It’s no secret that the Federal Reserve’s shift in monetary policy has been a seismic one when it comes to how investors find yield. Bonds are back, while equities have fallen out of fashion. With cash yielding close to 5% and bread-n-butter Treasury bonds yielding close to 4%, it’s easy to see why investors have abandoned many of the strategies that worked well over the last decade. This has included dividend stocks.

But investors may not be so quick to dump dividends these days.

In fact, now could be the best time to buy them. The rout of the last year has made many dividend names dirt cheap. Meanwhile, rates of dividend growth have continued to expand despite rate hikes. For investors, dividend payers could be a wonderful addition and drive future returns far down the road.

A Big Decline in Interest for Dividend Stocks

Over the last decade, investors were forced to think outside the box to find strong yields. If you remember, the Fed kept interest rates near zero since the end of the Great Recession. This left bonds, cash and other traditional income products yielding close to nada. To get any sort of income, investors had to move beyond these products and into more interesting alternatives.

Dividend stocks were a major winner during this time.

However, as inflation bit hard and the Fed has been forced to raise rates, investors have been fleeing dividend stocks and other alternatives. That’s because the risk-free return on cash and Treasuries is now pretty darn good. Why own shares of stock and take on any risk, when an investor can get a cool 4 to 6% in cash or a bond?

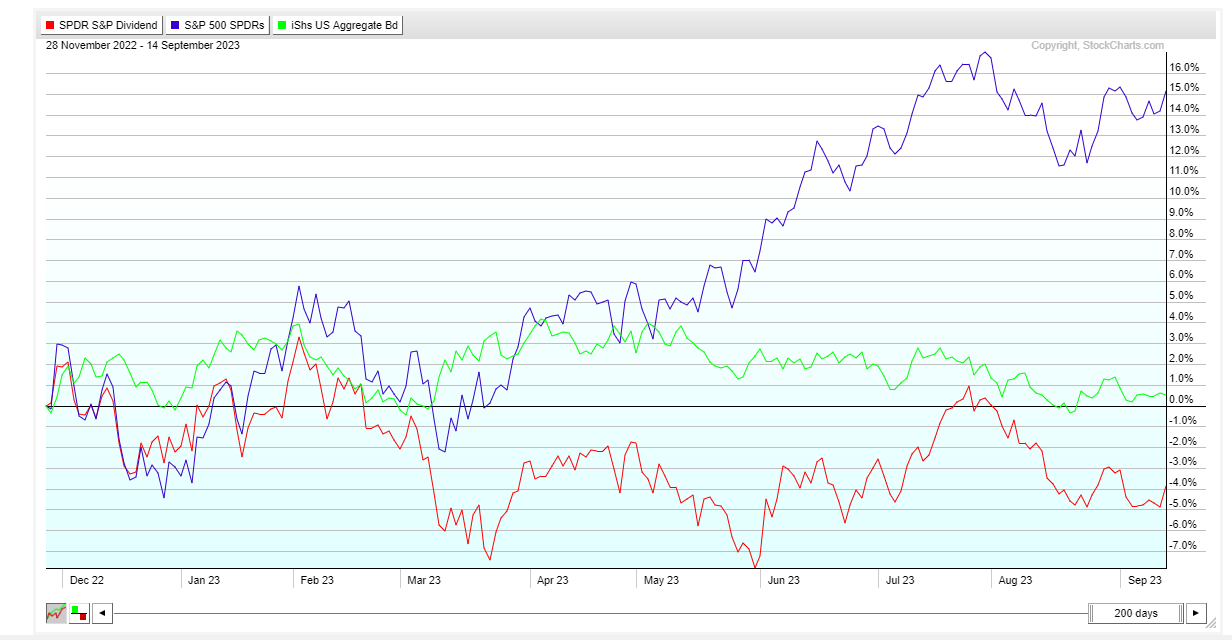

To that end, dividend and value stocks have been hit hard versus the broader market. You can see the discrepancy when looking at the S&P 500, S&P Dividend Index and the Bloomberg US Aggregate Bond Index as represented by the SPDR S&P 500 ETF Trust, SPDR S&P Dividend ETF and iShares Core U.S. Aggregate Bond ETF. The red line is dividend stocks.

Source: StockCharts.com

Investors have simply either abandoned equities that pay dividends for the yield of bonds or decided to take the risk and own growth stocks.

Dividend Stocks are Cheap

However, there may be a silver lining to dividend stocks’ recent underperformance. They could now be big values.

For one thing, their yields are once again juicy. Thanks to the decline in share prices, dividend stocks are yielding decent amounts. For example, the yield on the S&P Dividend Index is now above 3%. This compares to a 1.8% yield on the S&P 500. That’s not too shabby on the surface and is really not bad when you consider dividend growth.

