It’s often said that it’s never too early to begin retirement planning. This is especially true for investors with lofty income and lifestyle goals.

If you want to live out your golden years in style and comfort rather than just scraping by, it’s time to apply proven investing rationale to your retirement portfolio. When it comes to investing, knowledge is power. The following apps help you take that same approach to retirement planning.

Before you begin, be sure to check out a comprehensive list of the top free and paid investment tools available on the internet.

| Rank | App Name | Downloads | Platform(s) | Best Features | Reviews | Pricing |

|---|---|---|---|---|---|---|

| 1 | Vanguard | ~1M | Online, Android & iOS | Investment app geared toward retirement when used with online Retirement Nest Egg and Retirement Income Calculator; easily manage account activity; trade financial assets in retirement accounts. | Highly recommended for investors; complete retirement investing solution; free Nest Egg Calculator helps people who are nearing retirement set up the right portfolio. | Free |

| 2 | Mint | ~10M | Android & iOS | Comparative projection tool for various retirement accounts; powerful charting tools; automatic categorization. | Easy to use and access format; easy for money management; worthwhile for more than just retirement planning. | Free |

| 3 | RetirePlan | 0.005M | iOS (iPad) | Outcome-based app that allows users to compare various retirement outcomes; results compiled on spreadsheet; comprehensive savings tool. | Comprehensive, detailed and easy to use; responsive updates; sophisticated without being overly complicated. | $6.99 |

| 4 | Financial Calculators | 1M | Android & iOS | Extensive selection of calculators for retirement, savings and payments; retirement savings analysis; stock return calculator and financial planner. | Complete solution; easy to use for quickly crunching numbers; simple interface; great for evaluating financial opportunities. | Free |

| 5 | Retirement Outlook Estimator | 0.01M | Android & iOS | In-depth financial data at a glance; imports banking information; data is easily compiled into a budget. | Provides a near-painless budgeting process; simple to understand and apply; easy to search transactions; in-depth graphical analysis. | Free |

1. Vanguard

Investors need no introduction to Vanguard, which is one of the world’s largest investment companies with more than $3.5 trillion in global assets. Vanguard is a company of tremendous resources, and for that reason can offer premium retirement planning tools free of charge. Vanguard boasts one of the best mobile apps in the financial industry; combined with its free online Nest Egg Calculator, it also makes one of the best retirement planners.

Best Features: Vanguard offers two of the best retirement income calculators on the market. The Retirement Nest Egg Calculator provides an easy method for aligning your retirement goals with the realities of your financial health. The Retirement Income Calculator then helps you estimate how much income you’ll need to achieve your lifestyle goals during retirement. The calculators rely on statistically rigorous calculations using a Monte Carlo analysis to determine the probability you’ll achieve your income goals in retirement. These features may prove sufficient without the mobile app should you choose not to open a Vanguard account.

Pricing: Free (online calculators and mobile app)

Demographic: The retirement calculators can be used by anyone in the initial or advanced planning stages of their retirement. The mobile app is geared toward active investors and Vanguard account holders.

