Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

These past two weeks, our readers were mostly interested in companies that boosted their shareholder payouts. Indeed, Microsoft trended first after the technology behemoth increased its dividend and announced a share repurchase program. Second on the list is real estate company Realty Income, which also hiked its dividend. Telecommunications companies Verizon and Altria Group, third and fourth, respectively, recently increased their dividends as well.

Don’t forget to read our previous edition of trends here.

Microsoft

Microsoft (MSFT) has taken first place on the list this week, with an increase in viewership of 146%. Microsoft has been popular with our readers, largely because the technology giant has increased its dividend and announced a new share repurchase program.

On September 14, Microsoft declared a quarterly dividend of $0.62 per share, representing an increase of 11% over the previous quarter. Meanwhile, Microsoft announced a $60 billion share repurchase program, which it said has no expiration date and can be terminated at any time. Microsoft’s stock yields a dividend of just 0.73%, although it is higher than other technology behemoths like Apple (AAPL), 0.57%, and Nvidia (NVDA), 0.29%. However, it is lower than the technology average of 1.35%.

Yet Microsoft is hardly a company relying on its dividend to reward shareholders. The stock is up by 37% so far this year and has gained 422% over the past five years. Since 2017, Microsoft’s sales have doubled from $96 billion to $168 billion, while net income rose from $24 billion to $61 billion. Microsoft’s operating system Windows continues to be the leader in personal computing, while its cloud computing unit Azure has delivered most of the growth in recent years.

Microsoft currently has a payout ratio of around 30%, meaning it pays shareholders a third of its net income in dividends.

Check out our latest Best Dividend Stocks List here.

Realty Income

Realty Income (O) has taken the second position on our list these past two weeks, with a rise in viewership of 32%. The real estate company has over 6,700 properties under management in over 50 states, and recently increased its monthly dividend by 0.3% to 23.6 cents per share. This is the 112th dividend increase since Realty Income listed its shares on the New York Stock Exchange in 1994.

Realty Income has one of the best track records from the real estate industry in capital allocation. The company has a highly diversified portfolio, which it has been able to grow over time. The resulting cash from renting out its properties is returned to shareholders via dividends. Indeed, since 1994, the company has delivered a compounded average annual total return of 15.3%. The company counts blue-chip companies like Dollar General (DG), 7-Eleven, Walgreens (WBA) and FedEx (FDX) among its top 20 clients.

Although the company has some clients in industries that suffered from the coronavirus pandemic, its high exposure to the grocery retail industry has allowed it to withstand the shock.

The company’s shares still trade around 18% below their pre-pandemic level. Its dividend yields 4.1%, which is a little lower than the real estate average of 4.51%.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.

