Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

It was earnings season these past two weeks. Global mining group Rio Tinto trended first as the company announced a bumper dividend. British oil major BP reported strong earnings on the back of recovering oil prices. 3M, the industrial conglomerate that makes everything from safety and industrial products to electronics and healthcare, is third. The list is closed by real estate investor Omega Healthcare.

Don’t forget to read our previous edition of trends here.

Rio Tinto

Rio Tinto (RIO) has taken the first spot in the list with an impressive advance in viewership of 103%. The popularity was for good reason. Rio Tinto reported strong results during the first six months of the year, with pre-tax profits surging 240% to $18 billion. Revenues came in at $33 billion.

As a result of the strong results, the company said it will pay out $9.1 billion to shareholders, the largest dividend payout in the company’s history. Rising prices for iron ore and insatiable demand from China has boosted Rio Tinto’s coffers.

Shares in Rio Tinto are up 17% over the past 12 months, giving the company a market capitalization of $174 billion.

However, the strong cash inflows are unlikely to last, given that iron ore prices have already fallen from very high levels. At the same time, Rio Tinto is facing ongoing operational problems. Iron ore production at its Pilbara region mine in Australia declined 5% in the first half of the year to 152 million tons due to bad weather and lack of labor. In Mongolia, the company has been grappling to develop a copper mine in Oyu Tolgoi as a result of a dispute with the country’s government.

BP

British Petroleum (BP) is second in the list this past fortnight with an increase in viewership of 60%. BP has also reported strong results in the second quarter, with its net profit of $2.8 billion beating analysts’ expectations of a little more than $2 billion. During the same period last year, BP reported a loss of $6.7 billion.

BP raised its dividend from 5.25 cents per share to 5.46 cents, while committing to a share buyback of $1.4 billion during the third quarter. The company said it expects to raise its dividend by 4% annually through 2025 and repurchase $1 billion per year if average oil prices will be around the $60 per barrel level.

Shares in BP are up nearly 9% over the past 12 months. The company pays an annual dividend of $1.31 per share, resulting in a yield of 5.1%. BP pays out 40% of its earnings to shareholders via dividends.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

3M

3M (MMM), the company that produces more than 60,000 products in the industrial, healthcare, and worker safety areas, has taken the third spot in the list, seeing its viewership jump 23%.

For the second quarter, 3M reported better results. Sales of $8.9 billion were up 24.7% year-on-year, while adjusted operating cash flow of $1.9 billion was up 2%. The company said it returned $1.4 billion to shareholders during the quarter via share repurchases and dividends. 3M shares appreciated by 18% so far this year.

Although results are improving, a few clouds remain over the stock. 3M is dealing with legal liabilities from the PFAS, a chemical it manufactured a long time ago that spilled into the ground and contaminated the water. It now has to clean up the area and the related costs are yet unknown, as well as whether the suffering families will be rewarded compensation in court.

At the same time, the company is still working on reaching a settlement with war veterans that were affected by its faulty ear plugs, which have led to hearing loss.

Check out our latest Best Dividend Stocks List here.

Omega Healthcare Investors

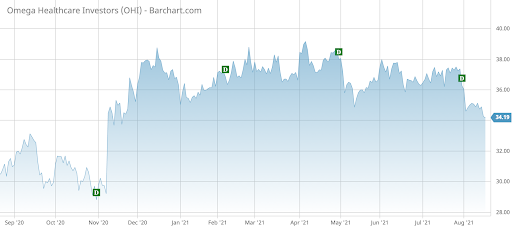

Omega Healthcare Investors (OHI) has seen its viewership rise 17% in the past fortnight, taking the last spot in the list.

At the beginning of August, the company that invests in operators of skilled nursing facilities and assisted living facilities reported its second-quarter results. Omega reported Nareit funds from operations of $180.8 million, or around $0.74 per share, compared with $186.5 million during the same period last year. The decline is partly attributed to $5.8 million of non-cash stock-based compensation expenses.

Omega Healthcare pays an annual dividend of $2.68 per share, amounting to a yield of 7.7%. The company pays its dividend on a quarterly basis. Omega Healthcare shares are up nearly 8% over the past 12 months, but remain down more than 5% for the past five years.

The Bottom Line

Rio Tinto has declared a bumper dividend on strong results, but clouds remain over the stock as the company has hit problems with some development projects. BP reported strong results on the back of strong oil prices and the company expects to increase its dividend annually and buy back shares. 3M also revealed solid financial results, but it faces some serious legal problems. Finally, Omega Healthcare pays a large dividend but its stock has stagnated over the past five years.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.