Platform(s): Online, Android & iOS

How to use Vanguard

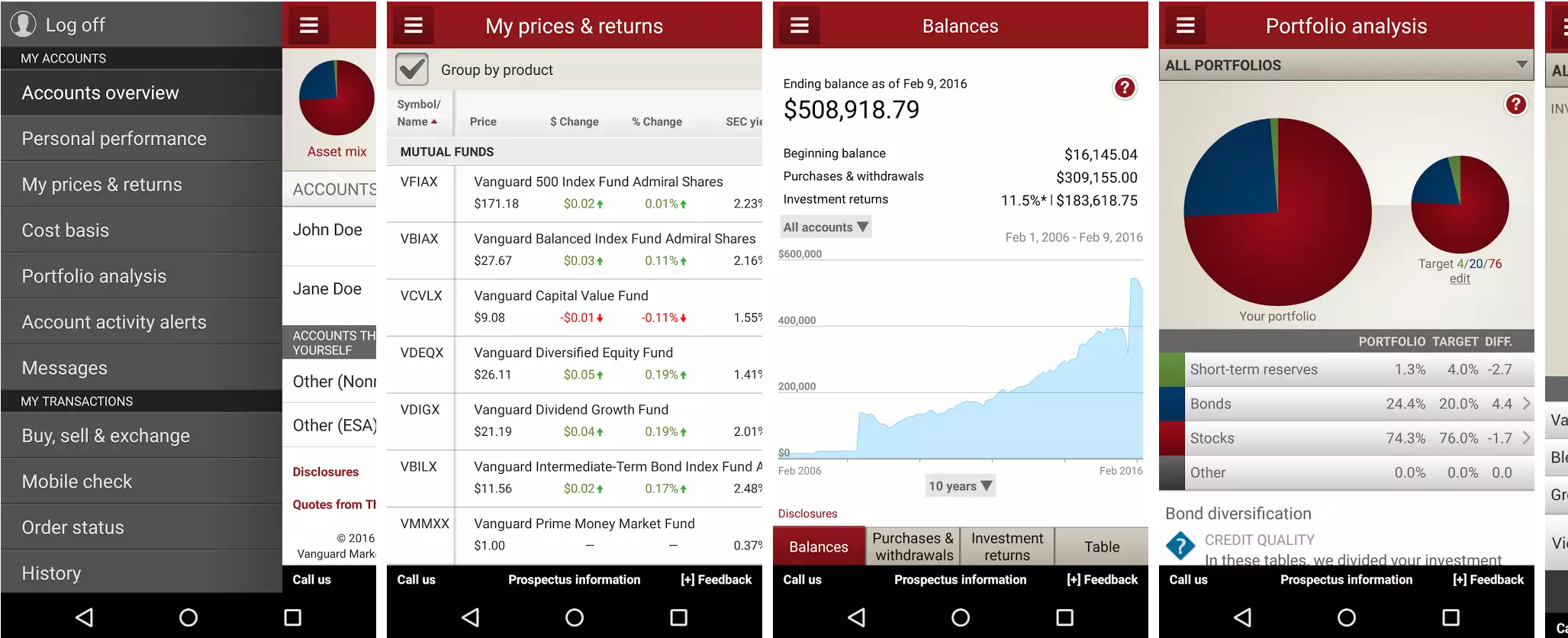

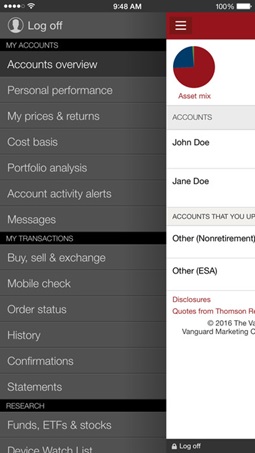

- Vanguard account holders can access their financial assets, deposit checks and transfer funds using the mobile app. After connecting your mobile device with your Vanguard account, you are ready to begin retirement planning from the palm of your hand.

- You can also research investments and review their performance before logging on to the app, as the following iPad screenshot demonstrates:

- iPhone users who have enrolled in Apple’s Touch ID can sign in to the Vanguard app with their fingerprint. This can be enabled by signing into the Vanguard app with your username and password, scrolling over to “Settings” and enabling “Remember user name.” From here, you can tap on the “Turn on Touch ID for log on” box. Review the statement and click “Yes.”

- Using the “Accounts overview” feature, you can check your accounts, transactions and conduct market research.

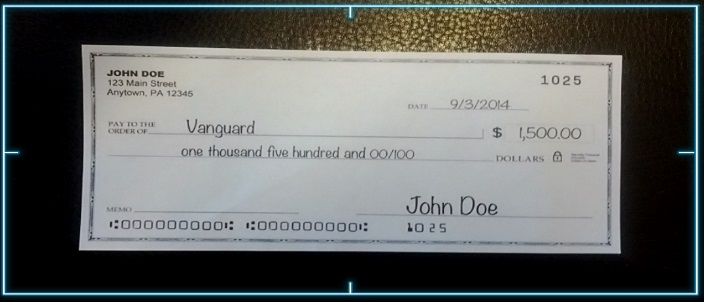

- You can deposit money directly into your account using the camera on your mobile device. Just take a picture of a check that’s made payable to Vanguard or a Vanguard account holder and the money will be deposited into the account.

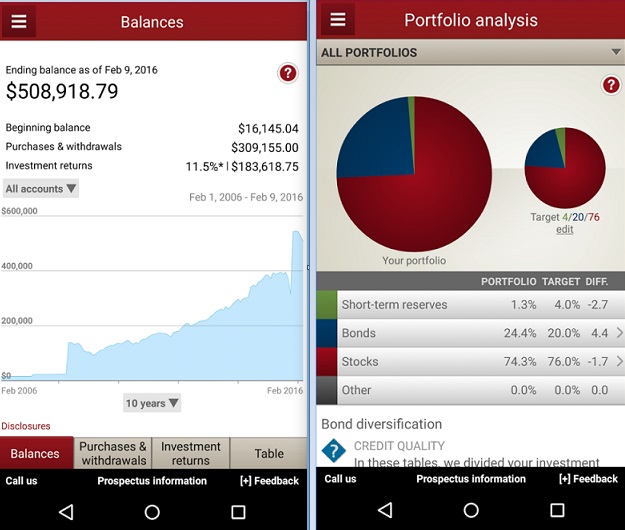

- Finally, check account balances and conduct portfolio analysis with just a few swipes.