Verizon Communications

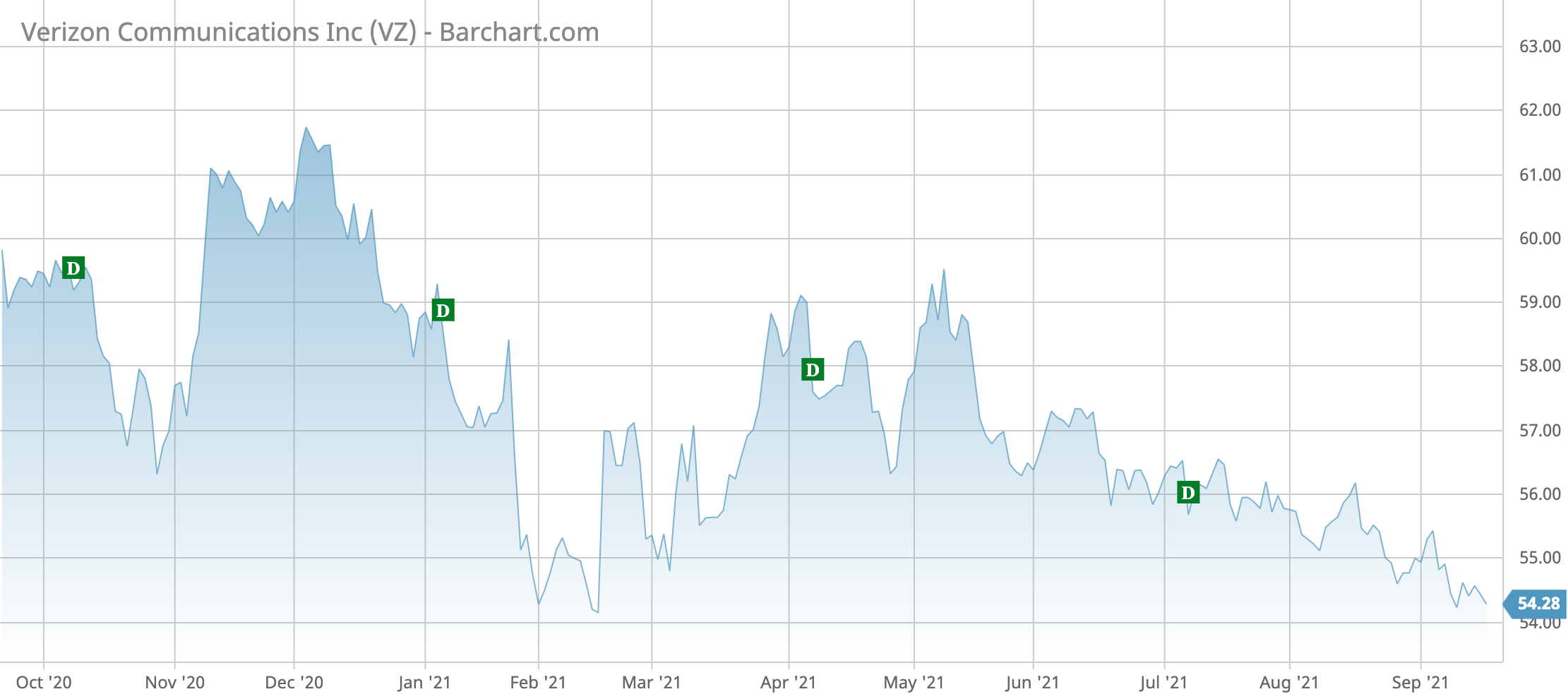

Telecom giant Verizon Communications (VZ) is third on the list this week, with an advance in viewership of 12%. At the start of September, Verizon boosted its quarterly dividend by 2% to 64 cents per share, the 15th consecutive year it has approved a quarterly dividend hike.

Although shares in Verizon are just slightly up over the past five years, the company could benefit strongly from the rollout of 5G, potentially making its stock attractive from both a growth and dividend perspective. Verizon’s Ebitda has increased from $42 billion in 2016 to $46.5 billion in 2020. And profitability could continue to expand as the company’s capital outlays on building the 5G infrastructure slows down and it starts to enjoy the benefits.

On top of possible stock appreciation, Verizon yields 4.6%, way higher than the average dividend yield for telecommunications of 2.55%.

Altria Group

Tobacco giant Altria Group (MO) closes the list with a slight increase in traffic of 2%. Altria recently boosted its quarterly dividend by 4.7% to 90 cents per share. This is the 12th consecutive annual increase by the tobacco company and the yield will increase to a little more than 7%.

Despite operating in an industry that many analysts believe could go extinct in a few decades, Altria is still delivering revenue growth, partly because of its investments in alternative tobacco products like vapes and heating tobacco.

Altria has a strategy to move beyond smoking, and it now calls itself a tobacco harm-reduction company. It is investing heavily in smoke-free products and aims to lead the way in helping consumers move away from combustible tobacco products.

While Altria’s dividend is high, the stock remains a risky play over the long term as it is unclear whether the transition to a smoke-free company will be a smooth ride.

Use the Dividend Screener to find high-quality dividend stocks. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

The Bottom Line

Microsoft has increased its dividend again, announcing a large share buyback program, as the company has been growing strongly. Realty Income has also hiked its dividend as it weathered the COVID-19 storm well. Verizon shares have moved sideways over the past five years, but 5G promises to pepper the stock in the coming half-decade. Finally, Altria Group also increased its dividend, but the stock remains a risky play due to worries about its transition to a smoke-free world.

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.