Although AbbVie Inc. (ABBV ) was separated from Abbott Laboratories (ABT ) in 2013, its legacy of producing valuable products stretches for more than 125 years.

Nearly 29,000 AbbVie employees serve more than 30 million patients located in 170 countries around the world every year.

The Business

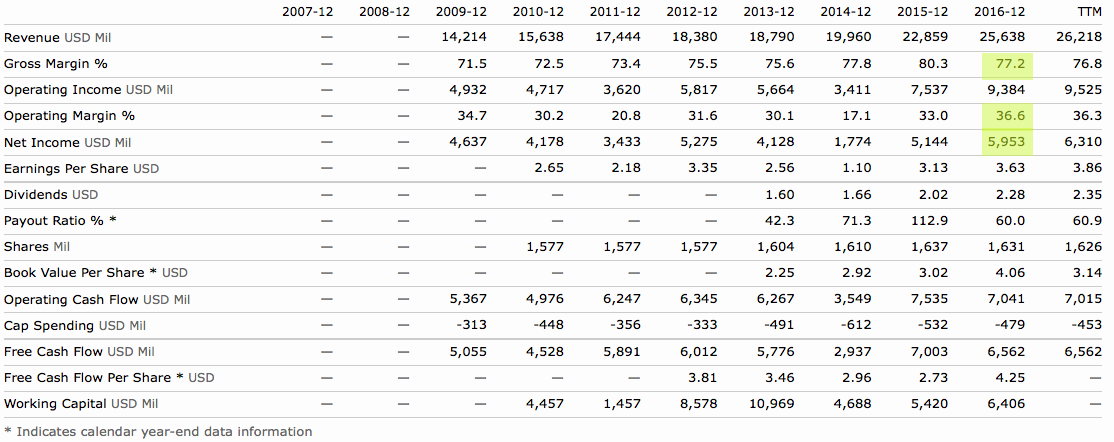

AbbVie Inc. has delivered compounded revenue growth of 11% and earnings per share (EPS) growth of 15% (no drastic changes in shares outstanding) since its inception. The company has successfully cut down its selling, general and administrative expenses, which now stands at just 23% (down from 28% in 2015 and 39% in 2014). It has also kept its cost of products and other expenses in check. As a result, it enjoys a substantial gross margin of 77% and an operating margin of close to 37%.

Despite revenue dropping in a number of smaller products, the company did well in two of its biggest products – Humira (to treat a particular autoimmune disease), which accounts for close to 63% of the revenue, and Imbruvica (to treat patients with chronic lymphocytic leukemia and other lymphomas), which accounts for 7% of the revenue.

