Facebook (FB) and Twitter (TWTR ) are both massive technologies companies that generate revenue through online advertising. The market for online advertising is still evolving and growing, making revenue estimates on companies operating within that space difficult to figure. This is part of the reason social media companies tend not to pay dividends.

Dividends are cash payments to investors for owning a small portion of the company, thus they are extremely costly for a company in a growing or evolving market. A dividend payment restricts the financial flexibility of a company because it must continue to pay a predictable dividend or suffer the wrath of investors. In a growing or changing market, a company’s survival may hinge on their ability to react to changes in their market and acquire competitors quickly.

Here are a few classic traits of dividend-paying stocks:

- Company dominance in primary market

- Long-term market stability

- Historically stable cash flows

- A surplus or hoard of cash

Market Growth: The Global Online Advertising Market

The global online advertising market (excluding mobile) is expected to grow from $91.1 billion to $124.7 billion in 2017, which is a compounded annual growth rate of 6.5%. During the same period, the global mobile advertising market is expected to increase from $10 billion to $52.2 billion.

The market for online advertising is growing extremely quickly, which means investors are not sure of its future value. Strong observed growth in the market causes investor estimates for the final future value of the market to be high, possibly overshooting actual values.

Dominant Players

The dominant players in the online advertising space are Facebook (FB), Twitter (TWTR ), Google (GOOG), Apple (AAPL ), LinkedIn (LNKD), and Yahoo! (YHOO). These companies represent the majority of shares in this quickly growing market. Let’s compare Facebook and Twitter from a dividend investor standpoint and postulate on the timing and effect that a dividend payout would have on these stocks.

Both Facebook and Twitter’s financial results have been strong, mirroring the strong growth in the online advertising market.

Twitter {% dividend TWTR %}

Second Quarter 2015 Financial Highlights

Revenue:

- Revenue for the second quarter of 2015 totaled $502 million, an increase of 61% compared to $312 million in the same period in 2014. Excluding the impact of year-over-year changes in foreign exchange rates, revenue would have increased by 68%.

Advertising Revenue:

- Totaled $452 million, an increase of 63% year over year. Excluding the impact of year-over-year changes in foreign exchange rates, advertising revenue would have increased by 71%.

Mobile Advertising:

- Mobile advertising revenue was 88% of total advertising revenue.

Data Licensing:

- Data licensing and other revenue totaled $50 million, an increase of 44% year over year.

U.S. Revenue:

- U.S. revenue totaled $321 million, an increase of 53% year over year.

International Revenue:

- International revenue totaled $181 million, an increase of 78% year over year.

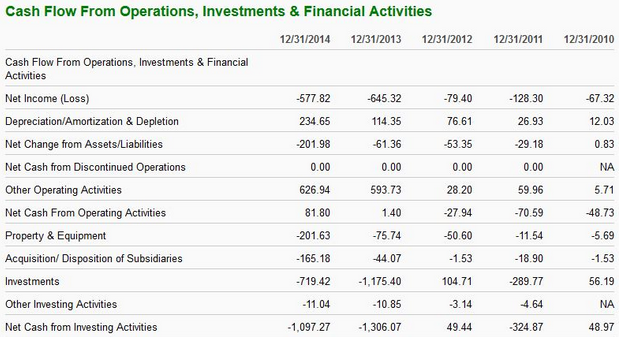

Is Twitter Hoarding Cash?

No.

Twitter is not currently hoarding cash because it is not yet profitable. The company is currently using outside capital from loans and sold shares to fund its operations. It would be awkward for Twitter to pay a dividend while the company was unprofitable, as it would be like stealing from Peter to pay Paul.

Is Twitter Growing?

Yes.

But there have been recent concerns regarding Twitter’s ability to continue growing its customer base of active users. Twitter’s monthly active users, or MAUs, only rose from 308 million to 316 million quarter over quarter. The recent growth is slower than past growth, increasing concerns that Twitter has topped out before becoming profitable.

Facebook (FB)

Second Quarter 2015 Operational Highlights

Daily Active Users (DAUs):

- DAUs were 968 million on average in June 2015, an increase of 17% year over year.

Mobile DAUs:

- Mobile DAUs were 844 million on average for June 2015, an increase of 29% year over year.

Monthly Active Users (MAUs):

- MAUs were 1.49 billion as of June 30, 2015, an increase of 13% year over year.

Mobile MAUs:

- Mobile MAUs were 1.31 billion as of June 30, 2015, an increase of 23% year over year.

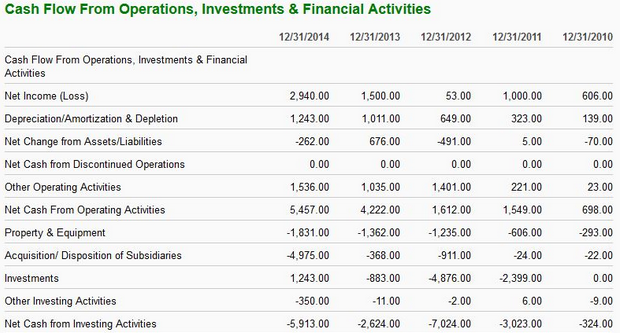

Is Facebook Hoarding Cash?

Yes.

Facebook has $4.384 billion in cash stashed away, and only $367 million in total debt. Yes, that’s correct, Facebook has a cash hoard of over $4 billion and growing.

Is Facebook Growing?

Yes.

Facebook’s MAUs grew from 1.44 billion in Q1 2015, to 1.49 billion in Q2 2015. The company is continuing to hit growth expectations as their service spreads across the globe. Additionally, Facebook has deepened their service offering by owning the top two online messaging services, Facebook Messenger and WhatsApp. Facebook’s acquisition of WhatsApp, the global messaging service, further solidified the company’s status as a leader in messaging services.

When Do Technology Companies Pay Dividends?

Technology companies do pay dividends, but only when they become mature stable companies. Take a look at this Dividend.com article on the Top 10 Tech Dividend Payers and you will notice that the names of Microsoft, Oracle, Qualcomm, IBM, Apple, Intel, Cisco, Texas Instruments, Corning, and Hewlett-Packard are all massive and mature companies. These companies have stable markets, yield stable cash flows, and their growth is predictable. In their respective markets, they are not too worried about external competitors quickly disrupting their businesses. At the same time, check out the below list to find out how long it took these companies to begin dividend payments.

Microsoft (MSFT )

IPO’d in 1986 and paid its first dividend in 2004. It took 18 years before investors began receiving dividends on their capital investments.

IBM (IBM )

Was listed in 1913 and paid its first dividend that year. IBM has been paying a dividend ever since, making it one of the strongest dividend performers of all time.

Apple (AAPL )

IPO’d during 1980 and paid its first dividend in 2012, making it 32 years before investors began receiving dividends.

Oracle (ORCL )

IPO’d during 1986 and paid its first dividend in 2009, making it 23 years before investors received dividends.

The Bottom Line

Facebook is more likely than Twitter to pay a dividend in the future, however, both companies are still too young to begin paying dividends right now.

Facebook is hoarding cash and building a defensible moat around its business. It will likely use its cash hoard to continue acquiring companies like WhatsApp and Instagram, in order to secure a dominating position in the online marketing sector.

Twitter is still growing and needs to show profitability before a discussion of dividends is even possible. The company has a unique real-time information feed that news sources around the world rely upon for data. The demand for real-time data is unlikely to decline, but Twitter needs to address concerns with user engagement in order to truly dominate the space.