Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Less than two weeks after his inauguration, U.S. President Donald Trump has already had a major impact on the global financial markets. Although international trade continues to dominate the headlines, Trump’s proposed plan to rebuild the U.S. remains top of mind for investors.

Trump’s infrastructure plan was also a major market catalyst last week. Learn more by reading last week’s Trends report.

Steel and Iron Steal the Show

Last week, steel and iron dividend stocks were No. 2 on our trends list. This week, they take the No. 1 spot with a 350% surge in traffic.

Central to Trump’s presidential campaign was a pledge to spend $1 trillion on infrastructure over the next 10 years. For investors, this means huge potential for materials stocks. Therefore, it comes as no surprise that materials have been one of the best performing sectors since Election Day. The S&P 500 materials index is up 11.4% over the past three months, far outpacing the large-cap’s gain of 7.3% over the same period.

Investors are still awaiting official word from the White House about the scope and timing of the new fiscal stimulus. Until then, market participants will be actively scouring basic materials stocks for the best picks. Stay up to date on the latest developments in our News section.

Infrastructure Plan Boosts Interest in Cement Sector

With all this talk on infrastructure spending, it’s no wonder cement dividend stocks take the second spot on our weekly list with a 288% rise in viewership. At 1.12%, the cement industry offers smaller dividend yields when compared to other sectors.

Demand for cement investments this week wasn’t just tied to Trump’s stimulus plan or even the U.S. for that matter. In India, the Union Budget allocated a record amount of funds to the infrastructure sector. Other announcements aimed at strengthening rural income and affordable housing in India were also taken as positives for the cement industry.

To compare cement stocks with other companies in the industrial sector, visit the Industrial Goods sector page. This section lists all the components of the industrial goods sector, allowing you to compare dividend yield and top companies.

Washington’s Support of Pipelines Resonates With Investors

President Trump has not only issued executive orders reviving key pipeline projects, but he also has ordered that American-made steel be used in their development. That partly explains why oil and gas pipelines made our list for the second consecutive week with a 220% increase in traffic. Most pipeline operators are structured as Master Limited Partnerships (MLPs) and pay very high dividends. The oil and gas pipeline industry currently has an average dividend yield of 5.05%.

Pipelines have been on investors’ radar ever since Trump reopened the files on Keystone XL and Dakota Access, two highly controversial projects that were put on hold by former President Barack Obama.

Blackstone Group Pledges $500 Million Makeover

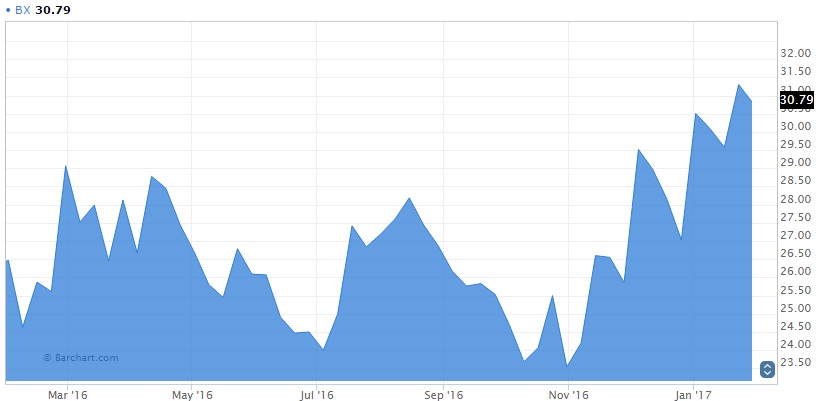

U.S. hedge fund Blackstone Group (BX ) announced big plans to revamp the country’s second-tallest building. For that reason, it secured 118% more viewership and took the No. 4 spot on our weekly list.

BX will spend $500 million to upgrade Chicago’s Willis Tower in an effort to boost tourism and office tenants. The makeover will be the first major renovation project in the tower’s 43-year history, according to a February 1 statement from Blackstone. The announcement provided a short-term boost for BX stock before it reversed most of the gains the following session.

BX enjoys a dividend yield of 6.11%, which is nearly double the financial average. Click here to check out Blackstone’s dividend history.

The Final Word

Materials stocks could be a boon to dividend investors’ portfolio as the Trump White House expounds its infrastructure plan.

To keep track of all the latest developments in the industry as they relate to your dividend investments, subscribe to our free newsletter.