Over a billion people log into Facebook (FB ) everyday and search through its 2.5 trillion posts more than 2 billion times a day.

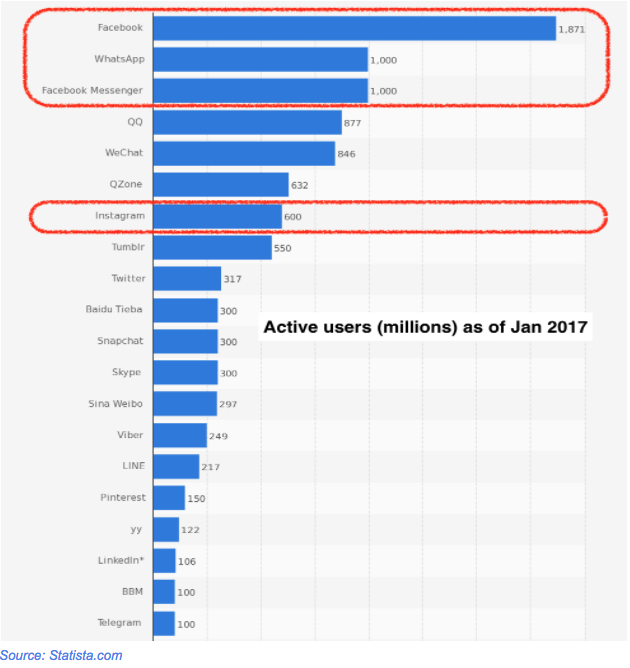

With WhatsApp and Facebook Messenger rolling in another billion active users apiece and Instagram adding another respectable 600 million, things have worked out pretty well over the past few years. Will this fairy tale ever come to an end? And should investors include Facebook in their portfolio going forward?

Platform Platform Platform

All of the platforms controlled by Facebook combined add up to approximately 4.5 billion users (not unique, obviously). 40% of the world’s population has an internet connection (3.5 billion), and Facebook, in one way or another, has relationships with 60% of them. It’s hard to imagine any other company with similar influence on the internet, except for maybe Google. In many ways, it’s not fair to categorize Facebook as a social network and Google as a search engine.

Facebook is not just a place to meet your friends, it influences presidential elections, abets democratic uprisings and initiates cultural movements. No self-respecting public or private organization can afford to stay off Facebook.

In essence, Facebook has become the means to our collective expression – and that’s good for business. However, not everything is hunky-dory. The next part of the article will elaborate on that.

Facebook Needs to Raise Its ‘AI’ Game

It’s hard to talk about the future without referring to Artificial Intelligence (or AI). It has been slowly evolving and we have arrived at the first wave of widespread usage. Self-learning, predictive machines are raising customer expectations beyond the reach of traditional businesses. Netflix is able to analyze billions of records and behavior patterns to predict movie options. Apple Music, Pandora and Spotify do pretty much the same with music. Tesla can remember road conditions and raise the suspension before nasty speed bumps.

Siri, Alexa and Google Assistant have been leading a new era in voice-activated search and now help with things we didn’t even know we needed help with. You can have your personal assistant switch on the lights, set the temperature, get the coffee ready and order your groceries all while you make your way from the bed to the kitchen. Remember HAL 9000? That was 1968. We never got the future we were promised as kids (where are the flying cars?). AI is getting us there, and it’s both fascinating and scary. Even Elon Musk and Stephen Hawking have predicted a less-than-ideal state for humans if AI gets out of hand.

My personal experience of talking to my telecom provider’s customer care using Facebook Messenger has been promising. Nevertheless, I was definitely talking to real humans, and Facebook’s AI is yet to participate in my life in a meaningful way. It is very close to communicating with me using natural language, helping me check-in to flights, making reservations at restaurants, sending flowers or helping with my next freelance project. Given its massive user base with WhatsApp and Messenger, it could be a dominant AI messenger, if it plays its cards right.

Future of Facebook in IoT & Virtual Reality

Facebook’s Parse platform was supposed to help it profit from apps in wearables, smart cars and self-learning devices in offices and homes (i.e. internet of things or IOT). Last January, Facebook announced they are shutting the platform down after only acquiring it just three years ago. This was a strategic shift for the company, as it now plans to double down on its bot messengers. The platform was diluting its walled garden by potentially producing applications that compete with Facebook’s future participation in our lives. It also means Facebook will stay close to internet usage that is specific to social media, social gaming and messenger services using smart phones. It will not be able to leverage internet experiences using other types of smart hardware in homes, offices or cars.

While IoT extends the internet experience to day-to-day devices and real life activities, virtual reality does just the opposite: It takes the users into an exciting virtual world and disconnects them from reality. There has been extensive coverage on virtual reality in the last two years and a multitude of products have made their way to the mainstream market. Sony, HTC, Oculus (a Facebook company), Samsung and Google have all launched their own headsets, and the market is set to grow at a rapid pace.

