Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Financial and telecommunications equities have trended this week. First in the list is Bank of America, which, along with other banks, has recently raised shareholder payouts. AT&T is second as the company maintained its dividend, although that is not expected to last. Third is Verizon Communications, while agency mortgage real estate company American Capital Agency is last.

Don’t forget to read our previous edition of trends here.

Bank of America

Bank of America (BAC) has taken first place in the list this week, seeing its viewership advance by 43%.

Bank of America, along with a host of other U.S. banks, has increased its quarterly dividend by 17% to $0.21 per share and an annual dividend of $0.84 after the bank passed a stress test conducted by the Federal Reserve. Other banks that will increase their disbursements to shareholders include Morgan Stanley (MS), Goldman Sachs (GS) and JP Morgan Chase (JPM).

Following the financial crisis in 2008, all large U.S. banks were forced by regulators to raise their capital buffers in order to avoid another government bailout. That meant there was a limit to how much money the banks could return to shareholders. After decades of building its capital position, Bank of America is healthy enough to withstand another financial shock, and as a result the Fed decided it can use some of its capital to reward shareholders.

Bank of America’s dividend yield will increase to an annual 2% from around 1.7% now. Bank of America has been one of the best performers in the banking sector over the past five years, with its stock gaining 212% versus 95% for the KBW Nasdaq Bank Index.

Source: Barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com ratings are Dividend.com’s current recommendations to investors.

AT&T

AT&T (T) is second in the list with an increase in reader traffic of 21%.

AT&T may have trended, thanks to its temporarily high dividend yield. The telecommunications company now yields a stunning 7.2%, but that dividend will be cut after the company completes the divestment of Warner Media, which will merge with Discovery.

The deal is expected to complete in mid-2022, if not later, and dividend investors can enjoy high dividend payouts in the meantime. Many dividend investors have sold out after AT&T announced its dividend cut, resulting in a lower stock price and higher yield.

And yet the remaining business will be better positioned given that the debt will decrease and management will be able to improve its focus on the core broadband and mobile business. Peer Verizon has been more focused on the core telecom unit and its stock has outperformed.

In late June, AT&T declared a quarterly dividend of $0.52 per share, same as last quarter but up one cent from the prior year. AT&T stock is flat for the year.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

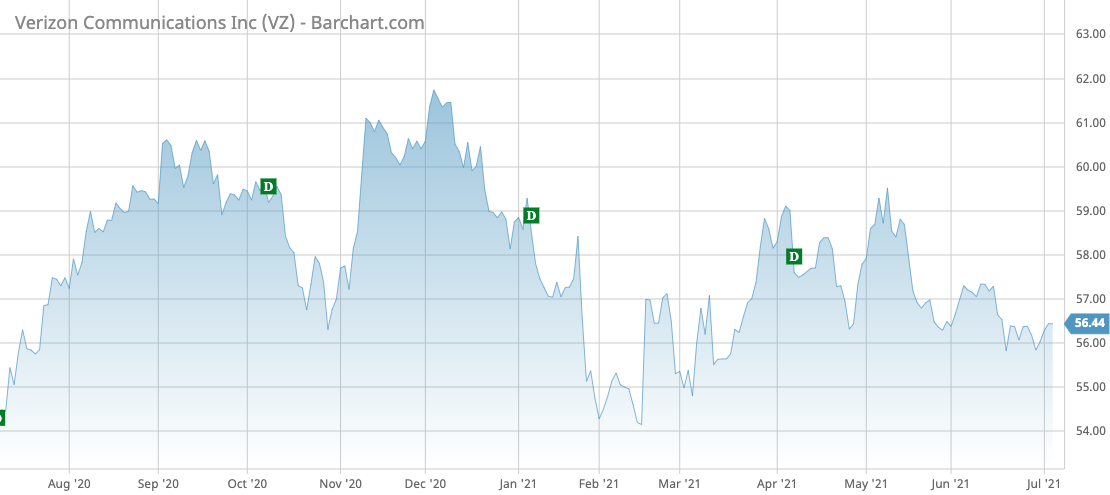

Verizon

Verizon (VZ) is third in the list with an advance in viewership of 8%. Verizon, a close competitor of AT&T, yields 4.46% annually, but its dividend is more sustainable than AT&T’s and is unlikely to be cut. Verizon has been increasing its dividend for the past 14 years and has a payout ratio of nearly 50%.

