Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Failed takeovers and misleading labels were the talk of Wall Street over the past seven days. However, that hasn’t stopped U.S. equities from staging new record highs on the continued promise of fiscal stimulus and tax reform. Relatively upbeat corporate results have also provided a mild catalyst, a sign that the worst of the so-called ‘earnings recession’ has passed.

This week’s Trends article diverges sharply from the February 7 edition, in which pharmaceuticals and REITs dominated the headlines.

Unilever Foils Kraft Heinz Takeover Bid

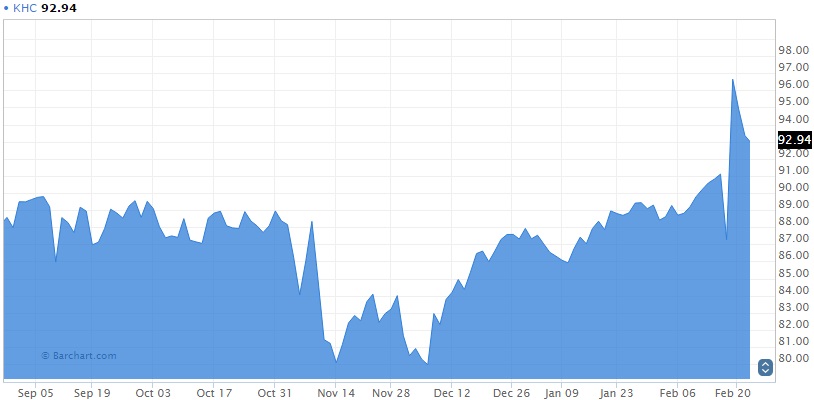

In a dramatic turn of events, Kraft Heinz Co. (KHC ) backed out of a $143 billion acquisition of Unilever Plc (UL ), the iconic Anglo-Dutch consumer staple that fiercely resisted any takeover attempts. The deal was squashed a mere 48 hours after the Philadelphia-based KHC expressed interest in its rival, but that didn’t stop Unilever’s stock from crashing. As a result, Kraft Heinz took the No. 1 spot on our weekly list with a 66% rise in traffic.

Trusted sources say Kraft Heinz’s key investors, which include Warren Buffett and Jorge Lemann, were sent packing after Unilever executives made it clear the company would not be sold. The deal would have been the second-largest corporate merger in history.

Shares of KHC were in for a wild ride this week. Prices spiked nearly 11% on Monday before giving back nearly 4% over the next three days as hopes of a mega-deal evaporated. Investors interested in KHC can keep track of its upcoming dividend payouts here.

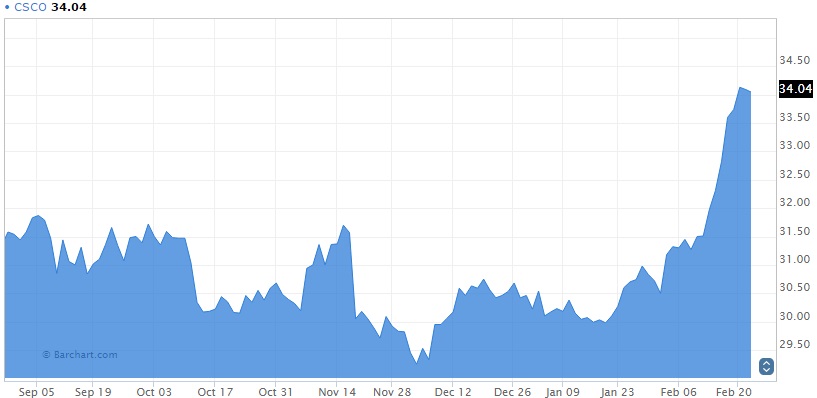

Cisco Systems Chairman Drives Foot Traffic to the IT Giant

Cisco Systems (CSCO ) takes the No. 2 spot on our weekly list with a 47% increase in traffic. Company Chairman John Chambers was in the headlines again this week after he claimed the Trump administration will be a boon to tech start-ups by easing regulations and opening more avenues for them to go public.

