Walgreens Boots Alliance Inc. (WBA ) defines itself as the first global pharmacy-led health and well-being enterprise.

It is the largest retail pharmacy in the U.S. and Europe – Walgreens employs more than 400,000 people, has over 13,200 stores and is one of the world’s largest purchasers of prescription drugs.

This article explores if it is a sound pharma exposure for a long-term portfolio.

The Case of Too Much Pricing Power

WBA purchased 45% of Alliance Boots GmbH in 2012, and decided to purchase the remaining 55% in December 2014. With the acquisition, the company expanded to Europe, the Middle East and Asia, to operate in a total of more than 25 countries.

In 2015, the company also announced the acquisition of Rite Aid, but that deal was recently dropped. Instead of buying the company, Walgreens will now buy more than 2,000 stores from Rite Aid (out of their 4,600 current locations) and some distribution centers along with their inventory. Even though the deal has been changed, this will make Walgreens the largest pharma retailer by number of stores in the US. The company will get an expanded scale and CEO Stefano Pessina laid out an expectation of $400 million in annual savings. While the deal still provides the company with more pricing power, it is significantly less than owning the complete supply chain of the third-largest pharma retailer in the U.S. Experts including former FTC policy director David Balto had stated previously that the deal would lead to an increase in prices in the long run. While this cost Walgreens a penalty of $325 million and the new deal still needs regulatory approval, it was mostly seen as a positive move by investors, as a long-drawn speculation was now finally over. Rite Aid investors had long feared this eventuality and have not reacted kindly to the speculation as the shares have dropped more than 70% since the beginning of 2017.

While you are exploring the pharma sector, check out our take here on AbbVie, a “young” pharma company.

What’s Next for Walgreens?

Approximately 76% of the U.S. population lives within 5 miles of a Walgreens store or Duane Reade retail pharmacy. In addition to being the largest pharma retailer in the U.S., as of March 2017 Walgreens also owns 26% of AmerisourceBergen Corp. (ABC), a leading drug wholesale company in the U.S. with $146 billion in revenue. This provides a lot of structural security to the company from a long-term perspective. Walgreens organizes itself in three segments:

- Retail Pharmacy USA: more than 8,000 stores, contributing $83 billion, or 70% of the total annual top line in 2016. Pharma products account for almost two-thirds of revenues.

- Retail Pharmacy International: more than 4,600 stores (mostly Boots) in the UK, Asia and other countries. Contributes $13 billion or 11% of the total annual top line in 2016. Pharma products account for one-third of revenues.

- Pharmaceutical Wholesale: mostly Alliance Healthcare–related brands and services in 11 countries, which contribute $22.5 billion or 19% of the annual top line in 2016.

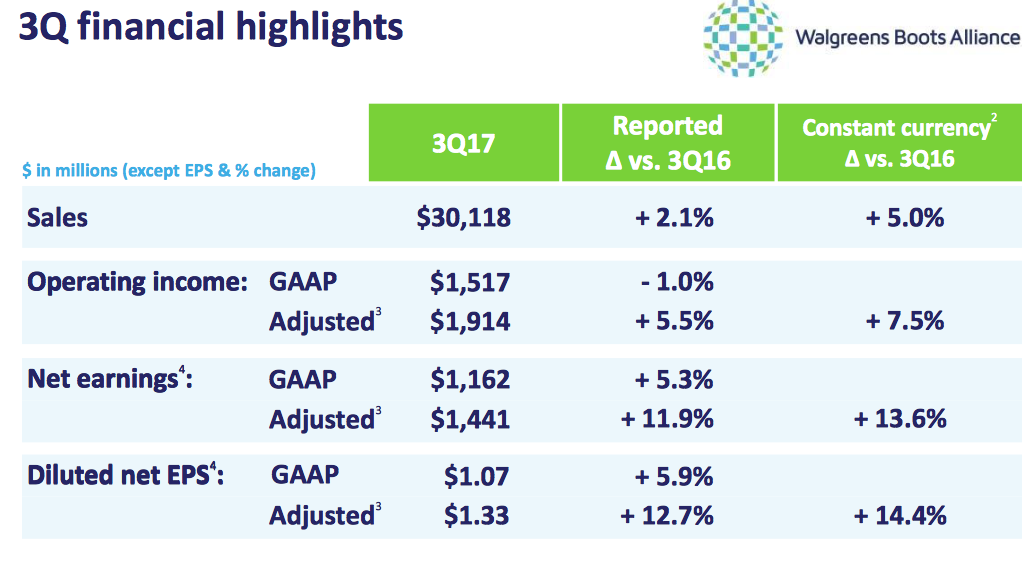

Walgreens just raised the lower end of its 2017 EPS guidance range in the Q3 results it published at the end of June. Comparable store sales have been going up consistently in the last few quarters, and the company demonstrated confidence by completing a $1 billion share buyback. Its cost-saving program is scheduled to save $1.5 billion in savings by the end of 2017.

