Evaluating a security’s dividend data is an essential aspect of successful income investing. That’s why Dividend.com provides five essential dividend-specific formulas at the top of each ticker page.

By analyzing a security’s dividend yield, annualized payout, payout ratio and dividend growth, investors can develop a clearer understanding of the strengths and weaknesses of a particular investment opportunity. Dividend.com’s proprietary Dividend Advantage Rating System (DARS) also explains a security’s overall ranking using various essential criteria.

In this article, we focus on the dividend yield and why it sometimes appears as 0%.

In general, dividend stocks with 0% yield are a warning sign that a company is facing adverse economic conditions or financial hardships. Although companies do not have to pay dividends, those that have already committed to doing so could face investor backlash in the event they fail to pay out profits. During recessions, a company’s dividend may fall rapidly, and in a worst case scenario, reach zero.

However, there are several other reasons why a particular yield may show up as 0%. Not all of the reasons relate to its underlying financial performance.

Irregular Dividend

If a stock usually pays a quarterly divided, its yield may show up as zero if Dividend.com determines it was supposed to pay out profit this quarter but has not yet done so. In this case, our coding system will automatically mark the dividend yield as zero. That’s because yield is a function of stock price (denominator) and dividend (numerator). If a numerator is not present, then the yield becomes zero-bound.

Typically, companies with an irregular dividend policy are under no mandate to pay out profits to shareholders. This could be due to a variety of factors, such as irregular earnings or lack of liquidity. To learn more about irregular dividend stocks and how they differ from other dividend payers, read the following article.

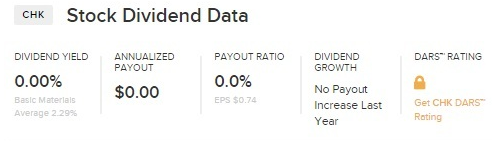

U.S. petroleum company Chesapeake Energy (CHK ) is an example of a special dividend stock with 0% yield. The company’s last dividend payment occurred on April 13, 2015. Its common stock dividend was scrapped to maintain capital expenditure amid the sharp downturn in oil prices. CHK blamed slumping commodity prices as the main factor behind the decision to scrap profit payments.

Income investors have one underlying goal: achieving steady income that is predictable and quantifiable. If that’s your goal, it is best to avoid irregular dividend payers. To discover the most profitable dividend stocks, check out the free Dividend Stock Screener tool, which allows you to navigate the market by industry, market cap and payout frequency.

Dividend Suspensions

If a company suspends its dividend, our code automatically marks dividend yield as 0%. That’s because the yield depends on a security’s price and dividend. If a company suspends its dividend, it essentially becomes a non-dividend-paying stock. Once again, non-dividend stocks are not conducive for income investors.

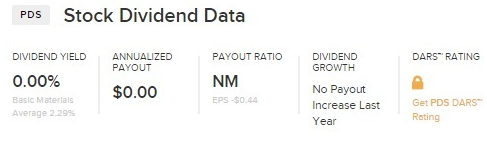

Precision Drilling Company (PDS), the largest drilling company in Canada, is an example of a security that has suspended its dividend. The suspension was officially announced in February of 2016 as a means to help the company cope with a large industry downturn stemming from the commodity-price collapse. The company’s last dividend payment occurred on November 18, 2015. PDS, therefore, has a dividend yield of 0%.

Special Dividends Not Being Annualized

Another example of a zero-bound dividend yield is when a company only declares special dividends. In this particular case, our coding system does not annualize it, which means the dividend and the yield show up as zero.

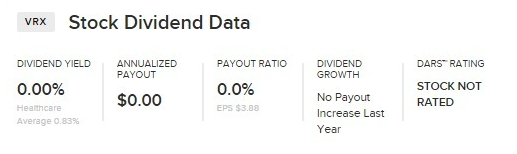

An example of a special dividend stock that has a 0% yield is Valeant Pharmaceuticals Inc. (VRX), a Canadian multinational pharmaceutical company. For Valeant’s last dividend payment, we have to go all the way back to September 27, 2010, when the company paid out a special one-time cash dividend of $16.77 per share. The dividend was announced in connection with a previously announced merger with Biovail, another Canadian pharmaceutical company.

To track the highest-yielding companies, visit the Dividend.com High Dividend Stocks page. Here, you can sort companies by their ex-dividend date, pay date and dividend yield.

Non-Dividend-Paying Companies

Dividend.com also tracks non-dividend-paying companies. We pay special attention to companies that have announced plans to start paying out dividends or have expressed a willingness in doing so. In this case, we begin tracking a security via our stock dividend data as soon as it begins paying out dividends.

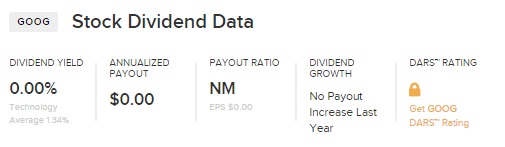

An example of a company that doesn’t pay a dividend but has considered doing so is Alphabet Inc. (GOOG), the parent company of Google. Alphabet is dividend-shy for several reasons, such as high R&D costs and a desire to expand into new ventures, such as driverless cars. Learn more about GOOG’s dividend strategy (or lack thereof) by reading: Why Google Doesn’t Pay a Dividend.

That being said, as the company’s cash pile continues to grow, executives are considering becoming more shareholder friendly by offering dividend payments. Until then, GOOG will have a dividend yield of zero.

Company Acquisition or Bankruptcy

Another example of a zero-paying dividend is companies that have either closed their doors permanently or been acquired by another company. Dividend.com still maintains the ticker page for these companies because it gives the user dividend and stock price history, which may aid in their analysis. Since the stock no longer exists, users will see a dividend yield of zero.

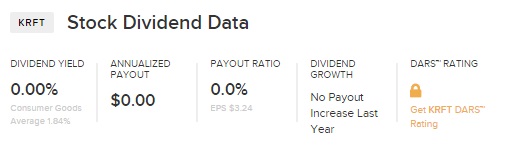

Kraft Foods Group, Inc. (KRFT) is an example of an acquired stock that no longer trades and has a dividend yield of zero. The company stopped trading publicly on July 6, 2015, after it merged with Heinz (HNZ) to become The Kraft Heinz Company (KHC ). Like other mergers before it, the marriage between Kraft and Heinz allows the new entity to expand its international presence and achieve greater economies of scale. Before merging, Kraft derived the vast majority of its revenue from North America, whereas Heinz derived 60% of its sales from regions outside the continent.

The Bottom Line

To learn more about a stock’s dividend yield, be sure to visit its ticker page on Dividend.com. More than 100,000 investors have subscribed to Dividend.com Premium. As a premium member, you receive a daily dividend newsletter that briefs you on the latest happenings in the dividend world. Go Premium for free by starting a free 14-day trial here.

Stay up to speed on all the latest dividend trends and developments by subscribing to our free newsletter.