Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Telecommunications towers REIT American Tower has taken the first position this week, as the company raised its dividend, even if its stock has continued to drop. AT&T has placed second, as the company’s high dividend yield attracted investor interest. Healthcare company Pfizer placed third, as the stock was boosted following the approval of its COVID booster shot. The list is closed by business development company Main Street Capital, which also increased its dividend.

Don’t forget to read our previous edition of trends here.

American Tower Increases Dividend

American Tower (AMT), a REIT owning and operating telecommunications towers, has taken the first position in the list with an advance in viewership of 99%. American Tower has trended after the company increased its dividend from $1.57 per share to $1.62. Combined with a stock price depreciation, the increase resulted in a yield of around 4%.

It is rare for a company of American Tower’s quality to trade at a yield of 4%. The stock has sold off on growth concerns, which might prove temporary, given that demand for 5G and digital transformation is likely to speed up. Moreover, American Tower stock has outperformed its peers Crown Castle International and SBA Communications over the past year.

On a price to funds from operations (FFO) basis, American Tower currently trades at around 17 times compared with about 20 historically.

AT&T Declares Unchanged Dividend

Telecommunications company AT&T (T) has placed second with a more modest increase in viewership of 39%. AT&T has declared an unchanged dividend recently, as its stock continues to struggle under high debt, competitive issues, and legacy M&A mistakes that have been unwound. The company will apparently have a hard time generating its targeted $16 billion in cash flow. In the first two quarters, AT&T produced less than a third of that amount.

AT&T already cut its dividend last year, as it prioritized paying down debt in the face of mounting losses stemming from the sales of its entertainment unit WarnerMedia and DirecTV. The company is continuing to sell non-core businesses to repay debt and improve its focus on the core wireless and broadband business. However, these businesses are not performing very well, due to competition from T-Mobile, which arguably has the best 5G in the country.

Pfizer Shares Rise After FDA Approved Updated COVID Shot

Big pharma company Pfizer (PFE) has taken the third position in the list with an increase in traffic of 24%. Pfizer’s stock received a boost after the FDA approved an updated COVID shot, with the Centers for Disease Control and Prevention (CDC) recommending people take the vaccine. Pfizer previously said it expects that about 24% of the population will take the updated vaccine.

That was enough to pepper a stock that has been slowly declining over the past year. Pfizer shares are up nearly 5% over the past five days, but are still down 34% since the start of the year. Pfizer raised its dividend at the start of 2023 by one cent to 41 cents, which now yields a strong 5%. The stock also trades at a relatively low price-to-earnings ratio of just about 9. While the company has received a boost from COVID vaccine sales, revenue from other drugs like Comirnaty and Paxlovid tumbled. Overall sales declined 54% in the latest quarter to just about $12.7 billion.

Main Street Capital Raises Dividend Following Strong Results

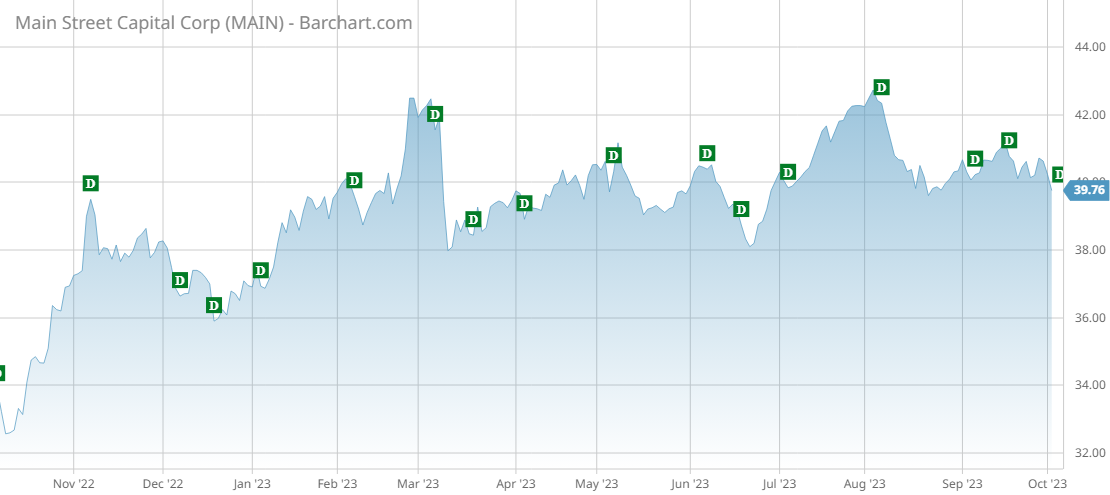

Main Street Capital (MAIN) has placed last with an increase in viewership of 17%. Main Street, a business development company that provides equity and debt financing to small and mid-size companies, has increased its dividend by nearly 7% to 23 cents per share.

In addition, the company reported a supplemental dividend of 27 cents per share, the eighth consecutive supplemental dividend. The company was able to raise its dividend thanks to rising investment income, largely driven by interest income, dividend income, and fee income. On the earnings call, Main Street’s management said it sees further opportunities to exit from businesses, which will likely lead to increasingly better results.

Main Street’s regular dividend yields about 7%. The share price has increased 12% over the past year, although it still remains about 10% below pre-pandemic levels.

The Bottom Line

American Tower shares have been selling off on growth concerns. AT&T faces ongoing business and competitive issues. Pfizer was boosted following the approval of its latest COVID shot. Main Street Capital raised its dividend following strong results.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.