Looking for top-notch dividends? Our Best Dividend Capture list is just a click away.

Happiness comes in small instalments. Anyone who has received a dividend check in their mailbox surely knows this.

At Dividend.com, we are determined to maximize such instances of happiness by helping you unearth the right dividends from the right stocks. If you are a day trader looking to make a solid profit or you are a high-volume player who is not shy to employ leverage to extract dividends, then you have landed in the right place.

We compiled the Best Dividend Capture list for you. This is our latest tool that will help you to identify relevant dividend plays. By updating the list every day, the tool will ensure that you do not run out of stock ideas to apply the dividend capture strategy.

Find one-day trades returning 1% on our Best Dividend Capture list.

Introduction to Dividend Capture Strategy

Sure, dividends might look like morsels compared to capital gains. But small dividends can help you to build a lifetime’s wealth.

But how? Enter the Best Dividend Capture list and the dividend capture strategy.

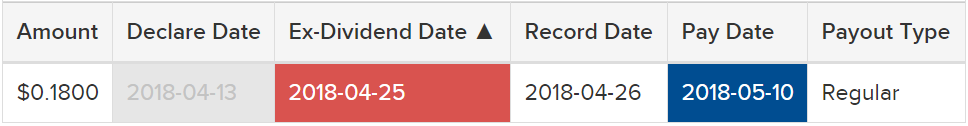

The dividend capture strategy requires an understanding of the dividend timeline. It consists of a declaration date, ex-dividend date, record date and payable date. While the dividend to be paid on a stock is usually declared a couple of months in advance, on the declaration date, the stock must be bought before the ex-dividend date to be able to collect the dividend. The strategy is best explained with the help of an example.

Let’s take the case of First Republic Bank (FRC ), a San Francisco-based financial institution and a top pick in our Best Dividend Capture list, as of April 25, 2018.

First Republic announced that it would pay a dividend of $0.18 per share on 2018-04-13, the declaration date. To be able to collect this dividend from the bank, a trader would have to hold the stock prior to the ex-dividend date of 2018-04-25. If a trader buys First Republic stock any time on or after this date, the trader would not qualify for its dividend.

After purchasing FRC’s stock, all a trader must do is hold the stock through the record date of 2018-04-26 and sell it immediately after this day. This way, the trader gets to pocket the dividend while minimizing the holding period.

While at first look the dividend of $0.18 might seem tiny, imagine a trader using leverage to purchase 1,000 FRC shares on the ex-dividend date. The trader will collect a cool $180 in dividends soon after. Once the dividend is collected, the trader can sell FRC and unwind the leverage. This way, in a matter of two to three days, a dividend capture strategist can grow his or her dividend corpus.

Neat. But there are some key issues to watch for. Stocks typically fall in price after the ex-dividend date, usually by an amount equivalent to the dividend paid. However, the dividend strategy will only be profitable if the stock recovers to its ex-dividend price before selling it back. If a stock takes forever to climb to its ex-dividend price, the dividend capture strategy will not be efficient.

But how does one identify a stock that would quickly recover to its ex-dividend price after paying a dividend?

This is where a bit of research and history can help, and this is exactly what our Best Dividend Capture list does for you.

To know more details about the pros and cons of the dividend capture strategy, click here.

Welcome to the Best Dividend Capture Stocks List

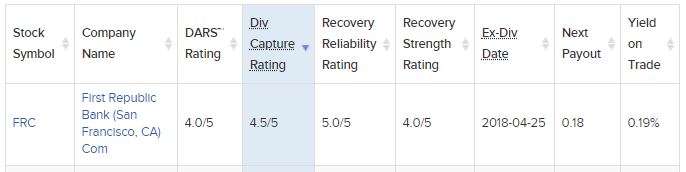

In its basic form, the Best Dividend Capture list is a CSV-based tool. It identifies a share by its symbol and company name and lists key metrics, such as Dividend Advantage Rating System (DARS), Dividend Capture Rating, Recovery Reliability and Recovery Strength, for a stock. It also includes Ex-Dividend Date, Next Payout and Yield on Trade for the stock.

