Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Drugmakers and REITs tied to healthcare were the main draw for investors this week, as the combination of volatile earnings and dark pool activity boosted interest in these market segments. It’s interesting to note that the sectors drawing the most attention this week have largely underperformed the market since the beginning of the year.

Compare this week’s Trends report with our February 3 edition, which included important commentary about the market’s response to Donald Trump’s presidential inauguration.

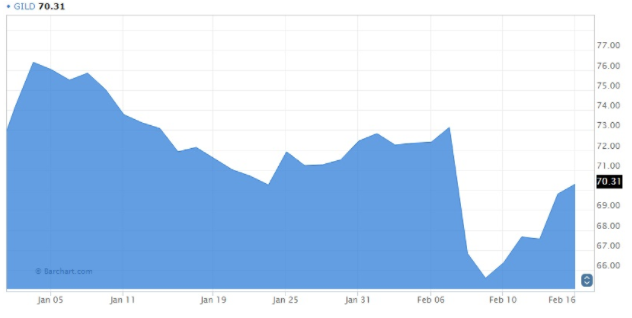

Gilead Sciences Recovers From Earnings Meltdown

Gilead Sciences Inc. (GILD ) takes the top spot on our weekly list with a 90% spike in viewership. The biopharmaceutical company that made its name developing HIV treatment drugs has run into challenges marketing its hepatitis C medicine Sovaldi. Annualized sales of the drug plunged in the fourth quarter, with the company warning of deeper losses in the not-too-distant future. GILD plunged 10% over two days last week.

GILD shares have since rebounded more than 7% amid speculation the cash-rich company was considering a merger with Bristol-Myers Squibb (BMY ), the New York-based pharmaceutical giant. To check the ex-dividend dates for GILD and BMY, use the free Ex-Dividend Date Search tool.

Despite the rebound, GILD is not out of rocky waters just yet. Following a sharp rise in revenues, the company has seen its prospects diminish in recent years, evidenced by declining new patient starts. Based on the company’s latest guidance, there’s no telling how far revenues could fall.

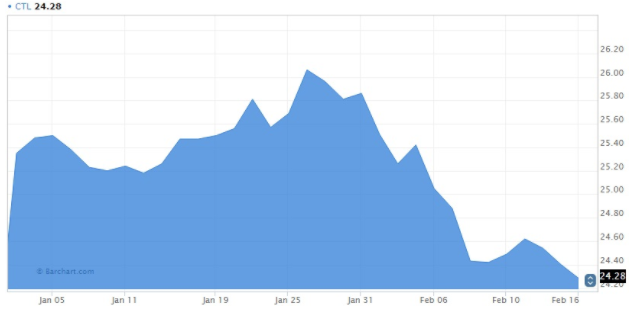

CenturyLink Inc. Hits Three-Month Lows After Earnings Miss

CenturyLink (CTL ) was in the headlines this week after Ohio and Utah became the first states to approve its merger deal with Level 3 (LVLT), another telecommunications company. CTL managed to snag the No. 2 spot on our weekly list with a 77% rise in traffic, despite posting dismal quarterly results earlier this month. The Louisiana-based company is trading at three-month lows in a belated response to disappointing fourth-quarter results that missed on both top and bottom line estimates.

Although CTL has underperformed the broader market since the new year, it is outperforming the telecommunications industry by a wide margin. CTL shares have returned more than 2% this year. By comparison, the S&P 500’s telecommunications index has tumbled more than 5% during the same period.

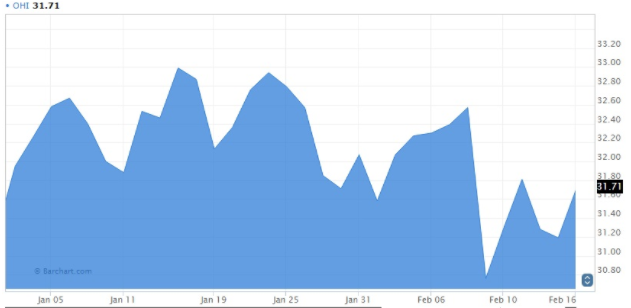

Dark Pools Favor Omega Healthcare Investors

With a dividend yield of 7.82%, Omega Healthcare Investors Inc. (OMI) takes the No. 3 spot on our list with a 58% boost in investor interest. The company, which operates as a U.S. REIT that invests in healthcare facilities, has been the subject of rising dark pool activity. Dark pools are private exchanges that are not accessible to the investing public and, therefore, do not impact the market with their large orders.

Although OMI shares have failed to generate much headway over the past 12 months, institutional investors are confident in the company’s long-term prospects as the demographics of the U.S. healthcare industry continue to shift. As the Baby Boomer generation continues to age, demand for long-term health facilities will continue to grow, making OMIa potentially lucrative long-term play. To learn more about REIT investments, read A Guide to REIT (Real Estate Investment Trust) Dividends.

The Bottom Line

Although the financial markets are brimming with confidence again, this week’s trends suggest investors are keeping an eye on volatile sectors. For more dividend news and analysis, subscribe to our free newsletter.