Walgreens as an Investment

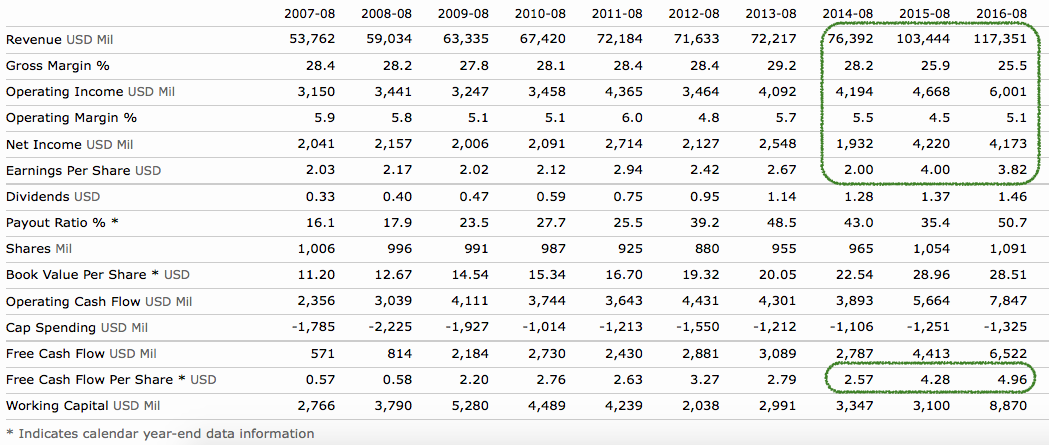

Walgreens is a dividend aristocrat that has been growing dividends for 41 years and currently has a yield of 1.98%. The company has been growing dividends at a healthy rate (12.9% in the last five years), and investors can expect the trend to continue, as there is plenty of room left due to the low payout ratio and the free cash flow bounty, which grew from $2.9 billion in 2012 to $6.5 billion in 2016.

Find all the companies that have increased their dividends for more than 25 consecutive years in our 25-Year Dividend Increasing Stocks page.

Earnings per share (EPS) for Walgreens has been around $2 to $2.50 for the most of the last decade. That changed at the end of 2014 with the consolidation of Walgreens and Alliance Boots. The consolidated revenues increased 35% from $76.4 billion in 2014 to $103.4 billion in 2015, and EPS doubled from $2 to $4. The revenues and operating income increased further in 2016, but net income reduced marginally. That can be attributed to the time needed to streamline operations with Alliance Boots.

The merger was largely received well by investors, as Walgreens stock hit an all-time high in August 2015. It has been range bound between $80 and $86 since then as the market is closely watching for the merger synergies to kick in, along with the potential of the Rite Aid deal. The company can maintain an operating margin of around 5% – which is at the higher end of the retail segment, with Walmart (WMT ) currently earning 4.7%, and Costco (COST ) and Amazon (AMZN) both earning 3.1%.

The Delaware company has a P/E ratio of 16 that is higher than CVS Health Corp. (CVS ) and AmerisourceBergen and lower than that of Baxter International (BAX).

The Bottom Line

The consolidation of Walgreens and Alliance Boots has been a largely successful deal, yielding encouraging top-line and bottom-line results. Even though the stock is not currently undervalued, the company’s 20% market share in the U.S. retail pharmacy segment and increasingly dominant wholesale position makes it a good choice for a long-term exposure. Investors can also expect a growing stream of dividends in the near term.

Follow Dividend.com on Twitter for the latest content on dividend investing. For the latest dividend news and analysis, subscribe to our free newsletter.

The views expressed in the article are my own and do not represent the views of my clients. Follow me on Twitter @tanmoyroy for more frequent updates.