Investors should get used to higher prices at the pump and the grocery store – Inflation could be sticking around for a while. After last year’s surge, inflation is once again back on the menu. And while various inflation metr ics have dropped, the outlook is a tad bit “sticky.” Analysts predict the days of very low inflation to be in the rear-view mirror.

That fact makes natural resources stocks a big buy.

It turns out that natural resource stocks are some of the best ways to fight stubborn and stable rates of inflation. Thanks to their structures, investors are able to fight rising prices through income and capital appreciation. The best part, many are now on sale after the recent inflationary drop.

Inflation Staying Around

Inflation is on every investor’s mind these days. Over the last year, we’ve seen measures like the Consumer Price Index (CPI) surge to highs not seen since the 1980s. And while the Fed’s path of tightening has worked to bring the CPI/inflation down to just 3%, consumers and investors have continued to feel the pinch. The problem is that inflation may stay here for quite a while. “transitory” inflation has become sticky.

A variety of factors have the potential to keep inflationary forces steady for the next couple of years. After years of underinvestment and issues during the pandemic, commodity supplies remain low, leading to elevated price levels. Tight labor markets with high participation rates and a plethora of available jobs has boosted costs for businesses, while the shift towards de-globalization has prompted big spending in onshoring and supply chain complexity.

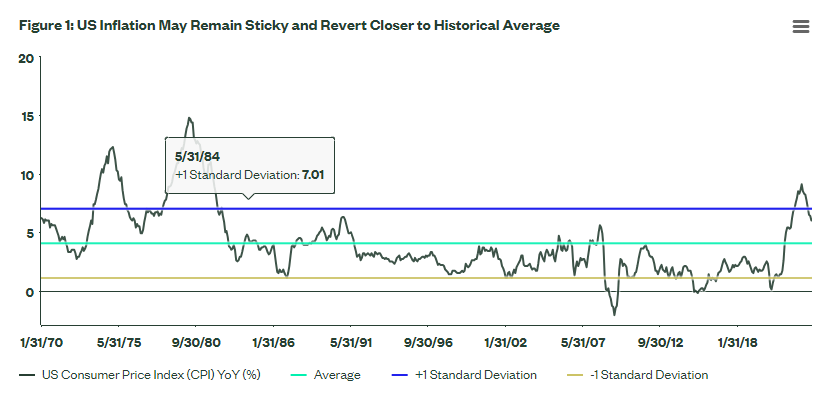

All of these factors have created a sort-of return to normal when it comes to inflation. Truth be told, we’ve been spoiled over the last decade since the Great Recession with mild global growth and even periods of deflation. Since the 1970s, inflation has averaged just over 4%. Going back to 1914- when data was first tracked- inflation has run at about 3.3% per year. This chart from State Street highlights the CPIs’ path to normalcy.

Source: State Street

So, inflation may be here to stay once again.

Natural Resource Equities To The Rescue

For investors and savers, so-called sticky inflation poses a problem. In addition to just growing their money, investors will need to grow it at a rate that overcomes the loss in purchasing power. There’s a variety of ways to do that. One of the best could be the shares of natural resource producers.

As the main inputs for basically everything, commodities are the most sensitive asset class with regards to changes to the CPI. However, the stocks of those that produce raw materials may be a better bet.

According to State Street, commodity stocks have a better per unit risk/return trade off than investing in commodities themselves. Looking at the 20+ year period from 2002 to March of 2023, broad commodities managed to post a total return of 1.32% with a standard deviation of 16.40%. Natural resource equities, however, managed to produce a total annualized return of 8.60% with a standard deviation of 20.82%. Taking this data, State Street shows that when looking at returns per unit of risk, natural resources clocked in at 0.41 versus just 0.08 for commodities. 1

With that, investors are getting a better bang for their buck when it comes to commodity stocks versus commodities themselves. The reason comes down to how commodity equities produce returns.

Commodity producers generally have mostly fixed costs and an easy to understand business model. You basically take the current price of a commodity minus the costs to produce it, and you have your profits. This creates a leveraged effect and as commodity prices grow, so do net incomes at the producers. That in turn, drives investors into shares, boosting share prices.

Moreover, many commodity and natural resource stocks pay dividends- either fixed or variable. This adds an extra way for investors to see profits and gains from their investment. Those with variable payouts rise during periods of high commodity prices/inflation as investors know they’ll get more in future dividends. Those fixed payments provide stability and help lower volatility in the sector.

The combination of these factors allows for natural resource stocks to post better returns and actually help portfolios overcome sticky inflationary pressures. Whereas, commodities themselves are great for sudden spikes.

Good Time To Buy

With inflation returning to normal being sticky, investors may want to look at the sector for their portfolios. Now could be a good time. Thanks to the recent decline to inflationary pressures, many “tourists” have fled natural resource shares. The sector remains cheap and a wonderful way to boost a portfolio’s inflation fighting powers.

You can certainly run our screeners and come up with top names. Stocks like Exxon (XOM), BHP Billiton (BHP), Archer Daniels Midland(ADM), and The Andersons (ANDE) are just a few examples of natural resource stocks that provide good exposure.

A better bet? Go broad.

There are a variety of both active and passive funds that own natural resource stocks. By buying a fund, investors get instant diversification and all the benefits of inflation fighting. For example, the SPDR Metals & Mining ETF is a strong fund in the category.

Natural Resource Passive ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| XME | SPDR S&P Metals & Mining ETF | $1.793B | 3.5% | 0.35% | ETF | No |

| IGE | Image Scan Holdings Plc | $588.4M | 2.7% | 0.41% | ETF | No |

| HAP | VanEck Natural Resources ETF | $142.2M | -0.4% | 0.49% | ETF | No |

| GNR | SPDR S&P Global Natural Resources ETF | $3.261B | -2.4% | 0.4% | ETF | No |

| MOO | VanEck Agribusiness ETF | $1.098B | -4.3% | 0.53% | ETF | No |

| GUNR | FlexShs Morningstar Glbl Upsteam Ntrl Res Idx Fd | $7.119B | -6.1% | 0.46% | ETF | No |

Natural Resource Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| DNLAX | BNY Mellon Natural Resources Fund Class A | $180.2M | 3.2% | 1.14% | MF | Yes |

| PRNEX | T. Rowe Price New Era Fund | $1.149B | 2.3% | 0.74% | MF | Yes |

| MDGRX | BlackRock Natural Resources Trust Investor A Shares | $100.3M | -4.4% | 1.12% | MF | Yes |

| GOFIX | GMO Resources Fund Class III | $246.8M | -5.4% | 0.72% | MF | Yes |

| FFGAX | Fidelity Advisor® Global Commodity Stock Fund Class A | $107.8M | -6.3% | 1.19% | MF | Yes |

The key to remember is that by choosing an active fund, the correlation between commodities and CPI will be impacted a bit as you’re relying on a manager to deliver extra returns. So, the effect may be muted or enhanced based on the manager’s ability.

The Bottom Line

Inflation has returned to a more normalized path. That’s actually a bad thing. Sticky inflation can be hard to fight. Luckily, natural resource equities have the muscle to protect purchasing power and grow a portfolio over the long haul. By adding an index ETF, active ETF/mutual fund or via individual equities, investors can gain the protection they need.

1 State Street (March 2023). Can Gold & Natural Resources Help Combat Sticky Inflation?