilities and commercial vehicles by the year 2020.

Check out Ford’s complete history here.

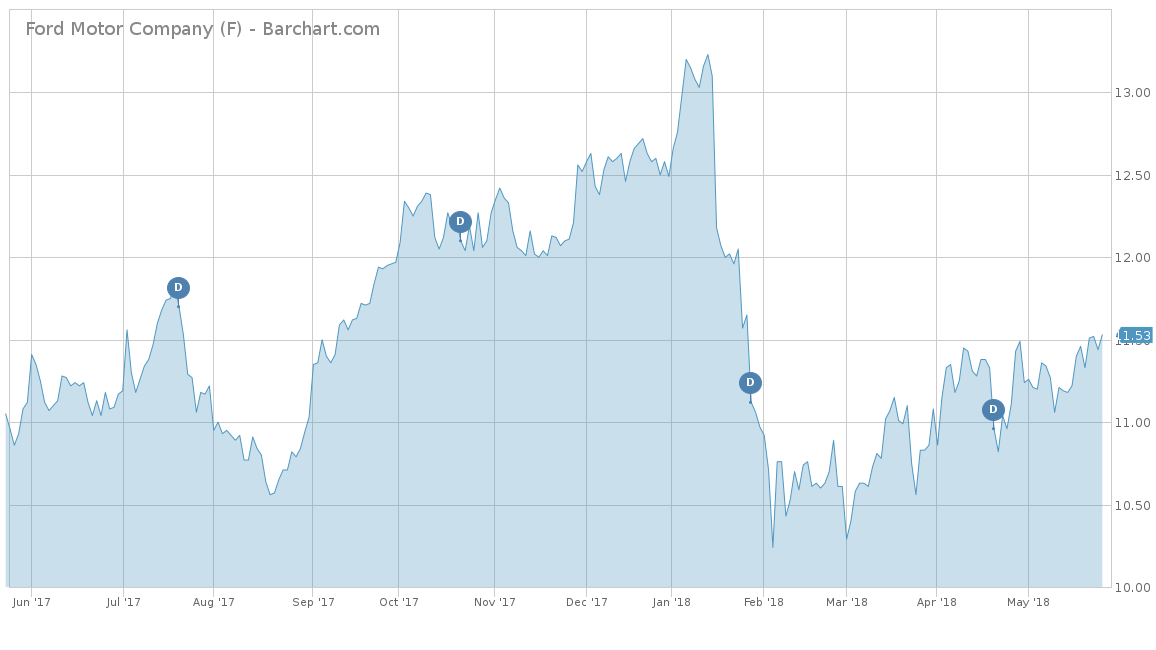

For 2018, Ford has gotten off to a rough start and is down 5.79% on a year-to-date basis. For the trailing one-year, it is positive and up 7.36% but significantly underperforming the S&P 500, which has been up 13.41% during the same time period. Over the longer term, Ford has also underperformed and is down 20.44%, again underperforming the S&P 500’s return of 65.26%. Ford’s largest American competitor is undoubtedly General Motors Co. (GM ), which also has had a rough start to 2018 and is down 5.90% for the year. However, for the trailing one-year and five-year measures, GM outperforms Ford with returns of 16.11% and 17.31%, respectively.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Ford has a modest revenue growth rate of around 3.3%, with its only negative year in 2014 with a slight decline thanks to mass recalls in its South American markets. In the last calendar year of 2017, Ford saw a 3.3% increase to $156 billion, with it selling over 2.58 million trucks, SUVs and cars in the United States. However, trucks and SUVs made up nearly 77% of the total volume sold, which is a clear indicator of why Ford is making the commitment to reducing its car manufacturing. With its new strategy, Ford surpassed expectations in the first quarter of 2018 with revenues of $41.96 billion versus the $37.16 billion forecast. However, analysts expect Ford to struggle to keep its revenues on track, with a 2018 estimate of $147.62 billion. This would represent a decline of over 5% from 2017 revenues. Same goes for 2019, where estimates are reporting at $145.9 billion, which would be a 1.2% decline from 2018.

Although Ford may be having trouble with its revenue, its earnings per share are a different story. Over the last five years, Ford has had an average EPS growth rate of 6.2%. Management has made the focus for Ford to become more “financially fit” and to maximize efficiencies and profit margins within its current product line. In the first quarter of 2018, Ford beat expectations with earnings of $0.43 per share, versus the $0.41 per share estimates. In the earnings call, Ford CEO Jim Hackett disclosed his expectations that the company will hit a pre-tax profit margin of 8% by 2020 by slashing $25.5 billion in costs and $5 billion on capital spending. However, like its revenue expectations, analysts believe that Ford cannot maintain its earnings. Both 2018 and 2019 estimates are pessimistic at $1.49 and $1.45 per share. This is considerably lower than 2017 earnings of $1.90 per share.

Strengths

Ford has really shifted its focus from being a broad-based car manufacturer to a company that builds cars people actually want. With increasing competition from overseas competitors like Toyota and Honda, Ford could no longer realistically compete in the passenger car market. Instead, it is focusing on its strengths, specifically in the light-truck, SUV and commercial segments. The F-Series for Ford has the highest transaction price and highest market share in its segment. The SUV segment has recently hit all-time high sales this last March, with accelerating sales from the new Ford EcoSport. Finally, the commercial division for Ford is also a significant revenue driver, with three of the top four best-selling vans in the U.S. coming from Ford.