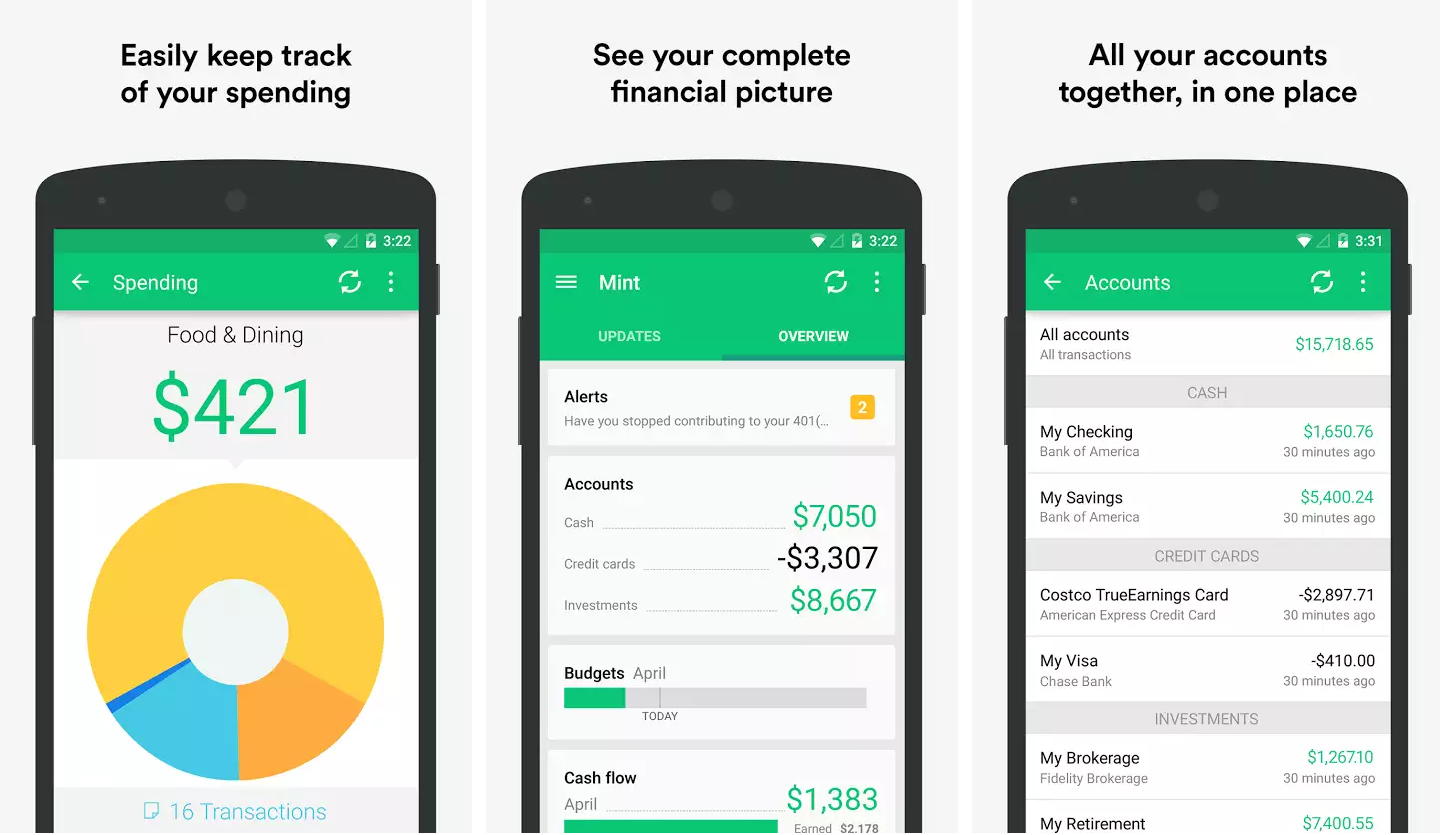

2. Mint Budgeting App

Mint is one of the most popular financial budgeting tools on the market. Its capabilities extend far beyond simple tracking and analysis; it is a complete financial planning app that helps investors compare and monitor the outcomes of their investment and retirement portfolios.

Best Features: Mint allows investors to compare projections for investing in various retirement accounts, including a 401(k), Roth 401(k), Roth IRA or traditional IRA. The app also allows investors to link various financial accounts and credit cards, providing a central repository for financial transactions. The tool provides an attractive, colorful layout with detailed transactions of incomes and outlays.

Pricing: Free

Demographic Base: Dividend investors, early- to mid-career professionals pursuing lifestyle goals or early retirement.

Platform(s): Android & iOS

How to use Mint

- After downloading the app, Mint gives you the option to “see all your accounts in one place.” Here, you can search for your bank and link it to the app.

