Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Real estate equities have trended these past two weeks, as the sector outperformed the broad market. Realty Income is first in the list as the company raised its dividend again. Stag Industrial, an owner of industrial real estate, is second in the list. British American Tobacco has taken the third place after the company raised its revenue guidance for 2021. The list is closed by pharma giant AbbVie.

Don’t forget to read our previous edition of trends here.

Realty Income

Realty Income (O) has taken first place in the list with an advance in viewership of 45%. Realty Income has attracted readership because the real estate sector has been outperforming the broad market in recent weeks; it also has a strong business model, and a relatively safe and rich dividend. O recently reached a merger agreement with fellow real estate company Vereit Inc. (VER).

Realty Income pays an annual dividend of $2.81 per share, amounting to a yield of 4.14%. The company has been hiking its dividend for 27 years in a row.

The company’s portfolio of real estate assets is diversified across a range of industries, including convenience stores, health and fitness, and drug stores. Aside from convenience stores, no industry makes up more than 10% of the company’s portfolio. This diversification means the company faces low risks when certain industries face rough times, like movie theatres currently.

Just a few months ago, Realty Income acquired VEREIT in an all-stock transaction that will result in a company with a combined enterprise value of $50 billion. The new company is expected to spin off all office-related assets. The transaction is expected to close in the fourth quarter of 2021.

Realty Income shares are up by 13.7% over the past year. With inflation picking up, investors are searching for protection from possible interest rate rises and plowing money into real estate equities. Given that Realty Income has a diversified portfolio and a strong balance sheet, the company’s gains could continue.

Source: Barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com ratings are Dividend.com’s current recommendations to investors.

Stag Industrial

Stag Industrial (STAG) has taken the second spot in the list, seeing its traffic increase by 24% over the past two weeks.

Stag is among the best performers from real estate stocks since the beginning of the year. Stag is up by 28.5%, beating both the Real Estate Select Sector SPDR Fund, which is up by 27% over the same period, and the S&P 500, up by 14%. Partly, the company has outperformed thanks to its strong results and acquisition-led strategy.

Stag owns nearly 500 industrial buildings and aims to make up to $1.2 billion in acquisitions every year. Stag’s revenues have grown at an annual rate of around 15% since 2016, reporting $83 million in revenues in 2020. Stag’s dividend yields 3.7% and the company has announced consecutive increases over the past seven years. The company pays its dividend on a monthly basis.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

British American Tobacco

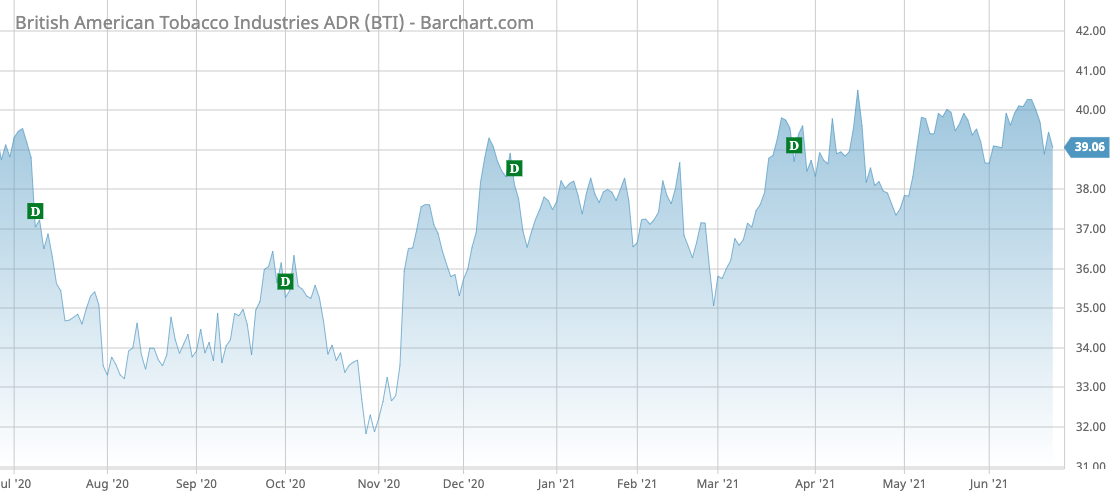

British American Tobacco (BTI) is placed third in the list, seeing an increase in traffic of 21%.

British American has recently raised its revenue guidance for 2021 to 5% growth from 3-5% previously, partly due to strong demand for cigars, cigarettes and new category products, which include tobacco heating products like Glo. At the same time, the company’s travel retail business has failed to show a strong recovery as the traveling industry is still hit by the coronavirus pandemic.

2021 is set to be a “pivotal year” for the business, as it accelerates its transition to tobacco heating products, British American said recently. The company has three key brands in this category: the aforementioned Glo, Vuse for modern oral products and Vuse vapour products.

British American Tobacco pays out a dividend that currently yields 7.7%. However, its stock has fallen by around 11% for the past 12 months, essentially erasing all the returns from dividends. At a price-to-earnings ratio of just 10, shares in British American Tobacco are cheap, but they do carry risk.

Source: Barchart.com

AbbVie

Abbvie (ABBV) has taken the last position in the list with an increase in viewership of 17%.

AbbVie appears to be a very good dividend stock. The company’s dividend yields a strong 4.6% and also offers investors growth possibilities. The stock is up by 18% over the past 12 months, bringing the total shareholder return to 22%.

However, the company is facing some looming clouds. Its blockbuster drug Humira, which generated more than $20 billion in sales in 2020, is losing its patent exclusivity in 2023. As a result of expected competition from generic drugs, Humira sales are expected to decline.

The company has other potential drugs treating conditions like cancer and plaque psoriasis, which could help withstand the shock from the patent cliff. At the same time, its blockbuster acquisition of Allergan last year gives it further protection.

Source: Barchart.com

The Bottom Line

With the real estate sector outperforming in recent weeks, Realty Income and Stag Industrial trended. Realty shares have underperformed the real estate market but this may not be for long. Stag has outperformed. Meanwhile, British American Tobacco raised its revenue guidance and AbbVie appears to be a good stock for dividend investors.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.