Near-Term Future

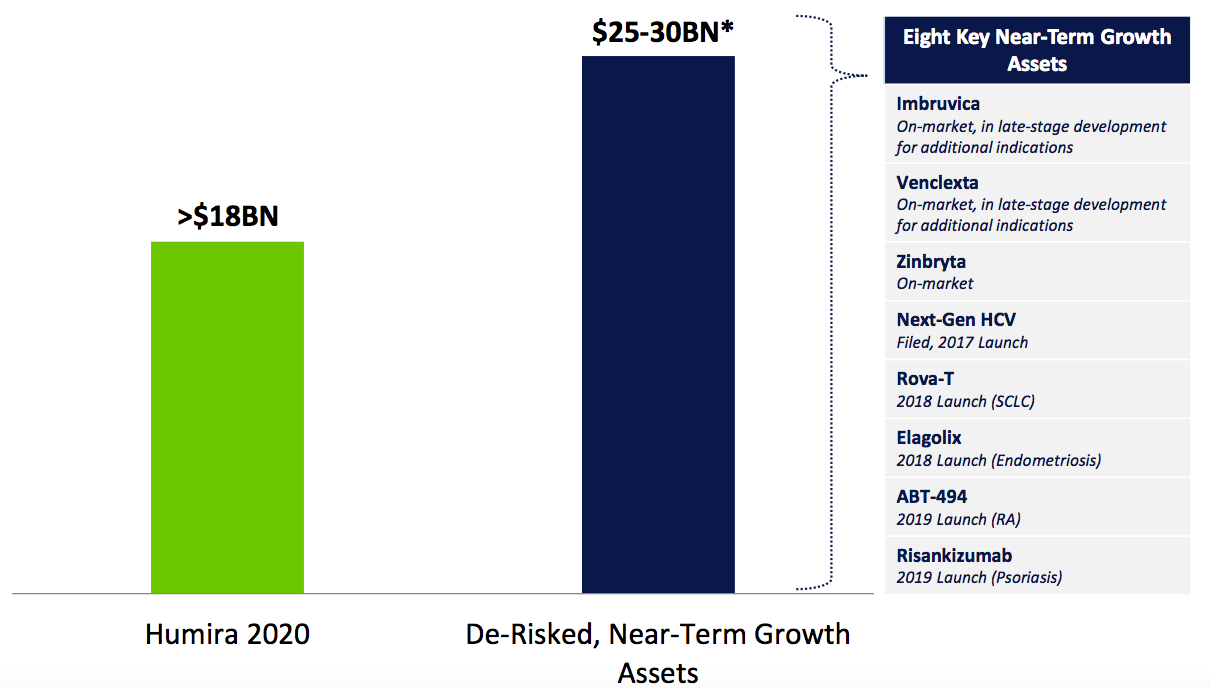

AbbVie is well invested in the future. The company invested more than $4.5 billion (including acquired in-process expenses for collaborative projects) in R&D in 2016, which is an increase of 17% from 2015. With more than 12 new products and a growing pipeline of more than 50 investigational programs in clinical development across important medical specialties such as immunology, virology, etc., the company projects a strong growth expectation for the upcoming years. With the $5.8 billion acquisition of Stemcentrx in 2016, the company has expanded its oncology pipeline, including the late-stage asset Rova-T that is currently in trials for small cell lung cancer and in early-stage development for others.

Click here to read more on why we believe AbbVie will continue to perform well.

AbbVie owns or has licensed rights to a substantial number of patents and patent applications that expire between 2017 and the late 2030s. It doesn’t expect any one patent, license or trademark to affect the company’s business, except for Humira. Given that it accounted for 63% of the revenue in 2016, Humira is the biggest source of strength and risk for the company. It competes in the market with anti-TNF and other products.

The FDA has also approved a biosimilar (i.e., Amjevita) of Humira in the United States, and the company expects the same to happen in the European Union. Despite the competition, Humira has not lost significant market share, and AbbVie has been able to grow its sales consistently since its introduction in 2003. Humira’s sales have doubled since 2011 and it beat analyst expectations in Q2 earnings released by the company recently.

As per CEO Richard Gonzalez, the company is well placed to reduce its dependence on Humira in the near term with the help of several promising products lined up for launch in the next two to three years. If the company is able to execute its plan, Humira’s dependency will be reduced to around 40% of overall revenues by 2020. Given that Humira went through a price hike in January and that biosimilars are likely to be priced lower, this will eventually start affecting AbbVie’s revenues (and 40% of revenue share is still a big amount). The degree of impact on AbbVie’s bottom line will depend on the biosimilars’ marketing and distribution power and AbbVie’s ability to fend off competition.

No discussion on pharma is complete without Obamacare and Trump. AbbVie CFO Bill Chase commented earlier this year that the repeal of Obamacare (one way or the other) is unlikely to substantially affect the company because around 80% of its U.S. sales happen from non-government channels. Chase also mentioned that he would love to see, as would any other CFO in corporate America, some tax reforms and lower corporate taxes from the Trump administration.