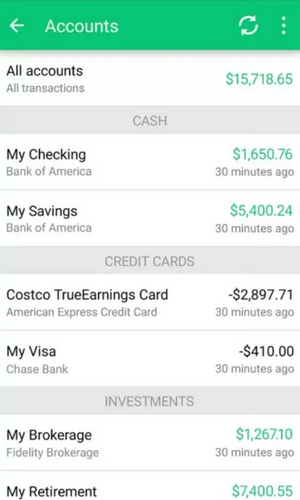

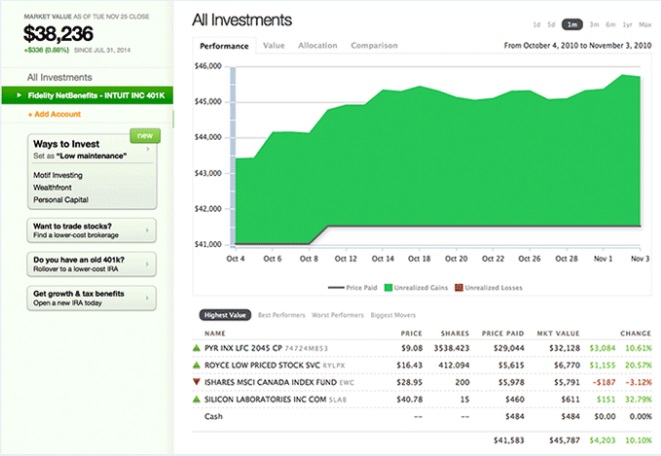

- After logging into your bank account, scroll down to the “Investment” section to access retirement and other brokerage services.

- While Mint is primarily known as a budgeting app, it also helps you track investments and incorporate them into your overall finances. This is the place to receive tips and investment advice.

- You can set up retirement and investment goals directly through the Mint app. You also have the option to set other financial goals. This allows you to create a solid investment strategy that aligns with your overall budget and other financial goals.

3. RetirePlan

RetirePlan has more exclusivity than the other platforms since it is only available on the Apple iPad. The app is designed to help users answer questions about retirement, including “When can I retire?” and “How much do I need to save every year?” By inputting values such as current age, expected retirement age, life expectancy and average yearly savings, users can begin to form a clearer picture of their retirement goals and what they need to do to get there.

Best Features: RetirePlan is an intuitive platform that provides no shortage of variables for answering life’s most important retirement questions. Users can control a wide variety of values from marital status all the way up to interest rates. Each change may bring about a different outcome for retirement, allowing you to plan effectively. Results are available in spreadsheet format that can be sent to your email.

Pricing: $6.99

Demographic Base: Anyone in the initial or advanced planning stage for retirement.

Platform: iOS (iPad)

How to use RetirePlan

- RetirePlan is designed to give you quick answers to the following questions: When can I retire? How much do I need to save on a yearly basis? How much money will I receive annually after I retire?

- After downloading the app and creating an account, simply enter your data and assumptions. The tool will quickly put a plan in place.

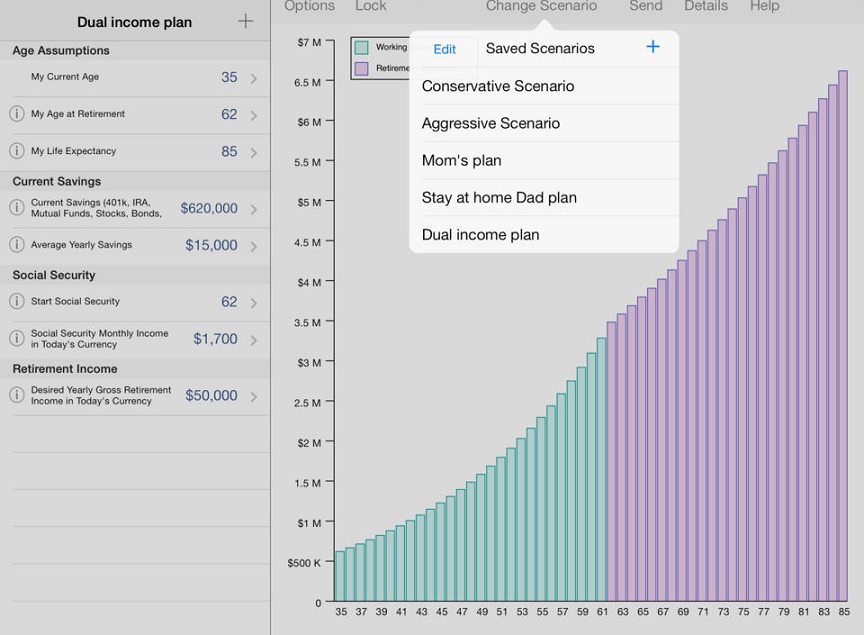

- A report will be generated automatically after entering your current age, expected age at retirement, expected life expectancy, current savings, social security and retirement income. At the top of the screen, you can change your scenario to reflect different hypothetical retirement plans or investment approaches. For example, you may choose to run your model under a conservative or aggressive scenario.

