Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Bank of America has taken the first spot in the list, as one of the best performing banks has announced the departure of a key executive. Intel, the legendary chipmaker that faces strong competitive challenges, is second in the list. Energy utility PPL is third as the company is focusing on becoming a pure-play U.S. regulated utility. The list is closed by mortgage real estate investment firm Arbor Realty Trust.

Don’t forget to read our previous edition of trends here.

Bank of America

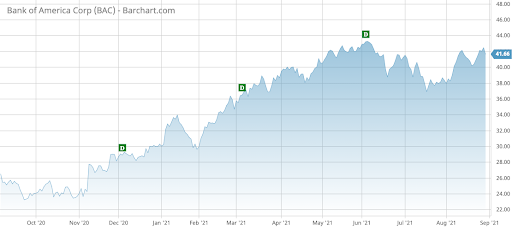

Bank of America (BAC) has taken the first position in the list this fortnight, with an advance in viewership of 56%. Check out the other banking industry stocks, ETFs and mutual funds here.

Bank of America has been one of the best performers in the banking sector since the financial crisis of 2009, outperforming all major peers like Wells Fargo (WFC), Citigroup (C), and JP Morgan & Chase (JPM). One key contributor to the outperformance has been Tom Montag, an executive who joined the bank in 2008 from Merrill Lynch, which was acquired by Bank of America in the same year. Montag announced he will retire by the end of the year.

Montag led Bank of America’s investment banking business and helped build a highly successful unit that spanned trading, commercial banking, and M&A. His abrupt retirement came as a surprise to some observers and has led to questions over who will replace him.

Whoever will be the next leader of the investment bank, investors appear to have confidence in the stock and management team led by Brian Moynihan. Over the past 30 days, shares in Bank of America rose nearly 10%, beating Wells Fargo, Citigroup, and JP Morgan by around 4-5 percentage points.

Bank of America recently hiked its quarterly dividend by nearly 17% to 21 cents per share as it successfully passed a stress test conducted by the Federal Reserve. Bank of America’s forward payout ratio is now 26%, resulting in an annual yield of around 2% at current stock prices.

Check out our latest Best Dividend Stocks List here.

Intel

Intel (INTC) is second in the list with a rise in viewership of 20%.

Intel has been in the news after the company won a U.S. government contract to lead the first phase of the Department of Defense program to set up a domestic commercial foundry infrastructure.

After the company brought in Pat Gelsinger as its new CEO earlier this year, Intel started to put more emphasis on its foundry arm, which manufactures chips. In March, the company announced a $20 billion investment to build two new factories and it expects to start construction activities this year.

Gelsinger has said in press interviews that he expects Intel to become an industry consolidator by acquiring smaller firms to decrease manufacturing costs. Press rumors indicated that Intel wanted to acquire GlobalFoundries for about $30 billion, but they were later squashed by GlobalFoundries’ CEO.

Intel has a payout ratio of nearly 30%, amounting to an annual dividend yield of around 2.6%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

PPL

Energy utility company PPL (PPL) has taken the third spot in the list with an advance in traffic of 19%. PPL is undergoing a transformative change.

Earlier this year, the company sold its UK utility National Grid for $10.4 billion, a move that it said will help it re-position as a high-growth regulated U.S. utility. The proceeds will be used to retire $3.5 billion in debt, with the rest either returned to shareholders or re-invested in renewable energy. At the beginning of August, PPL announced plans to cut 80% of carbon emissions by 2050, joining many other energy companies in their commitment to green energy.

PPL has largely underperformed in recent years. PPL shares have lost 16.7% over the past five years, while Reaves Utility Income Index gained 20%. Partly, the underperformance has been due to the company’s venture in the UK, which it has now undone.

PPL’s annual dividend of $1.66 per share yields an impressive 5.7%.

Arbor Realty Trust

Mortgage real estate investment company Arbor Realty Trust (ABR) is last in the list, posting an increase in viewership of 16%.

Arbor Realty’s stock has slowly recovered since the massive selloff in the spring of 2020, which stemmed from the coronavirus pandemic and now trades above pre-pandemic highs. Arbor Realty pays out 76% of its earnings to shareholders via dividends, resulting in a yield of 7.6%.

Arbor Realty originates and holds loans that cater to the multifamily REIT sector, which has historically been stable in crises. In addition, the mortgage REIT lends conservatively, making its income streams relatively safe. The company has increased its dividend for the past six years, and has been one of the best performing mortgage REITs.

The Bottom Line

Bank of America has outperformed its peers over the past decade, but now a key contributor to this success is leaving. Intel won a government contract to lead the creation of a robust chipmaking infrastructure. Energy utility PPL has underperformed its peers, as it may have been dragged down by its UK business, which it has recently sold. Finally, Arbor Realty Trust’s conservative lending to the relatively stable multifamily residential industry has resulted in a safe stream of income.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.