The problem with bonds is that their coupons are static. Yields change based on pricing and newly issued bonds. But once you buy it, that is your coupon till it matures. However, equities have the ability to grow their dividends. This provides income that expands over time. According to data aggregation site Multpl.com, the S&P 500 has a current dividend growth rate of 7.33%, which is higher than the long-term average. That dividend growth rate is advantageous to investors sitting in cash. As the Fed pauses and eventually cuts, short-term yields will fall fast, providing a negative rate of income growth on cash holdings. However, dividend growth can provide a buffer. 1

Then there is valuation itself to consider. Thanks to the share price declines and strong earnings, many dividend stocks can be had for peanuts. The S&P 500 can be had for a forward P/E of nearly 19. But many traditional dividend sectors can be had for far less than that: Financials at 13, Utilities at 16 and Industrials at 17. Together, the previously mentioned SDY can be had for a valuation of 17×. Other dividend indexes show even cheap valuations. The Morningstar US Dividend Growth Index, which focuses on stocks that grow their payouts and not just on headline yields, can be had for a P/E of 16.

Adding a Dose of Dividends

The backdrop for this comes down to what the Fed will do. Keeping rates the same is a win for dividend stocks and their strong dividend growth rates. This is also kept when the Fed cuts, as investors covet high yields once again. Given the cheapness, current strong yields and above average dividend growth, investors may want to take a look at dividend stocks once again. And luckily, there are plenty of ways to do just that.

Our model portfolios here at Dividend.com are full of individual names that offer hefty yields and strong potential. You can run our screeners as well. Many top dividend names like Walmart and Medtronic are now trading for forward P/Es of about 2 or 3 basis points less than they were a few months ago. These represent just some of the opportunities in the dividend stocks.

With such a wide range of dividend names now yielding more for cheaper prices, it may make sense to go broad with your exposure. The previously mentioned SDY is a good starting choice, offering a broad, high-yielding ETF. Another choice could be the iShares Core Dividend Growth ETF. This fund focuses on dividend growers, which have consistenly raised their payouts over the long haul.

Going active via a fund like the Fidelity Equity Dividend Income Fund or Capital Group Dividend Value ETF might make sense as well. The problem with indexing is that you get all the stocks, including those that may have cash flow issues or other hiccups that could hinder their payouts. Active management can help eliminate those issues before they impact returns and income.

Dividend ETFs & Mutual Funds

These funds are selected based on year-to-date total return, which ranges from -1% to +17%. Their expense ratio ranges from 0.06-0.62%, while their AUM is between 2bn and 63bn. Additionally, their dividend yield ranges between 1% and 3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| CGDV | Capital Group Dividend Value ETF | $2.86B | 16.5% | 1.7% | 0.33% | ETF | Yes |

| VIG | Vanguard Dividend Appreciation Index Fund ETF | $83.8B | 7.4% | 1.9% | 0.06% | ETF | No |

| PRDGX | T. Rowe Price Dividend Growth Fund | $22.5B | 7.3% | 1.2% | 0.62% | MF | Yes |

| FEQTX | Fidelity® Equity Dividend Income Fund | $5.91B | 5.3% | 3% | 0.58% | MF | Yes |

| DGRO | iShares Core Dividend Growth ETF | $24.6B | 4.4% | 2% | 0.08% | ETF | No |

| VYM | Vanguard High Dividend Yield ETF | $63B | 0.8% | 2.9% | 0.06% | ETF | No |

| SDY | SPDR S&P Dividend ETF | $22.6B | -1.6% | 2.6% | 0.35% | ETF | No |

Dividend Stocks

These stocks are selected based on their year-to-date total return, which ranges between -31% to +19%. Their market capitalization is between 10bn to $450bn, while their dividend yield ranges between 1% and 8%.

| Ticker | Name | Market Cap | YTD Total Ret (%) | Yield |

|---|---|---|---|---|

| SWK | Stanley Black & Decker | $13.68B | 19.91% | 3.72% |

| WMT | Walmart | $442.81B | 18.37% | 1.38% |

| DOW | Dow Chemical | $37.71B | 11.50% | 5.19% |

| MDT | Medtronic | $107.75B | 7.22% | 3.37% |

| CVX | Chevron | $311.47B | -4.18% | 3.61% |

| VZ | Verizon | $143.1B | -9.17% | 7.86% |

| GIS | General Mills | $38.06B | -19.23% | 3.58% |

| PFE | Pfizer | $192.81B | -31.23% | 4.81% |

Ultimately, dividend stocks have been left for dead as yields on bonds have surged. This provides a real opportunity for investors to lock in strong income today with income growth potential tomorrow. That’s something a bond simply can’t do. Given the current values, investors should snag dividend stocks today.

The Bottom Line

As the Fed has raised rates, investors have moved into bonds. This has left dividend stocks at cheap valuations. For investors, the high yields and low prices make dividend stocks big buys. No matter if they purchase individual names or via a fund, portfolios have a chance to grow their income over the long haul.

1 Multpl (September 2023). S&P 500 Dividend Growth