Verizon has also ventured into the media sector by acquiring AOL and Yahoo! in recent years. Fortunately for the company, the acquisitions were small compared to the size of its core telecom business and did not prove to be a drag on the company’s overall performance. Just recently, Verizon announced it was selling the unit for $5 billion, around half of what it paid originally.

As a result of its improved focus on its core broadband and mobile business, Verizon has outperformed AT&T over the past five years, with its stock up by 0.7% versus a loss of 31% for AT&T. The battle between the two telecom giants is going to be more heated in the coming years as AT&T also divested its large media business to focus on the core telecom unit.

Source: Barchart.com

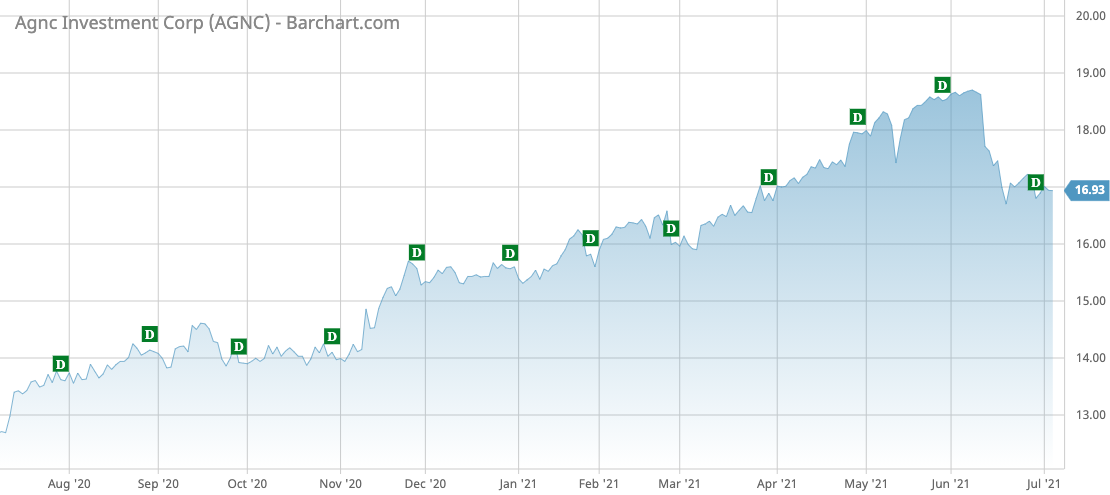

American Capital Agency

American Capital Agency (AGNC) is last in the list with a 4% increase in traffic. American Capital, a real estate investment trust largely investing in agency residential mortgage-backed securities, has trended due to its high dividend yield and poor stock price performance over the past 30 days after a bumper period.

American Capital pays a dividend of $1.44 per share, which is equal to an annual yield of 8.5%. The company’s stock has lost 10% over the past 30 days, but remains up 10% for the year. American Capital has not yet recouped all of the losses incurred during the coronavirus pandemic sell-off in spring 2020, but is still close.

As interest rates might rise following a pick up in inflation, American Capital might suffer. The company makes its money by borrowing money short term at low interest and investing in long-term instruments at higher rates.

A potential increase in short-term borrowing costs by the Federal Reserve is expected to tighten the spread and leave American Capital with less money to distribute to shareholders.

Source: Barchart.com

The Bottom Line

Bank of America has raised its dividend by 17% after successfully passing a stress test conducted by the Federal Reserve. AT&T has a high dividend, but this will be cut after it completes the divestment of Warner Media. Verizon has outperformed arch-rival AT&T, but now the battle is more intense given that both are laser-focused on core telecom services. Finally, American Capital Agency has a high dividend but might suffer from a potential increase in interest rates.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.