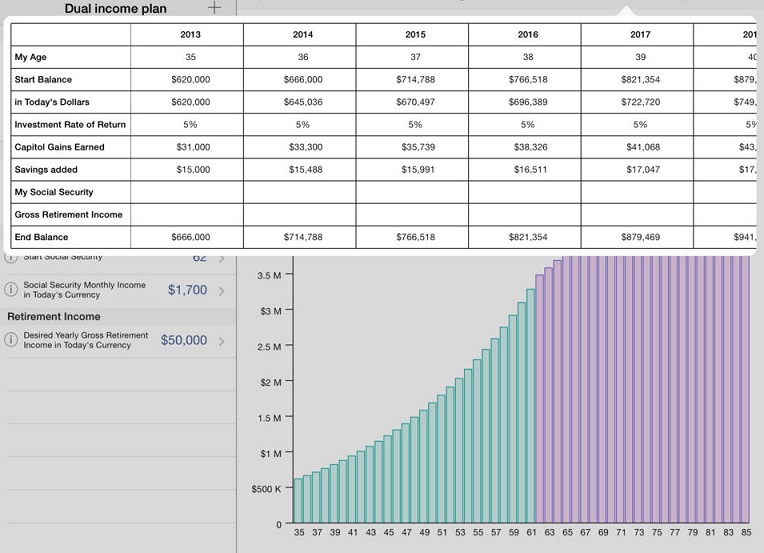

- Unlike other apps, RetirePlan gives you a breakdown of your financial situation on a yearly basis, accounting for things like inflation, starting balance and savings added.

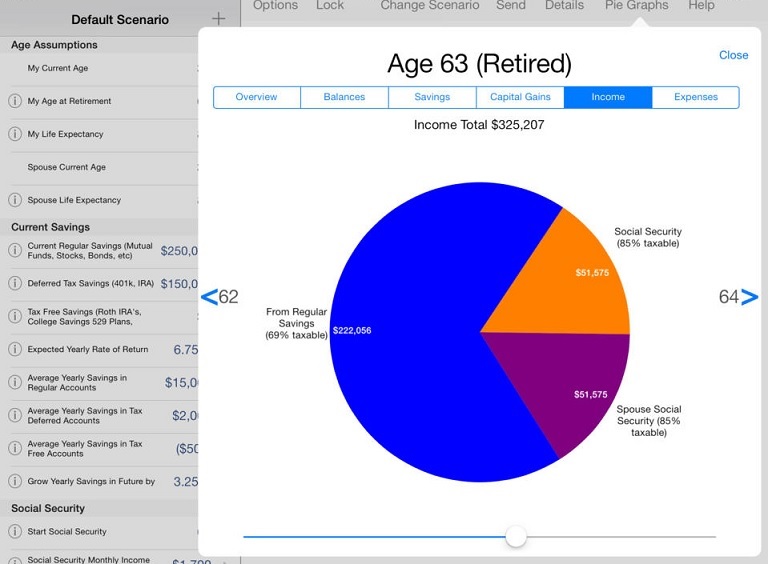

- Next, scroll over to the “Pie Graphs” section for a detailed breakdown of your expected balances, savings, capital gains, income and expenses once you hit your retirement age.

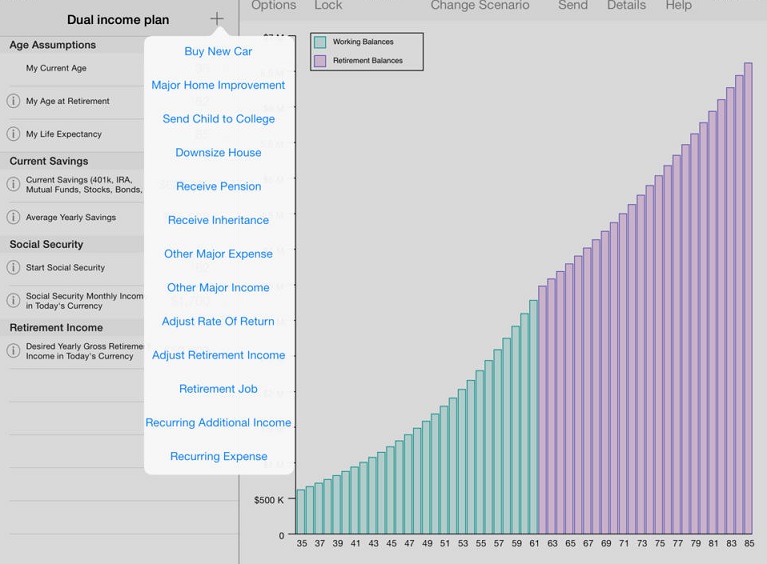

- RetirePlan also allows you to test out various assumptions that could potentially impact your retirement. By clicking the “+” symbol, you can add new scenarios that will impact your retirement, such as buying a car, paying for major home improvement, taking on a retirement job or other major incomes and expenses.