The Best Dividend Capture list gets updated daily and you can download the list in a CSV format to access dozens of great candidates for implementing the strategy on a daily basis.

Among these factors, the ‘Recovery Reliability’ and ‘Recovery Strength’ metrics require a bit more attention because Dividend.com uses them to assign a Dividend Capture Rating.

Recovery Reliability looks back at the history of a stock’s price in the past 10 dividend payout periods and determines how many instances the stock clawed back to its pre-dividend price within a period of five business days after the stock went ex-dividend. A stock that recovered eight out of 10 times within five days after going ex-dividend gets a top of rank of ‘5’. A stock that suffered post-dividend blues and failed to recover within five days during any of the past 10 post-dividend declaration periods is given a bottom rank of ‘0’.

Similarly, the Recovery Strength rating computes the speed at which a stock recovered post ex-dividend date in the past. A stock that marched back to its pre-dividend price within a day after going ex-dividend is likely to be helpful for a dividend capture strategist and is given a ranking of ‘5’; a stock that did not get back to its ex-dividend price even after five days is given a ranking of ‘0’. Who wants to buy a laggard that doesn’t rise quickly after going ex-dividend?

Dividend.com then assigns the ‘Dividend Capture Rating’ by taking the average of the Recovery Reliability and the Recovery Strength. The higher this rating, the better the stock to apply the dividend capture strategy. Further, for a stock to qualify for the Best Dividend Capture List, it must at least score a 3.5 in our proprietary DARS and should have a history of 10 previous regular payouts.

For more information on our proprietary dividend rating system, i.e., DARS, please refer to our article here.

Click here to learn more about the different individual rating buckets under the two criteria that constitute the overall Dividend Capture Rating System.

Using the Tool to Implement the Strategy

Let’s get back to our pick of First Republic Bank to get an intuitive understanding of the Best Dividend Capture list.

At the first stop, FRC qualifies for the Best Dividend Capture list with a DARS score of 4.

The fourth column in the tool, the ‘Div Capture Rating’, highlighted in blue, is the average of the ‘Recovery Reliability Rating’ and the ‘Recovery Strength Rating’, the fifth and sixth columns, respectively. On these two measures, FRC scores 5.0 and 4.0, respectively, for an average ‘Div Capture Rating’ of 4.5. This would mean that in each of the past 10 instances in which the San Francisco-based bank paid a dividend, it not only recovered to its ex-dividend price the most number of times but also did so relatively quickly compared to other potential Best Dividend Capture list candidates.

In short, it means that FRC is a trusted candidate for the dividend capture strategy.

If FRC trades at $93 per stock and pays a quarterly dividend of $0.18, its stock is bound to fall to $92.82. But if FRC recovers to a price of $93.50 after a few days of paying the dividend, a dividend capturer who sells at this price would make a profit of $0.18 in dividends and $0.50 in capital gains for a total gain of $0.68 before taxes and commissions. Leverage could magnify the returns further.

Such is the power of a simple strategy.

Further, in addition to helping you identify great dividend stocks, Best Dividend Capture List also allows you to sort an already great list of stocks based on a preferred metric of your choice. For example, with the Best Dividend Capture List, you can select only those stocks that have a certain amount of yield or only those that have a certain dollar amount of upcoming dividends.

You can also use our Dividend Screener to look for securities with which you can apply your other dividend-oriented investment ideas. You can even use the screener to create a filter like this to explore U.S. listed stocks with an attractive Dividend Capture Rating. To make it more useful, you can download this filtered list in a spreadsheet and perform custom analysis.

The Bottom Line

The possibilities and choices are many when Best Dividend Capture list is by your side.

If you are in the market for great dividend paying stocks, Best Dividend Capture list will make sure that you never run out of ideas to apply the dividend capture strategy.

Isn’t it time to go check the mailbox for your next ounce of happiness?

Be sure to visit our News section to be in touch with the latest dividend-oriented investment strategies and market updates.