Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Energy Transfer has taken the first position in the list as the company’s high dividend attracted readers’ interest. Second in the list is Walgreens Boots Alliance, which has been suffering from declining sales but has a strategy that might pay off. Abbvie is again in the list as the company’s stock plunged since the start of the year. Private equity firm Blackstone is last as investors worry about higher withdrawals.

Don’t forget to read our previous edition of trends here.

Energy Transfer Well Positioned to Benefit from Rising Energy Prices

Energy Transfer (ET) has been the most popular ticker this fortnight, seeing its viewership surge 64%.

Energy Transfer, which owns and operates natural gas pipelines across the U.S., has seen its shares jump 12% since the start of the year, even as the company’s stock remains undervalued and pays a solid dividend. Energy Transfer trades at a price-to-earnings ratio of 9, having just recently reached pre-pandemic levels. The company’s stock yields a solid dividend of 8%, which could continue to rise in the coming quarters.

Investors broadly expect energy prices to increase, especially since China is re-opening its economy, something that will boost demand for energy. At the same time, sanctions on Russian oil imposed by European countries risks taking out a good chunk of supply, which could lead to an unbalanced market. Companies like Energy Transfer are only expected to benefit from such developments.

Source: Barchart.com

Walgreens Pins Hope on Primary Care Strategy

Walgreens Boots Alliance (WBA) has seen its traffic rise 45% this fortnight, taking second place in the list.

Walgreens Boots has been struggling to turn a profit in the past two quarters, and its stock has been hammered. However, the company has been executing a new strategy to expand into primary care and aid through its more than 9,000 stores. Walgreens hopes this endeavour will generate more than $16 billion in revenues by 2025 and $1 billion in EBITDA. In 2022, the company generated $4.75 billion in EBITDA on revenues of $132.7 billion.

Walgreens pays a generous dividend of $1.92 per share, yielding nearly 5.3% a year. However, that has not been enough to offset the stock’s poor price performance. Over the past five years, Walgreens stock dropped 42%.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

AbbVie Retains Momentum on Optimistic Outlook

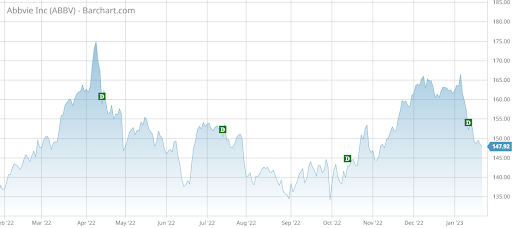

AbbVie (ABBV) is again in the list this week, jumping one place from the fourth it took last time. The pharmaceutical giant has seen its viewership rise as much as 40% during the past two weeks, just as its stock lost more than 10% and underperformed the broad healthcare sector.

Investors may have gotten ahead of themselves, bidding the stock up in recent months, even as questions remain over whether the company will be able to withstand an upcoming patent cliff. Its key drug Humira will soon face competition from generics as the patent expires. And although the company appears to have good replacements in the pipeline, it is still unclear whether it will manage to come out unscathed. AbbVie has been investing heavily in partnerships with oncology companies, including a $30 million deal with Immunome a few weeks ago.

AbbVie pays shareholders an annual dividend of $5.92 per share, resulting in a yield of nearly 4%.

Source: Barchart.com

Blackstone Group Raises New Fund

Private equity firm Blackstone (BX) has taken the last position in the list, seeing its viewership advance 32% in the past fortnight. Blackstone announced that it completed raising $25 billion for a new fund that would provide liquidity to investors and private equity sponsors.

The news comes as Blackstone and other private equity firms have been forced to limit withdrawals from their real estate funds as investors rushed to cash out amid a disconnect between private and public valuations. The publicly-listed REITs have been underperforming due to rising interest rates. However, private equity firms like Blackstone keep the net asset value of their real estate assets high, triggering a rush to the exits for a fear the value of the assets will be marked down in the future.

Blackstone’s business is unlikely to suffer much, though, given the diversification. The firm pays a dividend of $3.60, amounting to a yield of more than 4%.

Source: Barchart.com

The Bottom Line

Energy Transfer is expected to post strong performances given potentially higher energy prices. Struggling Walgreens is hoping that adding primary care in its stores will provide an additional $1 billion in EBITDA through 2025. Pharma giant AbbVie’s stock price fell over the past two weeks as investors weighed the risks of a potential patent cliff. Blackstone successfully raised a new fund even as it faces outflows from its real estate fund.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.