Facebook is in second place behind Sony with a large user base using Playstation. It’s too early to predict if virtual reality is a fad or a long-term growth market that is just beginning to grow. It has had its fair share of negative media coverage due to cumbersome devices, expensive price point, lack of content and how it makes users dizzy. None of these factors lend themselves well to widespread user acceptance in the coming years.

Watch: Why Facebook Could Be ‘All Video’ in 5 Years:

Facebook as an Investment

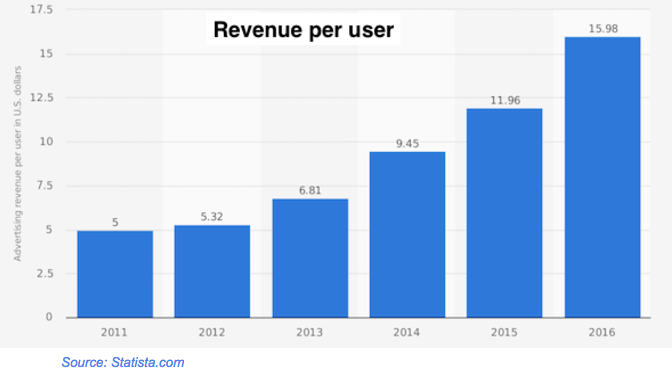

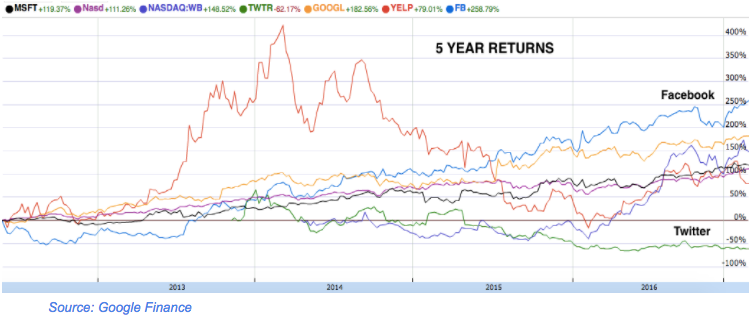

As of Q42016, year-on-year Facebook’s revenues swelled by more than 50% and net earnings surged by a whopping 177%. Ever since its IPO, Facebook has grown both its user base and its revenue-per-user on a consistent basis. No wonder the stock has had a phenomenal 250% return in the last five years. On the other hand, Twitter has failed to deliver on its promise and has largely been a disappointment despite widespread usage. Even the most powerful man on the planet can’t get enough of it.

A lot of attention is given to Facebook’s slowing annualized returns, but that is not unexpected for a company worth close to $400 billion. With $26 billion in cash and marketable securities, it announced its very first buyback for $6 billion. Given the buyback announcement and previous statements from the CFO, Facebook is unlikely to pay any dividends in the near future. Tech companies typically take a long time to start paying dividends: Microsoft took 18 years and Oracle took 23 years.

Further reading: Facebook doesn’t pay dividends, but these 25 stocks have been increasing their annual dividend every year.

It’s been a tricky last year for Mark Zuckerberg as a leader. There has been speculation about him preparing to run for U.S. president in the future. While he has clarified that isn’t in the cards, his recent comments and actions (e.g. meeting with people in every U.S. state, hiring a former White House photographer, etc.) have fueled some interesting theories. There have also been other instances of minor board tussles and a lawsuit when Facebook attempted to issue Class C shares.

There was also an interesting comment from Facebook CFO David Wehner in an earnings call (July 2016): “We anticipate ad load on Facebook will continue to grow modestly over the next 12 months and then will be a less significant factor driving revenue growth after mid-2017.”

In plain language, it can be interpreted as “Facebook is close to maxing out its ad space on the news feed.” The future growth, therefore, will come from adding users, increasing advertisement demand, and advertising on messenger platforms). All in all, this is likely to have an affect on its yearly returns. With a P/E ratio of 39 in the last six months, Facebook seems to be entering a zone in which investors are looking to find a new normal. It has breached and bounced from the $130 price bar a few times since Aug. 2016, but seems to have finally broken free in Feb. 2017 (a good thing, from a purely technical analysis point of view).

Further reading: Facebook vs. Twitter: Why Doesn’t Social Media Pay Dividends?

The Bottom Line

Facebook is likely to add users across its platforms and further solidify its dominant position in the market. Most of its new users are likely to come from new internet users in developing countries. Investors are likely to see above-average to good capital returns with no dividends in the near future. An argument can be made for Facebook’s not-so-strong current position from an AI and IoT point of view on a 10-year horizon. That could change if Facebook keeps both innovating and acquiring innovative companies like it has in the past.

Dividend.com compiles a list of the most watched stocks by their users. It gives a preview into what other investors are thinking about.