Earlier this month, Chambers urged the president to adopt a digital agenda focused on the Internet of Things (IoT) – a market he says could be worth $19 trillion at its peak.

CSCO has partaken in the Dow Jones Industrial Average’s illustrious run over the past two weeks. The benchmark gauge has reached new records in each of the last ten sessions – the longest such streak in three decades.

Have you ever wondered how much money you could make by investing in CSCO stock? Check out our free Dividend Reinvestment Calculator to find out how much money you can grow through this strong dividend payer.

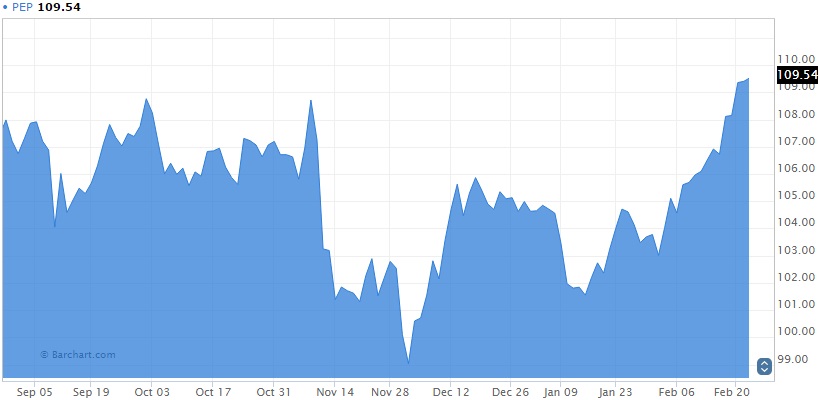

PepsiCo Dresses Naked Juice in a New Label

PepsiCo (PEP ) witnessed 40% growth in viewership this week after the beverage maker was ordered to change labels on its Naked Juice brand. The company agreed to update the label within eight months following a lawsuit claiming that it misled consumers about the product’s actual ingredients. Plaintiffs took exception to flavors like “Kale Blazer,” which they said did not convey the drink’s real ingredients (in this case, orange juice and not kale).

Although PEP vehemently denied any wrongdoing, it has agreed to change the label, according to official settlement documents that were obtained by various news outlets.

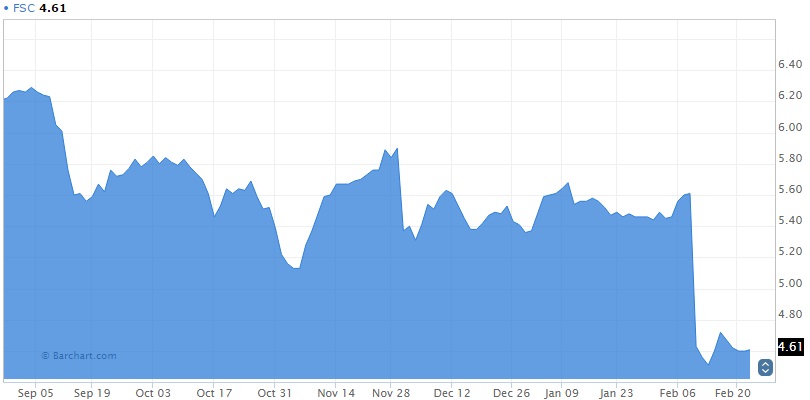

Fifth Street Finance Cracks the Top Four

Fifth Street Finance (FSC) cracks this week’s list with 36% higher traffic, although the exposure wasn’t exactly positive. FSC shares have declined nearly 16% since the start of the year. Earlier this month the asset manager reported a fiscal first-quarter loss of $74.2 million, raising fresh worries about its outlook. Company director James Castro-Blanco acquired 20,000 shares of his own company last Friday at a cost of $4.62 per share. The company’s share price has held relatively steady since.

Are you considering investing in asset management companies as part of your retirement portfolio? Our Retirement Center can help you navigate the way.

The Bottom Line

There was no shortage of action in the market this week, as investors juggled a mix of breaking news, corporate earnings and policy speculation.

For up-to-date dividend news and analysis, subscribe to our free newsletter.