AbbVie as an Investment

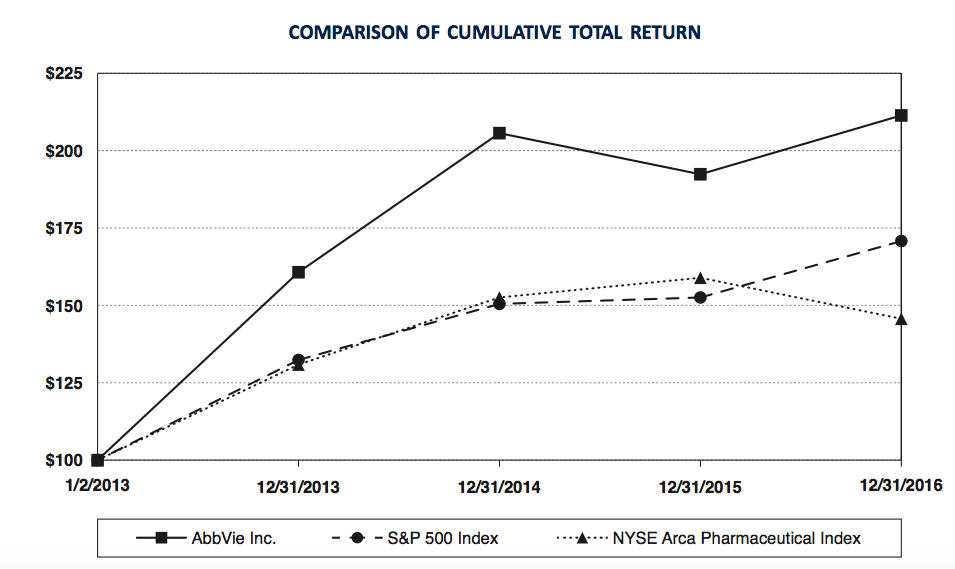

AbbVie has been paying dividends since its inception in 2013, with promising annualized growth of 12.5% in the last three years. Its predecessor, Abbott Laboratories, had been growing its dividends for 44 years. That is a stellar dividend record for any company. AbbVie has an exciting current dividend yield of 3.5%. With a payout ratio of well under 50% and free cash flow (FCF) of more than $6.5 billion, future dividend expectations can be considered secure. One thing investors should look for is future change to FCF. The company had only one instance of FCF growth in the previous five years (2015). Another potential risk factor for the company is the debt-to-equity and financial leverage ratios, which stood high at 7.86 and 14.26, respectively, as of fiscal year 2016.

Learn about all the companies that have increased their dividends for more than 25 consecutive years in our 25-year dividend increasing stocks page.

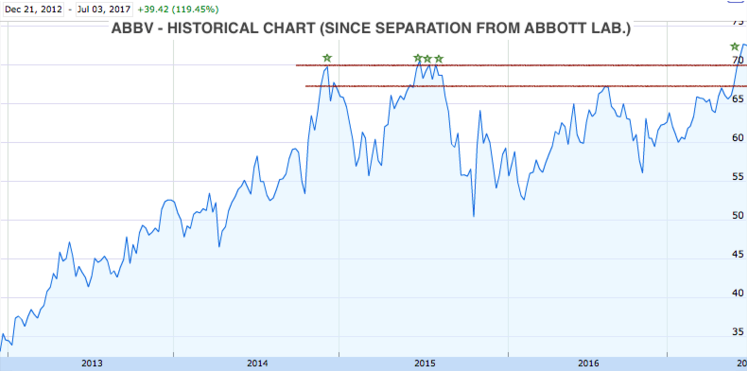

AbbVie has had a rocky time in the stock market but still has managed to return around 12% in the trailing 12 months. It lost some value in the second half of 2016 but, like most of the market, recovered well since the U.S. elections in November. The company had an incredible run in 2013 and 2014, growing more than 100% from $34 to $70. Since then, it went into a bit of rough weather in 2015 and couldn’t break free of the previous all-time high until last month.

It will be interesting to see if the $70 level is challenged in the upcoming weeks; if it does, then the stock might hit the next soft resistance at around $67. Even though the stock price is very close to its all-time high, the company can’t be considered over-valued. AbbVie’s current PE ratio of 13.04 suggests that its valuation is cheaper than the likes of Johnson & Johnson (JNJ ), Eli Lilly (LLY ), Pfizer (PFE ) and Bristol-Myers (BMY ), is approximately at par with Biogen (BIIB) and Amgen (AMGN ), and is costlier than Gilead (GILD ).

If dividends and capital returns from the stock are combined, AbbVie has outperformed the S&P 500 and the NYSE Arca Pharma index in the last three years, as shown in the graph above.

Follow Dividend.com on Twitter for the latest content on dividend investing.

The Bottom Line

AbbVie Inc. has performed exceptionally well since its inception and is well placed to face the challenges of the future. Corporate results should drive increase in capital returns and the company is likely to keep growing its dividends in future.

For the latest dividend news and analysis, subscribe to our free newsletter.

The views expressed in the article are my own and do not represent my clients’ views. Follow me on Twitter @tanmoyroy for more frequent updates.