While school may have just ended for the summer for millions of children, investors may want to revisit the classroom this summer. After a year that saw surging inflation, the rise and fall of meme stocks, crypto scams and other “growth” themes, back to basics should be the mantra. And that means revisiting our core portfolios.

These main drivers of long-time growth have been widely ignored by much of the investing public – particularly, younger clients and investors – since the pandemic, as growth became the only game in town.

But with the markets acting more normal, interest rates staying high and investors once again caring about valuations, the time is right to strengthen our core portfolios and get back to real investing. Luckily, building a core portfolio is an easy proposition and it can be done with only a few key funds.

What Exactly Is a Core?

Everyone loves to hear a good stock story about how someone purchased XYZ shares and they surged 200% in a week. But the reality is, the vast bulk of investors build their portfolios and wealth through a diverse set of asset classes. The funds doing the heavy lifting are essentially their core portfolio.

Core portfolios are made up of a variety of asset classes – usually, stocks, bonds and real estate – and form the bulk of an investor’s holdings. A core holding will provide historically stable and reliable returns over the long haul. At the same time, core holdings tend to be broad. Stock funds will cover the entire universe of large caps, while bond funds will focus on the entire market of investment-grade bonds. In more modern times, index funds and ETFs, such as those that track the S&P 500 or Bloomberg US Aggregate Bond Index, have become core essentials, providing broad exposure and passive management.

Finally, core holdings work in concert with each other to provide diversification benefits and improve long-term returns. When one asset class zigs, another will zag. This helps limit losses and grow wealth over time.

A Word About Asset Allocation

Perhaps the most important piece of a core portfolio is just how many stocks versus bonds versus other asset classes to own. This is known as asset allocation. According to asset manager State Street, asset allocation decisions “explain over 90% of the variance in portfolio returns.” That means the mix of stocks and bonds matters more than the assets themselves and are what drive long-term returns. 1

Asset allocation in a core portfolio comes from so-called risk tolerance, or how much loss can an investor stomach at any one time. For younger investors, risk tolerances can be high as they have a long working life to smooth out returns. For retirees living off their portfolios, losses may not be an option. Even within similar groups, depending on goals, there could be changes to the amount of risk they are willing to take.

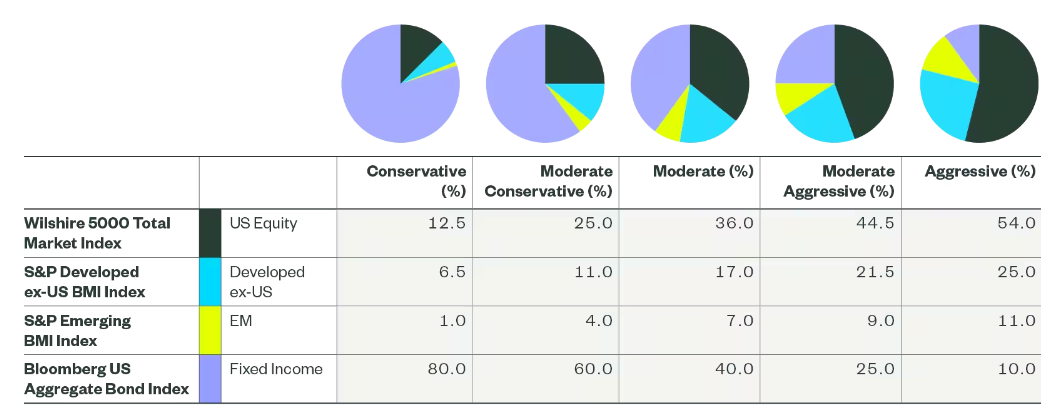

It’s here that investors can make a decision on what percentages of each asset class to hold. This chart from State Street highlights how four asset classes – U.S stocks, International stocks, Emerging Market stocks and bond investments – can be allocated via risk tolerance levels.

Source: State Street

Putting It All Together

With post-pandemic mania now over and things starting to get back to normal, investors and their advisors should revisit their allocations and their core portfolios. Investors sitting on large gains or losses will have skewed their asset allocation percentages, while changes in goals could affect long-term risk tolerance. Now is the time to set things right.

Once an investor figures out their asset allocation, there are a few things to consider.

The biggest of which is cost. Given that an investor’s core portfolio is the largest piece of their pie, paying too much can significantly impact long-term gains. The average mutual fund has an expense ratio of 0.84%. A $100k portfolio over a decade would lose $8,400 in fees before any gains or losses on the portfolio.

This explains why ETFs have surged in popularity especially when it comes to building core portfolios. These days, you can add core portfolio building blocks via ETFs for as low as 0.03%. That is virtually free and allows investors to keep more of their money, leading to higher returns.

Secondly, rebalancing is key. As we said, asset allocation is what drives much of a portfolio’s returns. Making sure that this allocation stays within guidelines and what its investors want is a paramount issue. That means, selling winners and buying losers if the allocation skews too far from percentages. Without doing this, investors may be exposing themselves to more risk than they want.

Putting it all together and building a core is quite easy. For example, using State Street’s framework and ETFs, a moderate investor could buy the SPDR Portfolio S&P 1500 Composite Stock Market ETF (36%), SPDR Portfolio Developed World ex-US ETF (17%), SPDR Portfolio Emerging Markets ETF (7%) and SPDR Portfolio Aggregate Bond ETF (40%) to outfit their core portfolio for cheap.

However, some investors may find it beneficial to break out some of these core holdings. For example, instead of using SPTM for U.S. stock exposure, they could use SPDR S&P 500 ETF, SPDR S&P MIDCAP 400 ETF and SPDR Portfolio S&P 600 Small Cap ETF for direct large-, mid- and small-cap exposure. You could do the same for fixed income allocations as well. The idea is to keep target allocations within line.

Here’s a list of State Street’s building block core ETFs

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| SPDR S&P 500 ETF Trust | SPY | ETF | No | $378 billion | 15.8% | 0.09% |

| SPDR Portfolio S&P 1500 Composite Stock Market ETF | SPTM | ETF | No | $5.53 billion | 15.0% | 0.03% |

| SPDR Portfolio Developed World ex-US ETF | SPDW | ETF | No | $12.2 billion | 13.0% | 0.04% |

| SPDR Portfolio Emerging Markets ETF | SPEM | ETF | No | $5.75 billion | 8.2% | 0.11% |

| SPDR S&P MIDCAP 400 ETF Trust | MDY | ETF | No | $18.8 billion | 6.9% | 0.18% |

| SPDR Portfolio S&P 600 Small Cap ETF | SPSM | ETF | No | $.36 billion | 4.9% | 0.05% |

| SPDR Portfolio Aggregate Bond ETF | SPAB | ETF | No | $6.44 billion | 2.4% | 0.03% |

The Bottom Line

With much of the mania now gone from the market, rebuilding and focusing on core portfolios may be a great idea. Creating these drivers for the long term is easy. Focusing on asset allocation and cheap broad ETFs makes building a core portfolio a breeze.

1 State Street. (June 2023). Core Portfolio Construction Principles