Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

It has been less than a week since Donald Trump was officially sworn in as president, but the new commander in chief has already issued a flurry of executive orders and compiled a list of 50 infrastructure projects he seeks to undertake. The market’s response has been nothing short of euphoric, with investors increasingly gravitating toward material stocks that have the most to gain under Trump’s proposed infrastructure plan.

Bristol-Myers Squibb Cuts Earnings Guidance

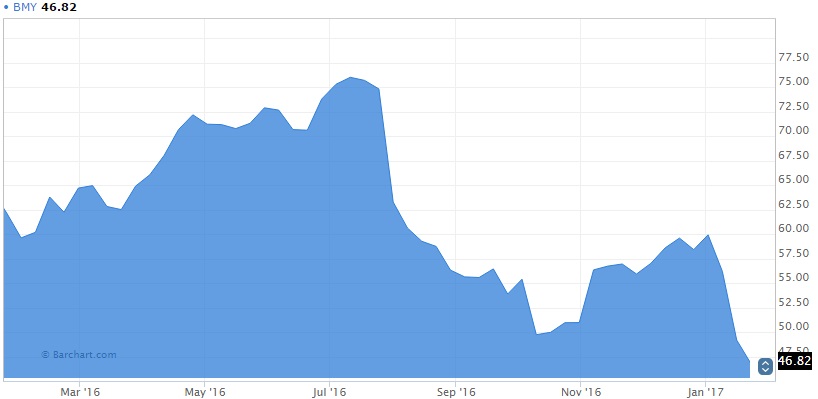

Infrastructure spending wasn’t the only item on investors’ agendas this week. Bristol-Myers Squibb Co. (BMY ) tops this week’s list with a 177% surge in viewership after the U.S. biopharma giant downgraded its 2017 earnings guidance. Plagued with setbacks to its cancer drug Opdivo, the company recently announced expectations for sluggish growth over the next 12 months.

Share prices have plunged roughly 19% since January 10, which amounts to a staggering $50 billion loss in market capitalization. Once touted as a mega-acquirer, the company is now just trying to keep its head above water. (BMY ) has a dividend yield of 3.33%.

It doesn’t help that President Trump has gone after big pharma for price gouging. Health stocks and the pharmaceutical industry have been left out of the Trump rally entirely since November 8, and face an uncertain future under the new administration.

Investors Eye Steel and Iron Dividends

For dividend investors, Donald Trump’s election to U.S. president brought material stocks to the forefront. Last week, steel and iron dividend stocks were No. 2 on our list with a 164% rise in viewership.

Various news reports this week indicated the Trump team has compiled a list of 50 infrastructure projects totaling $137.5 billion in investment. Roughly half of the reported investment will come from private industry.

Trump has made infrastructure spending one of the pillars of his presidency, and investors are anxiously awaiting the details. Materials stocks have gained 12.5% over the past three months, nearly double the return of the S&P 500 Index. The average dividend yield for the steel and iron industry is currently 0.94%. Learn more about the best steel and iron stocks here. Check out our News section for the latest news and analysis on the new presidential administration.

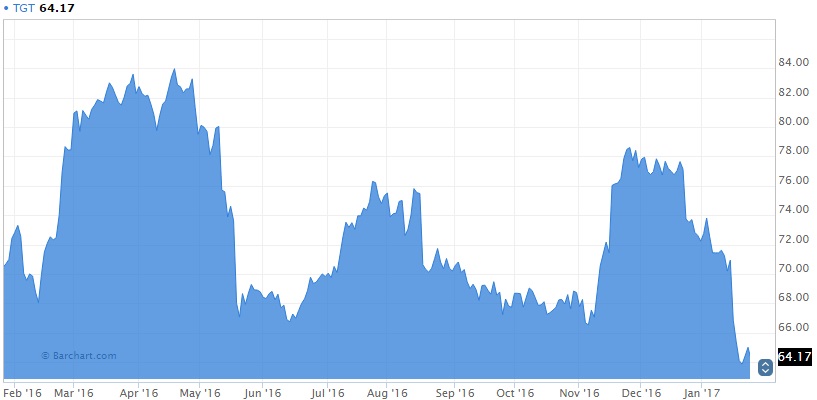

Downbeat Guidance Sends Target to Two-Year Lows

Target Corporation (TGT ) has had a rough start to the year, as weak holiday sales forced the mega-retailer to drop its Q4 earnings guidance. Investors have clearly paid attention to the headlines, pushing Target’s viewership 125% higher.

The company recently lowered its comparable store revenue and earnings outlook for Q4, citing a disappointing holiday season. (TGT ) shares have plunged 11% year-to-date and are down a whopping 18% from their post-election high.

It’s a difficult environment for traditional retailers, who are trying to compete with a fast-growing e-commerce sector. Target too has increased its online presence, but competition from the likes of Amazon (AMZN) and Wal-Mart (WMT ) is stiff.

To learn about the impact of e-commerce on the retail industry, check out Why E-Commerce Companies Don’t Pay Dividends in our Dividend Investing Ideas Center.

Trump’s Executive Orders Put Oil and Gas Pipelines on the Radar

It was an active week for oil and gas pipelines, which take No. 4 on our list with an 82% rise in viewership. The surge came after Trump issued two executive orders reviving Keystone XL and Dakota Access, two controversial pipelines that were paused under former President Obama. The Keystone pipeline will deliver crude oil to the United States from Alberta’s oil sands region, while Dakota Access seeks to transport up to 570,000 barrels of crude daily from North Dakota to Illinois.

Trump is a strong supporter of the U.S. energy sector, and has promised to lower regulations tied to fracking and drilling. This includes easing environmental requirements and opening federal lands to more exploration.

The Bottom Line

To learn more about what Donald Trump means for the U.S. economy and financial markets, read Dividend.com’s section on Trump’s Victory.

For more news and analysis, subscribe to our free newsletter.