Ever since economists Fama & French completed their groundbreaking work in 1992, investors have been fascinated with factors and their portfolios. At their core, factors are specifically focused attributes that drive the return of an asset class. Fama & French’s work taught us how size, value, growth, and quality have all played out over the long haul and in different market conditions. Most of their work focused on the equity side of the equation.

But fixed income and bond investors shouldn’t ignore factors.

It turns out that applying a dose of factor investing to bonds can help deliver real market-beating returns. The best part is that adding factors is a breeze. Thanks to new ETFs and other funds, factor investing in fixed income and market-beating returns are just a ticker away.

Not Just for Equities

Factor investing basically involves exploiting different attributes of an asset class to generate higher returns or mitigate risk. The concept has existed for decades, with several firms such as AQR, Research Affiliates, and Dimensional building very successful asset management programs based on the idea. Likewise, ‘value’ and ‘growth’ mutual funds have existed since the dawn of the modern market. However, it wasn’t until 2008 and the Great Recession that factor investing took off. Here, investors looked toward factors as a way to prevent any future economic/market carnage. The birth of ETFs helped spur adoption among retail investors.

The thing is many investors’ love affair with factors and the bulk of the academic research on them has focused on stocks. But bond investors should get to know factors as well.

The problem is that most bond indexes and benchmarks have some serious flaws. Arguably, the biggest flaw happens to focus on their construction and weighting. Many bond benchmarks are crafted by weighting the bonds based on outstanding debt. This means those firms with more debt on the balance sheets get a higher weighting in the index. In the case of the main bond benchmark, the Bloomberg U.S. Aggregate Bond Index, you’re overweighting U.S. government debt.

Essentially, you are rewarding those firms with more debt by giving them better placement, and therefore more ownership by investors. That seems counterintuitive.

By using factors, investors can circumvent this problem and craft extra returns, lower their risk, and increase their yields. Factors in fixed income include Value, Size, Volatility, Quality, Interest Rate Sensitivity, and Liquidity.

The Proof Is in the Pudding

It turns out that focusing on factors does make a difference when it comes to returns. Data and academic research are now coming to light that proves the concept. Much of the outperformance by active managers in the fixed income space (67%) can be attributed to their focus on factors. 1

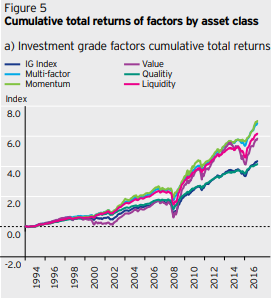

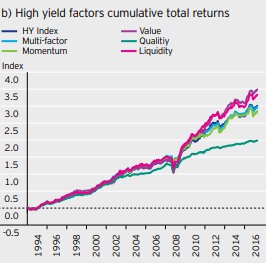

These charts from asset manager Invesco highlight the additional returns that individual factors can have versus their benchmarks. Here, charts are presented for both the investment-grade universe as well as high-yield bonds. But as you can see, factors outperform the broader indexes.

Source: Invesco

Two of those factors stand out. Both value and quality factors can make a real difference in bond investing. The value factor in bonds looks at price relative to underlying fundamentals, while quality looks at items like cash flows, sales, and other payback abilities. So, we have bonds at low prices in the market that have a strong ability to be repaid.

The combination of these two factors produces the best returns. According to a recent study by Northern Trust Asset Management, a global investment-grade fixed income portfolio that overweights quality and value factors generates more yield—about 1.55% more—and better total returns than its benchmark. At the same time, it has a similar level of credit risk as the benchmark. This is true for both investment-grade and junk bond markets. 2

Factors work well for lowering risk and volatility of a bond portfolio too. 2022 was a year that bond investors would like to forget, with the Agg dropping by over 13%. However, those bonds that had high liquidity and low volatility factors did far better, losing less money than the broader indexes.

The best part is research now shows that factors also can help work in some esoteric bond varieties. This includes emerging market bonds, municipals, and international sovereigns.

A Factor-Focused Portfolio

With major bond indexes featuring several flaws in their construction, investors may want to focus on factors in their fixed income portfolios. You could go with active management, which has proven to help drive returns in the fixed income world. Or you could focus on the idea of fundamental indexing. Here, benchmarks are crafted based on various factors. Think of it as blending the worlds of purely passive and active management.

Here is where many of the new ETFs and funds have launched covering factors for fixed income. With these new fundamental index ETFs, you get low costs, tax advantages, and ease of use on ticker access. Luckily, there are now numerous ETFs in the space to buy.

Fundamental Fixed Income ETFs

These funds were selected based on their exposure to various factors in the fixed income sector and are sorted by one-year total return, which ranges from -1.2% to 2%. They have assets under management between $9M and $1.5B, with expenses ranging from 0.18% to 0.50%. They are currently yielding between 4.3% and 8.3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYDB | iShares High Yield Systematic Bond ETF | $600M | 2% | 7.1% | 0.35% | ETF | No |

| HYGV | FlexShares High Yield Value-Scored Bond Index Fund | $1.47B | 1.6% | 8.3% | 0.38% | ETF | No |

| PHB | Invesco Fundamental High Yield Corporate Bond ETF | $680M | 0.6% | 4.99% | 0.50% | ETF | No |

| GHYB | Goldman Sachs Access High Yield Corporate Bond ETF | $134M | 0.6% | 5.6% | 0.34% | ETF | No |

| IGEB | iShares Investment Grade Systematic Bond ETF | $557M | -1.1% | 5% | 0.18% | ETF | No |

| WFIG | WisdomTree U.S. Corporate Bond Fund | $9M | -1.2% | 4.3% | 0.18% | ETF | No |

Investors can use these ETFs in combination with broader fixed income indexes to achieve higher returns. They could also forgo the bread-n-butter indexes all together depending on their risk profiles and timelines. Either way, factors could deliver additional returns in the fixed income market. And they shouldn’t be ignored.

The Bottom Line

Factor investing has long been a great way for equity investors to deliver additional returns for their portfolios. Now it’s fixed income’s turn. Factors can also help on the bond side, providing better risk-adjusted returns and yield. Adding a dose of factors via a low-cost ETF makes a ton of sense for bond portfolios.

1 S&P Global (January 2016). Factor-Based Investing in Fixed Income: A Case Study of the U.S. Investment-Grade Corporate Bond Market

2 Invesco (January 2024). Factor Investing in Fixed Income