Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This fortnight, shipping company Star Bulk Carriers has taken first spot in the list as its financial results impressed analysts. Second in the list is Microsoft, the second-largest company in the world that is now viewed as a play on the metaverse. Third in the list is tobacco company Altria, a high dividend stock that continues to entice investors. Telecommunications company AT&T closes the list.

Don’t forget to read our previous edition of trends here.

Star Bulk Carriers

Freight shipping company Star Bulk Carriers (SBLK) leads this week’s trends list with an advance in viewership of 64%. This is not a surprise – Star Bulk reported net income of around $225 million in the third quarter of 2021, up from $27 million during the same period last year. Meanwhile, the company’s revenues have more than doubled to $415 million. Shares in Star Bulk are up by 121% for the year, and the company’s dividend still yields an astounding 25%.

However, it is worth noting that Star Bulk operates in a sector that has been experiencing wild price swings lately as demand for shipping has increased frenetically amid high consumer demand and supply chain issues. Star Bulk pays out the lion’s share of its revenues to shareholders, but it is unclear how long the current positive environment will last.

Indeed, in the first nine months of 2020, Star Bulk posted a loss of $18 million, versus a gain of $380 million during the same period in 2021. Between 2016 and 2020, Star Bulk posted net income gains only once – $58 million in 2018.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

Microsoft

Microsoft (MSFT) is second in the list, posting a jump in traffic of 36%. The technology juggernaut trended due to the fact that it had lost the crown of the most valuable company in the world to Apple again, as well as its push into the Metaverse with the latest acquisition of artificial intelligence (AI) and speech technology firm Nuance Communications.

Microsoft shares have continued their advance and are up by around 30% over the past six months. Its market value is now hovering around $2.55 trillion, which is around $300 billion below Apple’s.

However, Microsoft is pushing ahead with its $16 billion acquisition of Nuance Communications, which aims to increase its presence in the healthcare sector. The company has already received the green light from regulators in the U.S. and Australia, while the European Union is also on track to approve the deal.

Microsoft reported revenues of $168 billion in fiscal 2021, up by 17% year-over-year. Meanwhile, net income jumped by 38% to $61 billion. The company pays out 27% of its profits to shareholders via dividends, with an annual yield of 0.7%.

Source: Barchart.com

Altria Group

Tobacco company Altria Group (MO) has taken the third spot in the list this week, seeing its viewership rise by 22%. As always, readers were excited about the company’s juicy and stable dividend, but its investment story remains challenged.

Altria offers a dividend of $3.60 per share on a payout ratio of 74%. This payout yields a handsome 7.9% to shareholders, although these dividend payments are more than offset by the poor stock price performance.

Altria has been attempting to move beyond traditional tobacco products to non-smoke alternatives like vapes and oral tobacco. However, some of these initiatives have backfired, including an investment in vape maker Juul Labs, which has been facing increased regulatory scrutiny.

Shares in Altria are up by 5.5% so far this year.

Source: Barchart.com

AT&T

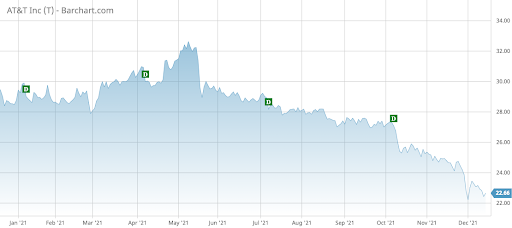

Telecommunications operator AT&T (T) is last in the list, with a jump in traffic of 17%. AT&T has trended for good reasons. The company’s stock performance was so bad in recent months that its stock now yields a staggering 9%, which is fairly high for a company of AT&T’s quality.

Indeed, AT&T plans to reduce its payout to shareholders from around 55% of free cash flow to around 40% following the breakup of its WarnerMedia division, which is in the process of merging with Discovery.

After an attempt to build a conglomerate failed, AT&T is now trying to focus on 5G and internet and become a pure-play broadband company. Its arch-rival Verizon Communications has followed a similar strategy and has been rewarded by stronger stock performance. Over the past year, AT&T shares declined by 15%.

Source: Barchart.com

The Bottom Line

Star Bulk Carriers has recorded impressive financial results, thanks to skyrocketing shipping rates. Microsoft is again the second-largest company by market value after Apple, but the technology giant is serious about pivoting into the Metaverse with its latest acquisition of Nuance Communications. Altria Group pays a high dividend, but its investment story is challenged by a series of setbacks stemming from its investments in smokeless products. AT&T’s dividend yields 9%, but this will be cut after the company completes the spin-off of WarnerMedia.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.