Founded in 1892, General Electric Company (GE ) is one of the oldest, largest, and most well known companies in the United States. Its roots begin with Thomas Edison and the invention of the first practical incandescent light bulb. Over more than a century, however, the company has expanded its operations, going well beyond the electric company label. A closer look at the company’s SEC filings reveals several key factors that show how the company really makes its money and gives more detail on General Electric’s dividend history.

GE's Revenue by Segment

Currently, the company is divided into eight major segments: Power & Water, Oil & Gas, Energy Management, Aviation, Healthcare, Transportation, Appliances & Lighting, and GE Capital. Together, these segments account for over $146,000,000,000 in revenue for a single year (according to GE’s 2013 10-K filing). In this piece, we explore each of these segments, detailing their operations as well as contribution to the company’s overall profitability. The below chart displays the percent of consolidated three year revenue that each segment hauls in:

GE Capital

The GE Capital segment accounts for roughly one-third of GE’s total consolidated revenues. The segment provides a wide array of financial services and products for businesses around the globe, including commercial loans, fleet management, credit cards, and personal loans. Currently, the segment has operations in North America, South America, Europe, Australia, and Asia. Its current services and products line includes:

- Commercial Lending and Leasing (CLL)

- Consumer

- Real Estate

- Energy Financial Services

- GE Capital Aviation Services (GECAS)

- GECC Corporate Items and Eliminations

Power & Water

Though many may have thought this segment accounted for the lion’s share of GE’s revenue, the company’s power and water business contributes nearly 18% to revenues, making it GE’s second most profitable segment. The segment’s main objective is to deliver products and technologies that harness resources such as wind, oil, gas, and water to produce electric power. According to the company’s website, GE’s technology currently helps to deliver a quarter of the world’s energy. Some of these technologies include:

- Gas Turbines

- Wind Turbines

- Nuclear Reactors

- Solar Power

- Steam Turbines

- Generators

Aviation

GE’s Aviation segment accounts for roughly 13% of total revenues and is currently one of the world’s leading providers of jet engines. The segment has operations throughout North America, Europe, Asia, and South America. GE provides products and services for use in both military and commercial aircraft, which include fighters, bombers, helicopters, surveillance aircraft, as well as executive and regional aircraft. The aviation’s current product offering includes:

- Aviation Services & Systems

- Commercial Engines

- Marine Engines

- Military Engines

- Turboprop Engines

- Shaft Engines

Healthcare

The company’s Healthcare segment contributes over 12% to GE’s consolidated revenues, providing healthcare technologies for developing and emerging countries. GE is a leading expert in medical imaging and information technologies, medical diagnostics, as well as patient monitoring systems. The segment is also involved in drug discovery and biopharmaceutical manufacturing technologies. Some of GE’s top healthcare products include:

- MRIs

- PET/CT Scanners

- X-ray

- Ultrasound

- Surgical Imaging

- Molecular Imaging

Oil & Gas

GE’s Oil & Gas business accounts for a little over 10% of total revenues. Its mission is to provide critical equipment for the global oil and gas industry, used in applications spanning the entire value chain – from drilling to refining to downstream processing. The segment is currently operating in more than 120 countries across North and South America, Asia, Australia, and South Africa. Its line-up of products and services include:

- Drilling Solutions: Land and Offshore

- Offshore Solutions

- Subsea Solutions

- Enhanced Oil Recovery (EOR)

- Unconventional Resources

- Full Range LNG Solutions

- Industrial Power Generation

- Refinery & Petrochemicals

- Gas Storage & Pipeline

Appliances & Lighting

A little over 5% of GE’s total revenues are attributed to the company’s Appliances & Lighting (formerly known as Home & Business solutions), which primarily sells major appliances for commercial and industrial customers. Some of the segment’s most popular brands include GE Monogram, GE Profile, GE, Hotpoint, and GE Café. In addition, GE also manufactures a variety of lamp products for commercial, industrial, and consumer markets. The Home & Business solutions lineup includes:

- Refrigerators

- Freezers

- Electric & Gas Ranges

- Cooktops

- Dishwashers

- Clothes Washers & Dryers

- Microwave Ovens

- Hybrid Water Heaters

Energy Management

This portion of GE”s business accounts for roughly 5% of the company’s total revenues, perhaps a somewhat surprising number given the company’s origins. The segment designs, manufactures and services technology solutions for the delivery, management, conversion and optimization of electrical power for customers across multiple energy-intensive industries. Some of the segment’s products and services include:

- Automation & Process Control

- Critical Power

- Drives

- Electrical Distribution

- High Voltage Equipment

- Power Conversion

- Motors and Generators

- Utility Operation Systems

Transportation

GE’s Transportation segment contributes over 3% to revenues, providing technologies and supplies to the railroad, marine, drilling, and mining industries. The segment provides goods to customers in more than 100 countries across the globe. Its most popular product is the Evolution Series Locomotive, a diesel-electric, heavy-haul locomotive. The segment’s other products include:

- Drill Motors

- Locomotives

- Marine Engines

- Mining Drive Systems

- Diesel Engines

- Generator Sets

GE is highly regarded among dividend investors as it has consistently paid out a distribution to shareholders every quarter since 1899. There are more companies that consistently raise and pay dividends; find out more in Profiling 7 Companies That Have Raised Dividends For 25 Years.