Another major change, which will turn into a serious strength, is the company’s new focus to become leaner. One way it is doing this is by building more Ford models on common platforms, which improves the overall economies of scales. For example, in 2007, Ford had 27 platforms. As of 2016, it had only nine platforms. This allows Ford to cut costs while also allowing it to switch production faster to meet the ever-changing demands of the consumer.

Although analysts are certainly not bullish on Ford’s revenue and earnings outlook for the next two years, the company is headed in a drastically different direction and should be in a much better position over the long term.

Click here to learn how autonomous vehicles can change the perspective of investors targeting this sector.

Growth Catalyst

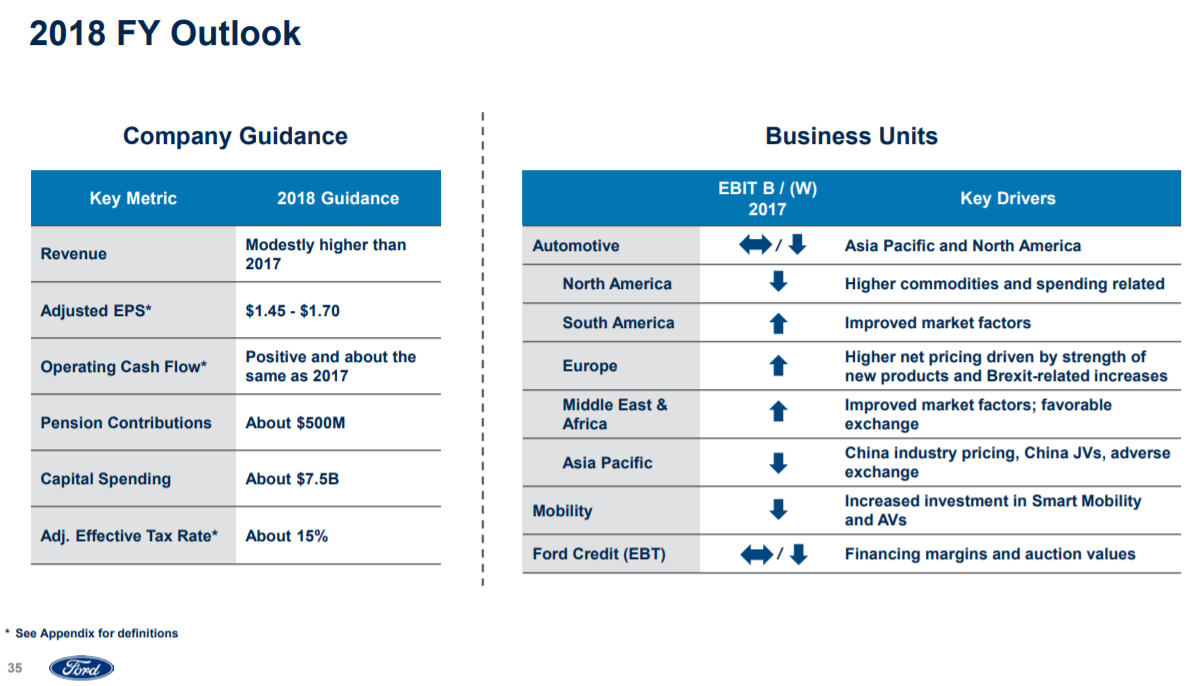

The few growth spots in Ford’s futures all stem from the company’s involvement in South America and Europe. In Ford’s 2018 full-year outlook, as seen below, the only two positives are in these business units, while the rest are either stable or on the decline.

In the last quarter, the South America unit saw a seasonally adjusted annual rate (SAAR) year-over-year gain of 18%. Brazil, in particular, was up 25% at the same time. Ford also has a lot of upside with its South American market, currently only occupying an 8.8% market share.

Ford’s Europe segment does not have the same results as the South American segment but is impressive nonetheless. Europe had a 6% SAAR change on a year-over-year basis and currently occupies only a 7.6% total market share in the area.

Dividend Analysis

Ford stock has a yield of 5.21% and a higher yield than the best auto manufacturers dividend yield average of 1.61%. The company pays its shareholders $0.60 per share on an annual basis. Ford does not have a steady track record of dividend hikes, with its last increase in 2014. However, it occasionally has special dividend payouts, like the $0.13 per share distribution it declared to shareholders on January 16, 2018.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The biggest risk for Ford is the increasing competition it sees within the automobile industry as a whole. All the American automobile manufacturers have been priced out of the passenger car market, for the most part, unable to compete with Asian companies like Toyota, Honda, Kia and Nissan. China, in particular, has been an issue for Ford. In the last quarter, all of the performance measures except revenue were down in the Asia Pacific sector, thanks to underperformance from China.

If Ford cannot find a way to offset the competition it is seeing from foreign manufacturers, it will have a very tough time keeping itself relevant in the eyes of the consumer.

The Bottom Line

With Ford making significant changes, now is not the time to buy. There is too much downside risk as the company is going through the “growing pains” of changing its philosophy. Investors that currently own the company will benefit from an over 5% dividend. Otherwise, wait a few more years until Ford has a more firm grip on what the company’s future really looks like.

Check out our Best Dividend Stocks page by going Premium for free.