4. Financial Calculators

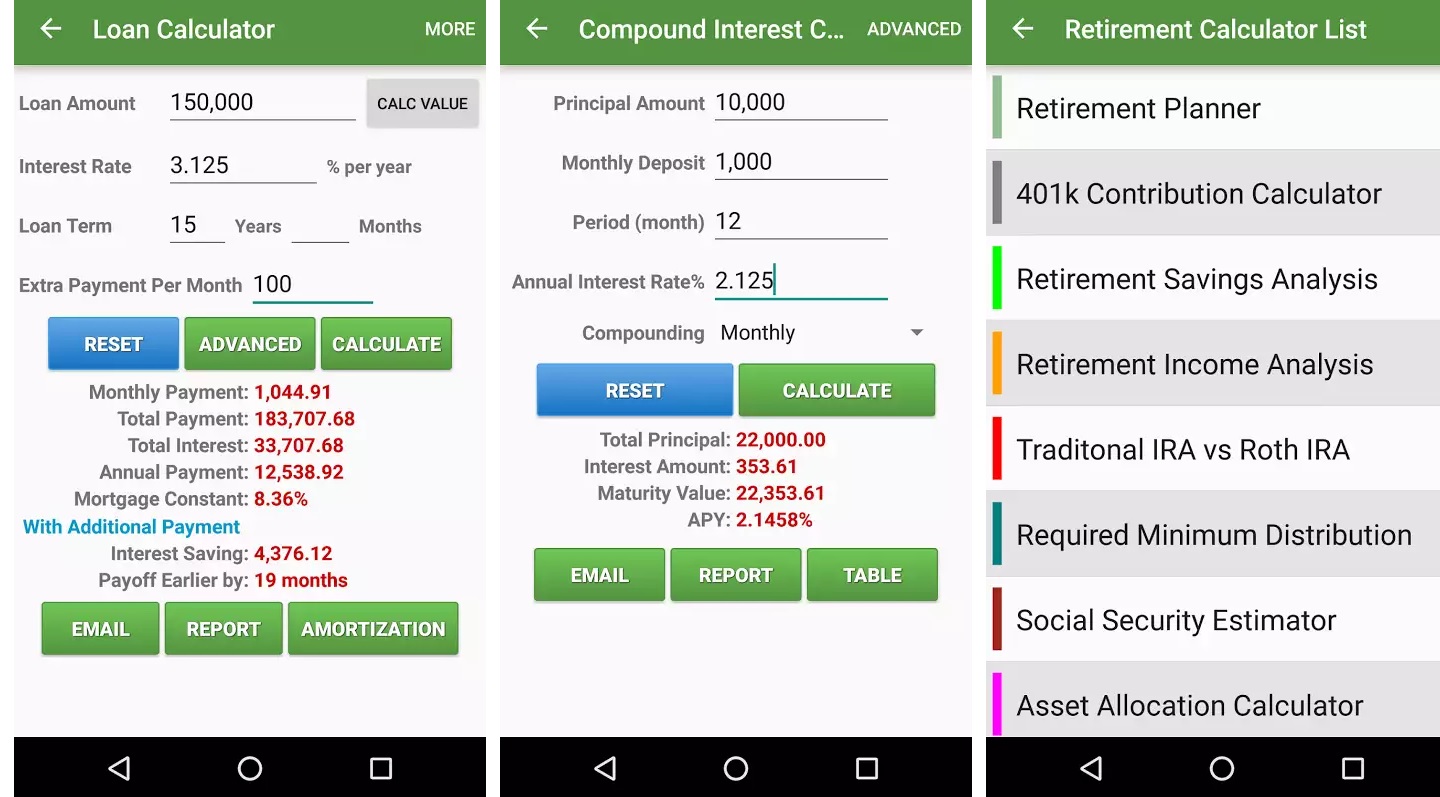

Financial Calculators offers a myriad of investment tools geared toward both investors and consumers. It also has one of the largest selections of retirement calculators in the market, allowing investors to perform asset allocation and determine their required minimum distribution. The app is available on mobile phones and tablets, giving investors plenty of options to crunch their numbers.

