Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Technology behemoth International Business Machines has taken the first spot in the list as the company surprised analysts with strong sales growth. Second in the list is pharmaceutical company Pfizer, which is seeing its stock peppered by solid sales from its hit COVID-19 vaccine. British American Tobacco is third as the maker is making progress towards diversifying away from tobacco products. The list is closed by pipeline operator Enbridge.

Don’t forget to read our previous edition of trends here.

IBM

IBM (IBM) has taken the first spot in the list with an increase in viewership of 32%. IBM’s shares have gained more than 5% over the past two weeks, as the company delivered a strong set of results, pleasantly surprising analysts.

Revenues for the first quarter increased 1% to $17.7 billion compared to the same period last year, above analysts’ expectations of $17.4 billion. What is more, the results were largely due to strong sales of cloud products, which jumped 21% to $6.5 billion. Meanwhile, the company’s profit came in at $1.6 billion, or $1.77 per share.

IBM has been experiencing a slow decline over the last five years. Revenues have fallen from an annual $80 billion in 2016 to $73.6 billion in 2020, despite the company’s strong cloud adoption. Falling revenues from the legacy business have largely failed to offset rising sales from cloud.

However, this quarter has given investors hope that IBM is turning a corner. The following quarters will be crucial for the company and its investors. To change the perception of it as a struggling behemoth, IBM will have to continue to surprise to the upside.

IBM pays out an annual dividend of $6.52 per share, amounting to an yield of 4.61%. IBM has increased its dividend for 21 consecutive years.

Pfizer

Pfizer (PFE) is second in the list, experiencing an increase in traffic of 20%. Pfizer shares have jumped more than 15% over the past two months, as the company emerged the clear winner from the race to provide the world with COVID-19 vaccines.

Just recently, Pfizer reached an accord with the European Union to sell an additional 100 million doses, which is expected to increase revenues by around $1.4 billion. Pfizer’s vaccine has been more effective and safe than its key competitor AstraZeneca, which received a blow in Europe after its shots were linked to the creation of rare blood clots.

In a further boost to Pfizer’s vaccine, recent tests have shown that it is effective against a new strain of the virus that appeared in South Africa and that it can be safely administered to children aged between 12 and 15.

These developments should lead to a continuous improvement in earnings per share in the coming quarters.

Pfizer pays an annual dividend of $1.15 per share, equaling to an yield of nearly 3%. The company’s payout ratio stands at nearly 50%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

British American Tobacco

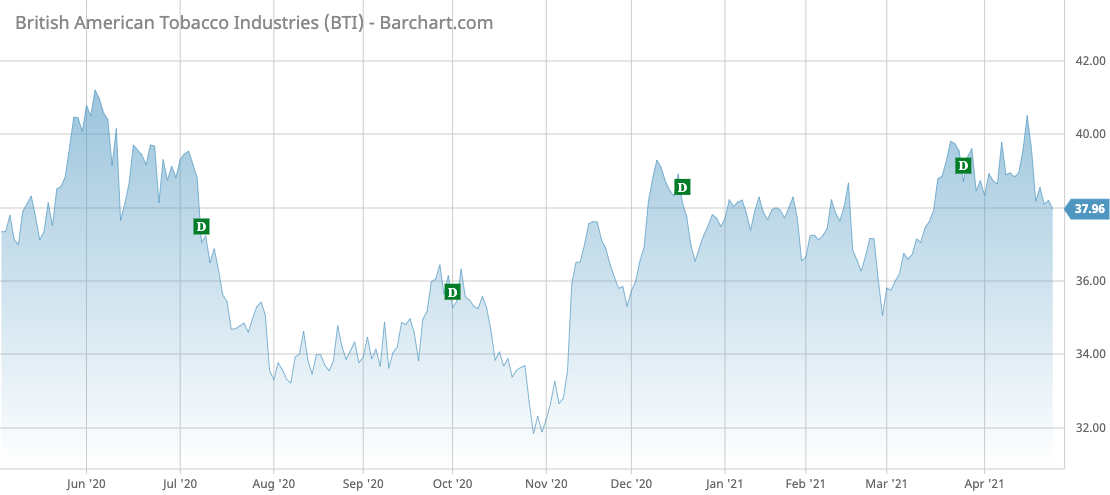

British American Tobacco (BTI) is third in the list, seeing a jump in viewership of 14%. British American is facing huge challenges to its business model of selling tobacco products as people move away from smoking cigarettes. As a result, British American Tobacco appears extremely undervalued, trading at a price-to-earnings ratio of 9.9.

However, the company is taking proactive steps to diversify its revenues by tapping new markets. Its Vuse vapor products saw sales rise 85% in 2020 and are expected to continue their upward trajectory. At the same time, British American is exploring the emerging cannabis market. In mid-March, it announced a 20% strategic investment in Canadian cannabis company Organigram Holdings. The proceeds of around $175 million will be used by Organigram for the research and development of the next generation of cannabis products.

British American pays out nearly $3 per share in annual dividends, equal to a yield of 7.8%.

Check out our latest Best Dividend Stocks List here.

Enbridge

Enbridge (ENB) is another company paying a strong dividend that has trended this week with an increase in viewership of 7%. The Canadian pipeline operator pays a dividend of $2.46 per share, amounting to a solid yield of 6.6%. The company also has around $30 billion of new projects that are expected to boost its revenues and profits, raising the possibility of a dividend increase.

However, the company is facing constant criticism that its pipelines are damaging the environment, along with many actions that call for pipeline shutdowns. Less than two weeks ago, Michigan Governor Gretchen Whitmer ordered the company to shut a 4-mile stretch due to worries that it could leak. The section is responsible for carrying 540,000 barrels per day. Enbridge has sued to reverse the order, arguing a shutdown would lead to job losses and fuel shortages.

The Bottom Line

Technology giant IBM has reported upbeat results thanks to solid cloud sales, raising investor hopes that the company is turning a corner. Pfizer has benefitted and will continue to see higher sales from its hit coronavirus vaccine, as other producers stumbled. British American Tobacco faces a dying business, but the company is pursuing diversification into cannabis. Pipeline operator Enbridge has a strong dividend yield, but its business is constantly challenged over environmental concerns.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.