Not only is the company’s payout record impressive, so too is the size of its monstrous distribution. As such, below we highlight seven impressive facts about General Electric’s dividend:

- In 2014, GE paid out $9.24 billion in dividends. To put the size of this distribution into perspective, it totals out to roughly $178 million per week — or just over $25 million returned to shareholders every day [see also The Ten Commandments of Dividend Investing].

- GE’s most recent quarterly payout of $2.02 billion is comparable to the value of Mukesh Ambani’s house. India’s richest man is building a 398,000 square foot home that is 27 stories high, has 3 helipads, a 600 person wait staff, along with a modest garage that fits 160 cars.

- Since the year 2000, GE has paid out in total $164 billion in dividends. By compassion, the Federal Reserve spent nearly four times this amount, totaling roughly $400 billion, to implement “Operation Twist” in September of 2011.

- In the beginning of 2010 GE paid out a distribution of 10 cents per share. Compared to its last quarterly payout in 2014 of 23 cents per share, this marks an impressive dividend growth rate of 130% in the last two years alone.

- With its last annual distribution topping $9.24 billion, GE’s dividend surpasses the payouts made by a number of key competitors in 2014, including 3M (MMM ) ($2.63 billion), Johnson & Johnson (JNJ ) ($7.84 billion), and Honeywell (HON ) ($1.62 billion).

- Given its recent closing price of roughly $24.3 per share, GE’s last quarterly dividend payout of $2.02 billion was enough to purchase more than 83 million shares. For more dividend investing ideas, try out our High Yield Stock Tools.

- With the $164 billion in dividends that GE has paid out since the year 2000, the company could have purchased 72,000 Bugatti Veyron supercars, 410 Cullinan diamonds (estimated at 3,000 carats each), 395 Boeing A380 airbuses, or more than 1.49 billion shares of Apple (AAPL ) (assuming a price of $110 per share).

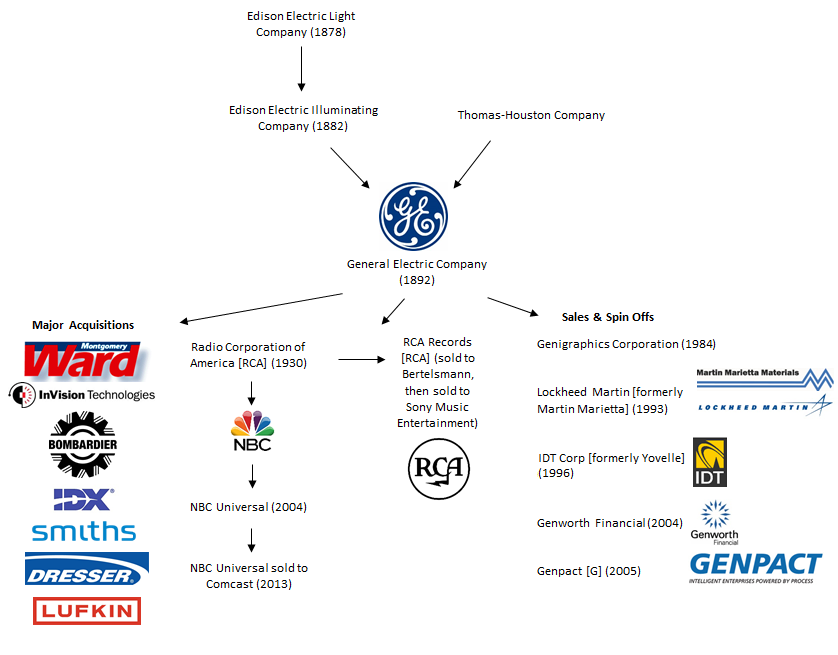

Since 1892, GE has continued to grow, expanding and changing its businesses for more than a century. In the visual below, we show how GE has changed over the years, including the company’s major acquisitions, mergers, and spin offs.

GE’s Major Sales and Spin Offs

RCA & NBCUniversal

The Radio Corporation of America (RCA) was founded by GE in 1919. In 1930, the U.S. Department of Justice brought antitrust charges against RCA, forcing GE to give up its ownership. Prior to that, RCA founded the National Broadcasting Company (NBC), but in 1986 control of NBC was passed to GE after the company reacquired RCA. GE then bought Universal Pictures from Vivendi and formed NBCUniversal. NBCUniversal was eventually sold to Comcast (CMCSA). The remaining parts of RCA were sold to various companies, including Bertelsmann, which acquired RCA Records.

Genigraphics

In 1984, GE spun off its commercial computer graphics products and services (Genigraphics division), forming the Genigraphics Corporation.

Aerospace

In 1993, GE sold its Aerospace Division to Martin Marietta, now Lockheed Martin (LMT )

GEnie

Only a decade after GE developed its pioneering online services GEnie, the company sold it to Yovelle, now part of IDT Corp (IDT).

Genworth Financial

In 2004, GE spun off various life and mortgage insurance assets to form Genworth Financial (GNW).

Genpact

In 1997, GE established the GE Capital International Services, which later became Genpact. In 2005, GE sold its stake in Genpact.

The Bottom Line

GE has long been not only one of the most popular companies in the world, but one of the most popular dividend stocks as well. The company’s dedication to a solid payout and to innovation will ensure that it will stay at the helm of the investing world for years to come.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.