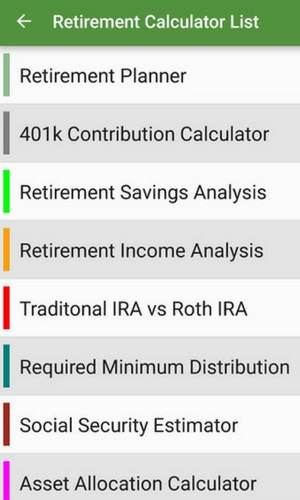

Best Features: Living up to its name, this app provides seven categories of calculators, including Finance and Investment, Loan/Mortgage, Retirement, Stock, Credit Card, Auto Loan and Lease, and Miscellaneous. The Retirement category provides the following calculators:

- Retirement Planner

- 401k Contribution Calculator

- Retirement Calculator

- Retirement Savings Analysis

- Retirement Income Analysis

- Retirement Saving Calculator

- Retirement Income Calculator

- Traditional IRA vs. Roth IRA

- Required Minimum Distribution

- Social Security Estimator

- Asset Allocation Calculator

- 401k Save the Max Calculator

Pricing: Free

Demographic Base: Investors planning for retirement, dividend investors, stock traders, consumers looking for a comprehensive budgeting tool.

Platform: Android & iOS

How to use Financial Calculators

- From a retirement planning perspective, Financial Calculators is simple to set up. Simply download the app and navigate to the Retirement Calculator List, where you have the option of 12 calculators. Below is a snapshot of some of the available calculators.

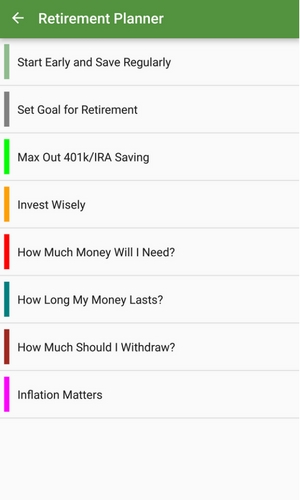

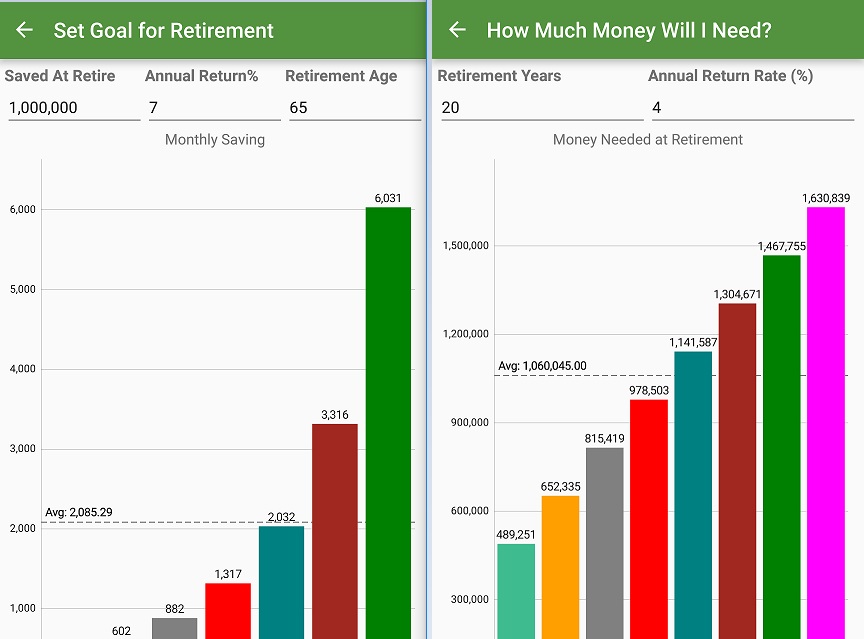

- The Retirement Planner section gives users the opportunity to try out various retirement scenarios. This section helps you answer the following questions: How much money will I need at retirement? How long will my money last? How much should I withdraw?

- Inside these sections, the calculator is very straightforward. Simply type in your planned retirement rate and annual return rate. You’ll also have the opportunity to set your retirement goal by indicating the amount of money you plan to have at retirement. The app will then quickly run an analysis.

