AT&T is a $243 billion ‘non-oil’ Texas behemoth that features on numerous top 10 large U.S. company listings.

Brand Finance ranks the company at number four on the list of most valuable global brands, behind Google (GOOG), Apple (AAPL ) and Amazon (AMZN). It has an impeccable record of growing dividends for 32 years and a reputation of making outlandish acquisitions. The analysis will explore if the company should still feature in your retirement portfolio.

Access the dividend history of AT&T.

AT&T Is Now a TV, Film, Sports and News Company

AT&T (T ) and other telecom operators have seen a steady decline in their wireless revenues in the last few years due to stiff competition. Not surprisingly, AT&T has been diversifying into related business segments by making acquisitions like DirectTV (and expanding its geographical footprint by buying Mexican wireless operators).

Earlier this year, Time Warner’s shareholders wholeheartedly approved a $84.5 billion merger with AT&T. The company is now officially a major player in media and entertainment with ownership of content from brands like CNN, HBO, Cinemax, TCM, TNT, TBS, NASCAR, NBA Digital, etc. HBO happens to be the most successful cable subscription in history and CNN is one of the most widely followed news channels in the world.

The deal came into the limelight for the wrong reasons in recent months with President Trump famously categorizing CNN as ‘fake news.’ AT&T CEO Randall Stephenson confidently reacted to the attention by saying, “It’s not the first time that we’ll have been in a controversial area. We are a rather large company. We face hundreds of thousands of consumers every day.” The deal, however, brings hundreds of millions of cable and online subscribers to AT&T.

Comcast (CMCSA ) made a similar move in acquiring NBCUniversal. Verizon (VZ ), on the other hand, has chosen a different future with a series of acquisitions of AOL, Yahoo!, Vessel, Skyward, etc. With Internet companies like Google, Amazon, Netflix (NFLX) and Facebook (FB ) becoming media and entertainment companies, these acquisitions certainly align the company better with a future where it will be hard to differentiate Internet, TV, media and telecom companies. While big acquisitions are usually hailed as symbiotic, they are also known to fail. Interestingly enough, it brings back memories of the failed $160 billion AOL acquisition of Time Warner, which is often touted as the worst deal ever made.

Explore the dividend yield of the technology sector. Domestic and foreign telecom companies are listed separately under this section.

AT&T as an Investment

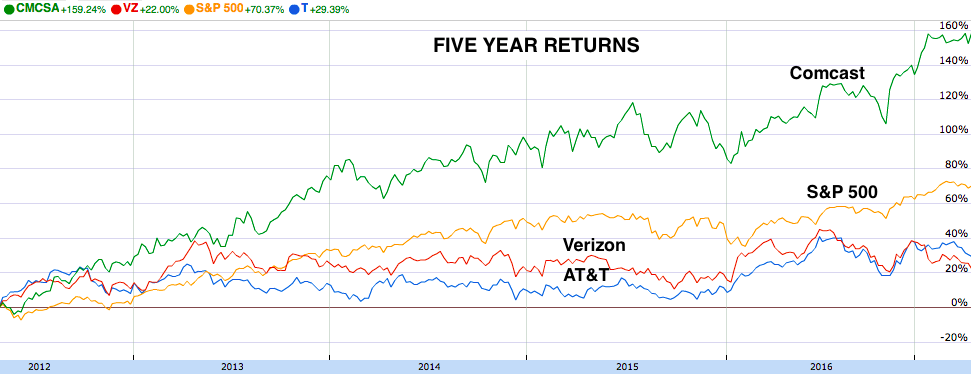

It has been a patchy last year for AT&T on the stock market and it has consistently fallen behind the S&P 500 returns over the last five years. Verizon has a similar story to tell when it comes to capital returns. Comcast, on the other hand, has had exceptional returns.

AT&T is a dividend aristocrat with more than 25 years of consecutive dividend growth. Find other companies that are dividend aristocrats on our 25-Year Dividend Increasing Stocks page.

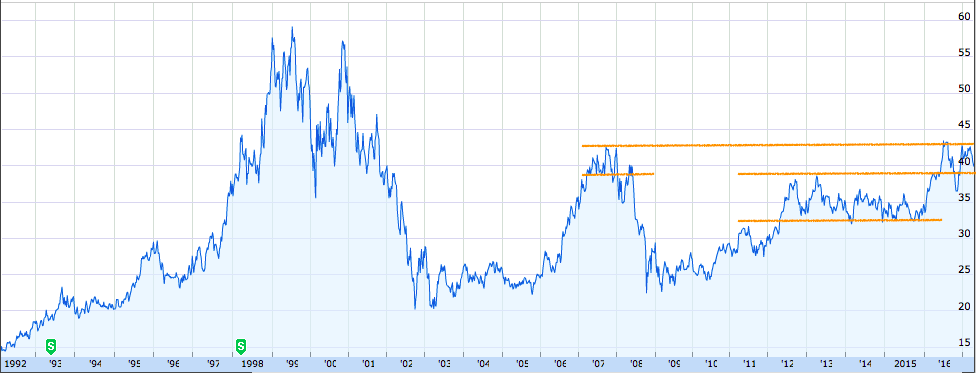

As things stand today, AT&T has a competitive P/E ratio compared to its peers (although Verizon has a cheaper ratio at this point because of the recent dip in its prices) and the stock is far away from its peak in the late 90s. AT&T has tended to stay range bound in the recent years, before breaking free in a direction. From a historical range perspective, $38 to $43 is a significant range to keep an eye on.

From a dividend perspective, AT&T has hearty historical credentials. Not only does it have a good dividend yield of around 4.9% (higher than the S&P 500’s dividend yield of around 2.16%), the company has been growing its dividends for 32 years. Comcast and Verizon do not have a similar dividend payout growth history. Comcast, in fact, doesn’t share the same enthusiasm when it comes to dividends.

Despite its acquisitions, AT&T has maintained a healthy free cash flow (FCF) in the last few years. Verizon, on the other hand, has had a sharp dip in its FCF in 2016. So even if the payout ratios are similar, FCF can potentially make Verizon’s dividend ambitions unsustainable in the upcoming years.

AT&T is a top 15 Most Watched Stocks List regular. Find the latest rank of AT&T by going premium. Our Most Watched Stocks List is a user-generated, interest-based ranking of dividend paying stocks. Generated by our Premium members’ watch-lists, it’s aggregated and ranked by the most watched stocks. The list is updated at the end of every week, helping investors to identify dividend stocks that are moving up or down on investors’ radars.

The Bottom Line

AT&T is a compelling option from a passive, dividend investing perspective but it does have a tendency to get into turbulent times with the stock market. The company looks well prepared for the future with its strong financial position and head-first jump into the media and entertainment segment. It might not be a bad idea to watch the company closely to see if the large acquisitions are causing any digestion issues in the coming year.

Stay up to date with the latest AT&T news.