Sometimes the stars just align for certain sectors and asset classes. And right now, it could be fixed income’s moment in the sun. Thanks to a variety of factors, bonds have not been this attractive in years. Many investors have gotten the hint, with fund flows showing a robust picture.

But some investors still haven’t taken the plunge in joining the fixed income parade and still prefer equities in the current market.

Investment manager Western Asset implores investors to reconsider and give bonds a go. With three big reasons why bonds are back, investors should seriously consider fixed income assets for their portfolios.

How We Got Here

The pandemic is firmly in the rearview mirror at this point. However, COVID’s effects are still lingering. This is certainly true when it comes to fixed income markets. Excess stimulus, pent-up demand amid supply constraints, and a variety of other factors sent inflation surging.

To that end, the Federal Reserve increased benchmark interest rates to levels not seen in decades. As benchmark rates hit 5.5%, bonds responded in kind. With their inverse relationship, bond prices fell while yields rose. New debt that has come to the market has reflected these higher rates. Today, the 10-year Treasury bond is yielding around 4.5%. Government debt is alone, with corporate, junk, munis, and even mortgage-backed securities all paying high yields.

According to Western Asset, this has created one of the best environments for fixed income assets in years. In fact, with the Fed pausing and potentially cutting rates, bond investors are in a unique place to win over the long haul, with both capital gains and coupons creating strong total returns.

In their latest whitepaper, they cite three big reasons why investors may want to move more money into bonds than they had previously considered.

1. High Starting Yields

As we said, bonds have an inverse relationship to interest rates. As rates rise, bonds currently on the market fall to match new bonds coming to market. A small quarter point increase here or there doesn’t necessarily cause too much change in terms of yield. But with one of the most aggressive monetary tightening schemes in history—effectively taking rates from zero to 5.5%—bonds are now yielding more than historical averages.

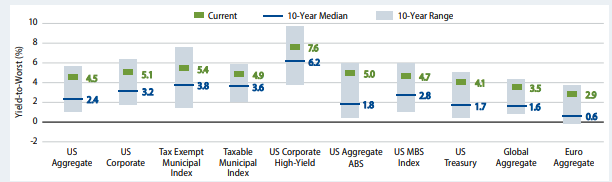

This chart from Western Asset shows the current yields for many fixed income types versus their 10-year medians.

Source: Western Asset

As you can see, yields on a variety of debt currently offer better yields than they have over the last years. Looking at data, you’d have to go back to the Great Recession and Credit Crisis to find yields that are as attractive as today. Western Asset believes these high yields provide attractive valuations for investors, essentially restoring bond valuations to more normal tiers. Coupon clipping is once again on the table.

2. A Strong Tailwind for Capital Gains

High yields are only one part of the equation. Western Asset believes that fixed income assets now offer the chance for capital gains as well.

While inflation has been stubborn over the last few months, it has declined from its peak of around 9%. At the same time, economic data has been drifting lower. With inflation moving toward the Fed’s target of 2% and economic conditions falling, the Fed has some wiggle room to start cutting rates. The central bank is still targeting two to three rate cuts this year.

For fixed income investors, this means capital gains could finally be on the menu again.

Data suggests this is true. Looking at the last five rate-cutting periods—beginning in 1988 and including events such as the Savings & Loans Crisis, Dot-com bubble, and Credit Crisis—the Bloomberg U.S. Aggregate Index has offered positive total returns in the six-month, one-year, three-year, and five-year periods. 1

With none of these events or periods having such high starting benchmark rates, Western Asset believes the potential for capital gains is very large indeed.

3. Bonds Provide Diversification Again

Those high yields and potential for capital gains are also helping bonds in another way. Fixed income is once again offering ballast to the stock market. With the Fed now hitting the end of its tightening cycle, bond yields can offer actual protection during market declines.

Looking at historical data and the last five major market drawdowns, Western Asset shows when bond yields are high, bonds can provide serious protection. For example, during the tech bubble, equities managed to return -49%. Bonds managed to provide a 29% return. During the recent U.S./China trade war, stocks sank by 19%, but bonds gained 1.6%.

This is wonderful news for investors and provides support to classic 60/40 portfolios. Many pundits have called for the death of the stock/bond mix as low bond yields don’t provide diversification benefits anymore. However, with the bond market reset and yields once again high, 60/40 can once again provide lower volatility and strong long-term returns.

Fixed Income Is Back!

With these three factors in tow, Western Asset believes fixed income is truly back and it’s a great time to be a bond investor. The combination of high starting yields, the potential for capital gains, and the return of real diversification for portfolios means investors need to get serious about owning bonds once again.

That means boosting allocations and adding fixed income assets to their portfolios.

Given all the potential, investors may not need to do anything but go broad with their exposure. Simply adding the Agg or other major fixed income benchmark could be enough to gain exposure. However, with yields on a variety of bond sub-asset classes like junk, mortgage backed securities (MBS), and corporate bonds now high, investors have plenty of choice to expand their bond portfolios for yield and gains.

Popular Bond ETFs

These ETFs were selected based on their size and popularity with investors. They cover a wide range of bond types and are sorted by their YTD total returns, which range from -8.8% to 0.1%. They have assets under management of $3.77B to $316B and expenses of 0.03% to 0.40%. They are currently yielding between 3% and 7.7%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SJNK | SPDR Bloomberg Short Term High Yield Bond ETF | $3.77B | 0.1% | 7.7% | 0.40% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26.3B | -0.1% | 3.6% | 0.15% | ETF | No |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $8.99B | -0.2% | 7.4% | 0.08% | ETF | No |

| VCSH | Vanguard Short-Term Corporate Bond Index Fund | $42.6B | -0.3% | 3.6% | 0.04% | ETF | No |

| BSV | Vanguard Short-Term Bond Index Fund | $58.8B | -0.7% | 3.0% | 0.04% | ETF | No |

| VCIT | Vanguard Intermediate-Term Corporate Bond Index Fund | $39.6B | -2.6% | 4.2% | 0.04% | ETF | No |

| BND | Vanguard Total Bond Market Index Fund | $316B | -2.8% | 3.4% | 0.03% | ETF | No |

| AGG | iShares Core U.S. Aggregate Bond ETF | $90.4B | -2.9% | 3.6% | 0.03% | ETF | No |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | -4.0% | 4.5% | 0.14% | ETF | No |

| TLT | iShares 20+ Year Treasury Bond ETF | $49.8B | -8.8% | 4.0% | 0.15% | ETF | No |

The end all, be all is that bonds have played second fiddle to equities over the last decade or so. But now, it’s fixed income’s turn. Offering some of the most compelling valuations in decades, high yields, and real diversification benefits once again, investors should be buying bonds for their portfolios. Western Asset makes a very compelling case to add bonds to your investment mix.

The Bottom Line

The Fed’s rate increases have set up one of the best environments for bond investors. With high starting yields, Western Asset now believes that fixed income is back. Historical data shows that they may be right. For investors, that means focusing on fixed income in the quarters ahead to gain the trio of benefits from bonds.

1 Western Asset (January 2024). Back in Favor: The New Case for Fixed-Income