5. Retirement Outlook Estimator

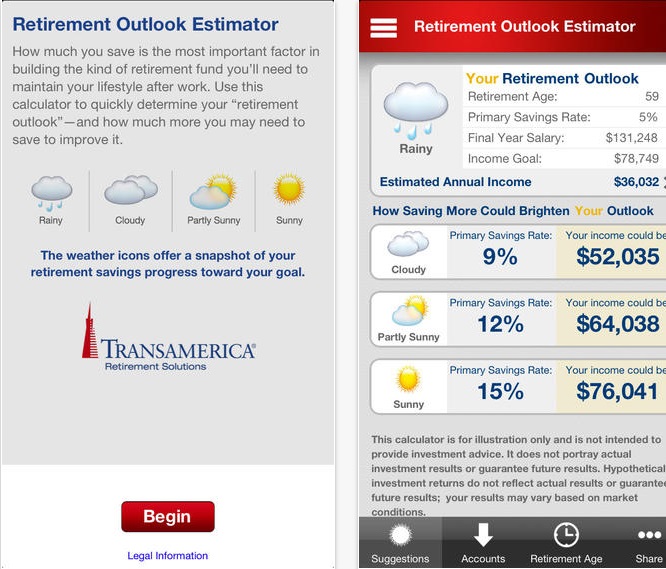

In the world of mobile apps and digital devices, creativity goes a long way. That’s why Retirement Outlook Estimator (ROE) cracks our list. Rather than just give you the bare bones budgeting tools and calculators, Retirement Outlook Estimator helps you answer the following question: How close am I to meeting my retirement income goals?

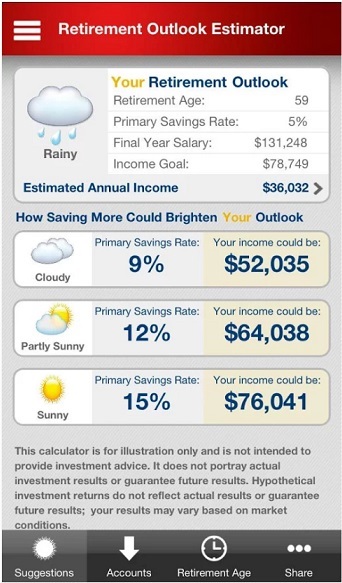

Best Features: ROE cleverly provides a weather forecast for your retirement savings, giving you an intuitive, easy-to-understand snapshot of your financial health as it relates to your overall goals. By playing around with your personal income and desired outcomes, you can begin to brighten your retirement forecast. ROE isn’t the most comprehensive tool on the market, but offers something unique that investors will enjoy.

Pricing: Free

Demographic Base: Anyone in the initial or advanced planning stage for retirement.

Platform(s): Android & iOS

How to use ROE

- The Retirement Outlook Estimator greets users with a breakdown of the weather icons that will describe your results. The aim of the app is to help users attain a “sunny” retirement outlook.

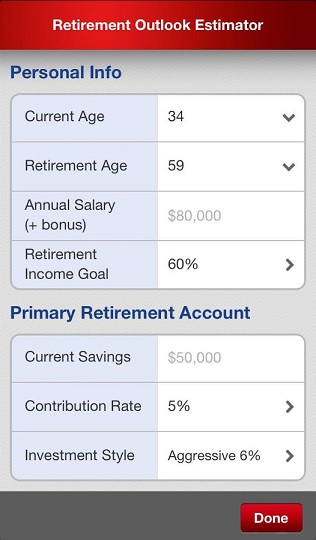

- To set up your retirement outlook estimator, begin by filling out the “Personal Info” section by typing in your current age, desired retirement age, annual salary and retirement income goal. Next, fill out the “Primary Retirement Account” section, which includes info on your current savings, contribution rate and desired investment style.

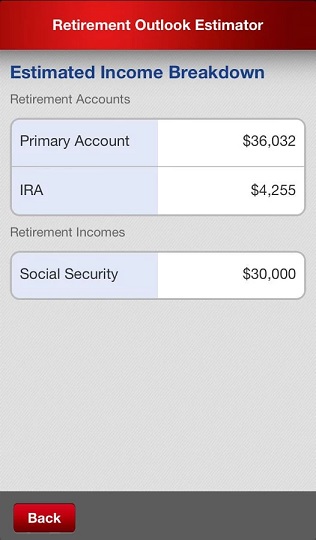

- The tool also provides an estimated income breakdown that looks something like this:

- After crunching the data, ROE provides a detailed snapshot of your retirement outlook, including a breakdown of the strategies you can use to boost your savings. The calculator also provides an estimate of your estimated annual income during retirement. If the number doesn’t quite jive with your goal, consider ROE’s suggested savings rates to boost your after-work income. Remember, these numbers can change by adjusting your personal info and existing retirement account features.

Remember, you can supplement these and many other apps with Dividend.com’s compounding returns calculator and other online resources, such as the top 20 blogs/websites for dividend investors.

The Bottom Line

Retirement planning doesn’t have to be onerous. If you’re a dividend investor, you’re likely ahead of the curve in many respects. By complementing your investment portfolio with some of the budgeting tools provided above, you can save valuable time en route to the retirement lifestyle of your dreams.

If you found this article useful, be sure to follow our Investment Resources section where you can find similar resources.

Make sure to read our article on budgeting apps you should know about as well.