As the newest sector tracked by the S&P 500 Index, real estate plays a dynamic role in the financial markets. Despite their relatively small size, Real Estate Investment Trusts (REITs) are known for their dividend prowess, giving them an important role in any well-balanced income portfolio.

On Aug. 31, 2016, real estate officially became the eleventh primary sector to be tracked by the S&P 500 Index. In doing so, it became the first new sector entrant since 1999.

With a market capitalization of $1.24 trillion, real estate is tied for last in terms of overall representation. Since inception the subindex has gained a paltry 4%, vastly underperforming the broader market average and high-profile sectors such as financials and information technology. This comes despite the S&P 500 booking its longest bull market on record.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

Real Estate Stocks and Dividends

Within the S&P 500, real estate is further broken down into two categories: REITs and Real Estate Management and Development Companies. From the perspective of income investors, Dividend.com still tracks real estate companies as part of the financial sector, which consists of 60 components. The real estate-relevant categories and their dividend information are provided in the chart below as of August 28, 2018.

| Industry | Company Count | Industry Dividend Yield |

|---|---|---|

| Property Management | 26 | 3.02% |

| Real Estate Development | 49 | 3.49% |

| REIT – Diversified | 54 | 4.66% |

| REIT – Healthcare Facilities | 20 | 4.24% |

| REIT – Hotel Motel | 25 | 3.49% |

| REIT – Industrial | 19 | 3.81% |

| REIT – Office | 29 | 2.98% |

| REIT – Residential | 41 | 4.04% |

| REIT – Retail | 44 | 3.76% |

As the chart illustrates, REITs and other real estate management companies yield exceptionally well in comparison to other financial components and the broader market. The average dividend yield for the S&P 500’s financials index is 2.95%, putting it in top spot versus other sectors. All the property management and REIT categories listed above yield more than the financials sector average.

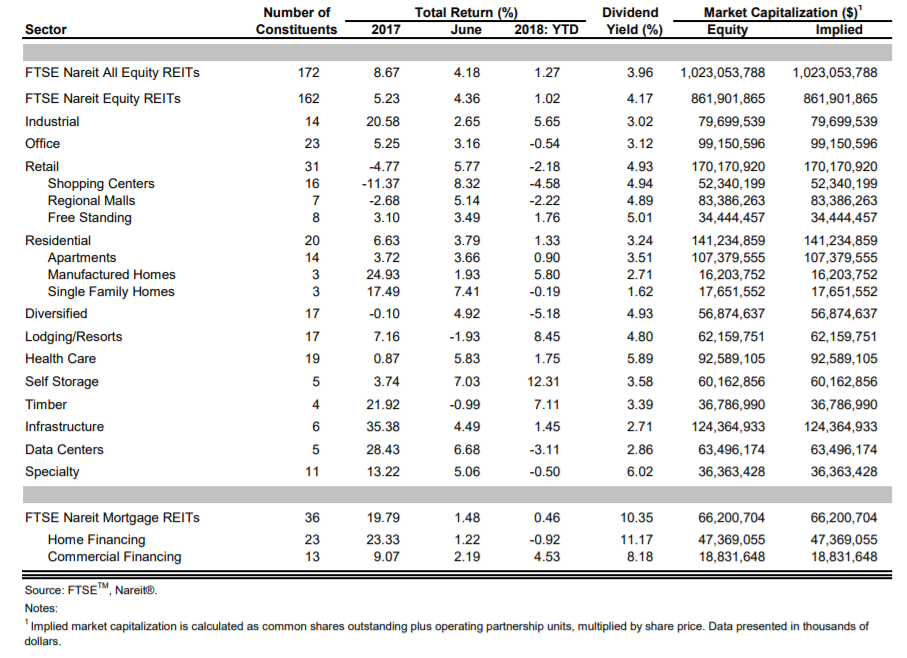

A closer evaluation of the retail subcategories reveals solid income across the board, with virtually every industry surpassing the S&P 500’s average yield of around 1.75% (as of Aug. 29, 2018). Some of the top-yielding categories within real estate include specialty (6.02%), health care (5.89%), free standing retail (5.01%) and regional malls (4.94%). In fact, the retail category as a whole, inclusive of shopping centers, regional malls and free-standing buildings, boasts the highest average yield, based on 2018 data.

Interestingly, residential REITs have been among the worst performers amid the gradual cooldown in the housing market. Home sales in the United States have declined sharply in recent months, as affordability issues and rising interest rates weed out potential buyers.

Below is a detailed breakdown of the sector’s yield performance as of Q2 2018.

Follow Dividend.com’s Dividend Education section to get answers to all your dividend-specific questions.

90% Rule

For income investors, very few industries are as attractive as REITs. That’s because the Securities and Exchange Commission (SEC) has specified that these companies must distribute 90% of their taxable earnings to shareholders.

As far as the SEC is concerned, “taxable income” has a very specific meaning – namely, it refers to financial results explained through generally accepted accounting principles (GAAP). Real estate trusts determine their dividend payouts based on their cash flow statement rather than their earnings. Even REITs with negative GAAP earnings still pay dividends.

Although these types of payouts benefit income investors, some notable REITs such as PS Business Parks (PSB ) and Digital Realty Trust (DLR ) do not to follow the 90% rule.

In Spite of the 90% Rule, Why Do Some REITs Have Poor Payout Ratios? Find out here.

Advantages and Disadvantages of Real Estate Dividend Stocks

For yield-seeking investors, real estate trusts offer both advantages and disadvantages. Below is a quick rundown of each.

Advantages

- 90% Rule: Despite its issues, the 90% rule provides a strong value proposition for investing in real estate trusts. Either way you cut it, guaranteed payouts are almost always a good thing for dividend investors.

- Higher Yields: Large payouts (again, see the 90% rule) usually lead to higher yields. A company’s yield is one of the biggest considerations for income investors.

- Diversification: REITs are largely uncorrelated with stock prices, which means they are well positioned to outperform the market during cyclical downturns or recessions (provided that the real estate sector is not affected). REITs can also be used to diversify an existing real estate portfolio.

- Liquidity: REITs are more liquid than physical ownership of real estate, which means they can be bought and sold hassle-free.

Disadvantages

- Poor Performance: As we mentioned at the outset, the real estate sector has vastly under-performed other sectors during the bull market.

- High Debt: High dividend payouts can be a double-edged sword. REITs with high payouts are usually required to take on more debt to expand property holdings.

- Impact of Monetary Policy: Unlike other sectors, real estate is directly impacted by monetary policy. Rising interest rates, like in the current environment, have been known to hurt profitability.

- Impact of Vacancy Rates: Despite offering diversification benefits, REITs are strongly influenced by the broader economy. As such, vacancy rates have a major impact on revenues.

The Bottom Line

Real estate investment trusts should be on the watch list of every yield-seeking investor. However, there’s often a price to be paid for higher payouts. It therefore makes sense to align REITs with your investment objectives rather than simply chase the higher yield.

Start your free trial to Dividend.com Premium account here.