Master Limited Partnerships (MLPs) have grown in popularity since the financial crisis, as income investors looked to earn attractive yields while enjoying favorable tax benefits. But as the era of record-low interest rates comes to an end, investors need to once again weigh MLPs against more traditional dividend stocks.

MLPs: An Introduction

MLPs are a type of business that exists in the form of a publicly traded limited partnership. In other words, they combine the tax advantages of a partnership with the liquidity of a public enterprise. For investors, one of the main benefits of MLPs is they are taxed only when profits are distributed.

As a rule, MLP partners are of two types: limited partner investors who purchase shares in the enterprise and provide the capital for its operations and general partner owners who are responsible for managing the daily operations of the MLP. Limited partners are paid periodic distributions from the MLP, usually on a quarterly basis. General partners are compensated based on the underlying performance of the business.

MLPs are traded on national exchanges and usually operate in the energy industry where they provide and manage resources. MLPs are concentrated in this segment of the economy because they were originally mandated in the 1980s to help businesses that operate in the natural resources sector. One notable example of an MLP is the Texas-based Genesis Energy L.P. (GEL ), which provides pipeline, refinery and logistics services for the oil and gas sector.

Click here to learn about the different ways to access MLPs.

MLPs vs. Dividend Stocks

Although MLPs are generally considered to be high-yield stock classes, they differ from regular dividend stocks, which are publicly traded companies that pay out profits to shareholders on a regular basis (i.e., monthly, quarterly, annually).

Unlike regular dividend stocks, most MLPs operate as “pass-through” entities, which are exempt from corporate taxes. Under U.S. law, “pass-through” entities pass on cash and tax obligations to unitholders. This set-up also means MLPs retain very little earnings that can be used for future investments or growth initiatives.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

The structure of an MLP is designed to allow partnerships to raise capital from qualified investors. As such, most of the cash flow is used to fund large payouts. This isn’t the case for dividend stocks, where payouts are determined by a company’s dividend per share. Regular dividend companies also distribute the same payout to every investor who holds the stock. Participation in these companies is also less restrictive than MLPs and open to far more sectors and industries.

Whereas MLPs are taxed as “pass-through” entities, dividend earnings are taxed as ordinary income. However, qualified dividends are qualified at a much lower rate.

Click here to learn what a qualified dividend is.

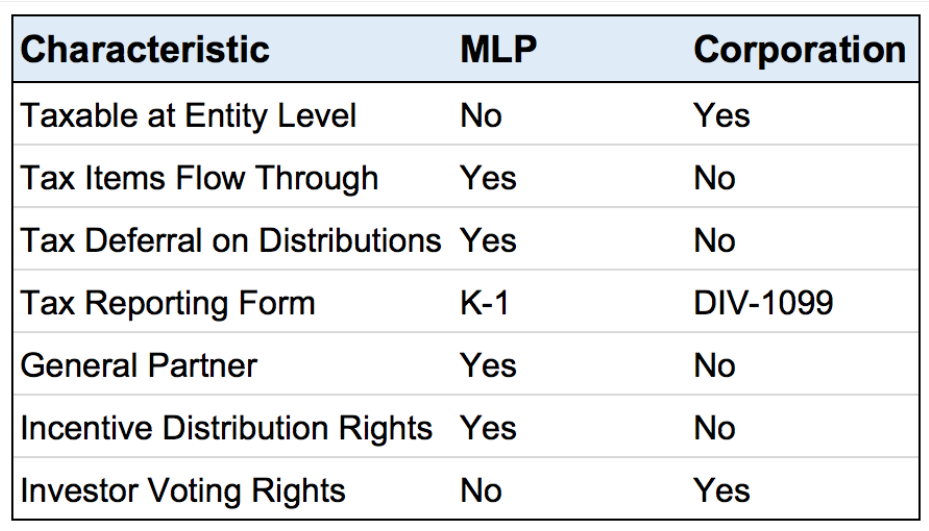

Since most dividend stocks are structured as corporations, it’s also important to bear in mind the tax differences between MLPs and regular dividend-paying companies. The following chart highlights the tax differences between MLPs and corporations.

Source: Simply Safe Dividends

Take a look at the complete list of MLPs and Dividend Stocks.

Despite these differences, there is a way for investors to gain access to both MLPs and dividend stocks at the same time. Several oil and gas companies are structured as MLPs instead of a corporate entity. Under this structure, a company is likely to own a stake in its own MLP. It is also likely to establish separate stock-issuing corporations that own shares (i.e., units) of the MLP and redistribute income through the corporation as a regular dividend. An example of such a firm is Linn Energy Inc., which operates an MLP and a corporation that owns interest in the MLP.

MLPs are advantageous in that they offer slow investment opportunities, which means low risk and steady cash flows. This allows MLPs to offer attractive income yields, which are usually much higher than average dividend-paying companies. Combined with the unique tax benefits, MLPs are a viable investment vehicle for risk-averse investors looking for long-term stable income growth.

Some of the examples of slow-growth MLPs are found in the market for exchange-traded funds (ETFs). ALPS Alerian MLP ETF Liquid error: internal is the largest MLP-focused fund in the U.S., based on assets under management (AUM). The AMLP fund is designed to track a leading infrastructure index of MLPs. Meanwhile, the Vanguard Dividend Appreciation ETF (VIG ) is the largest dividend-focused ETF based on AUM. VIG seeks to track the performance of the NASDAQ U.S. Dividend Achievers Select Index, emphasizing stocks with a strong track record of dividend growth.

On the other hand, MLPs are limited by sector as they mostly operate in oil and gas logistics. This makes diversification difficult if one solely relies on MLPs for income growth. This investment vehicle also requires unitholders to file a Schedule K-1 form, which is much more complicated than the 1099-DIV tax return form. If you don’t have an accountant, prepare to get one and be ready to pay more for their services. Additionally, if the MLP operates in more than one state, you may have to file in multiple states.

There’s also no getting around the fact that MLPs have had limited upside historically, which means reliable income can take a while to accumulate.

Want to learn about the dividend history of the real estate sector? Click here.

The Bottom Line

MLPs offer unique benefits that most income investors will find useful as part of a well-balanced portfolio. But the opportunities and risks should be weighed carefully, especially when comparing against traditional dividend stocks.

Check out our Best Dividend Stocks page.