Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Oil carriers have been trending in recent months, thanks to a sudden rise in demand for storage. This week is no exception. Nordic American Tankers, which operates a fleet of 23 Suezmax tankers, has taken the first spot in the list. Cisco Systems disappointed investors with a set of weak earnings, taking second place in the list. Oil major Chevron, which was forced to cut half of its production in the Gulf of Mexico due to two storms, is third in the list. Technology giant Microsoft closes out the list.

Don’t forget to read our previous edition of trends here.

Nordic American Tankers

Nordic American Tankers (NAT) has taken the first spot in the list with a rise in viewership of 48%. Oil tankers have been trending in recent months, with previous names including Frontline Ltd. and Nordic American itself. The industry has benefitted from surging tanker rates as many oil producers were left with huge reserves and nowhere to sell in the midst of the coronavirus pandemic.

Despite a stabilization of the market, Nordic American continued to post strong net income growth and dividends. In the second quarter ended June 30, Nordic American reported net income of $49.1 million, up from $39.5 million in the previous quarter and a $15 million loss in the same period last year. As a result, the company increased its dividend to 20 cents per share from 14 cents in the previous quarter.

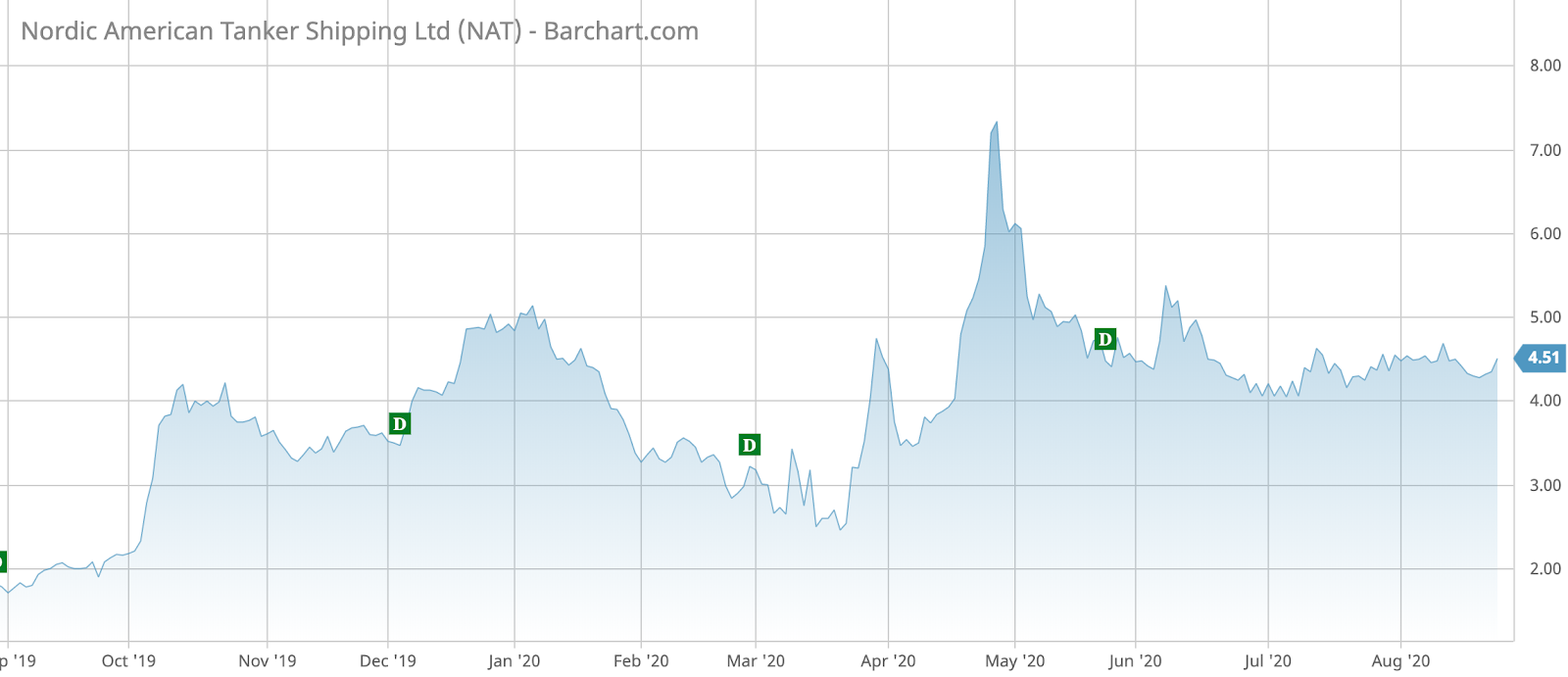

Nordic American shares have been extremely volatile this year, reaching a high of nearly $9 at the end of April, before giving up half of the gains to trade at around $4.3 per share.

Nordic American has 23 Suezmax vessels with each able to carry one million barrels. The company says these carriers are more versatile than the usual 2 million barrel vessels because it gives it higher trading flexibility.

Source: Barchart.com

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Ratings are Dividend.com’s current recommendations to investors.

Cisco Systems

Cisco Systems (CSCO) has taken the second spot in the list with a 25% advance in viewership. Cisco has trended in part due to its stock’s poor performance and weak guidance for the current quarter, even as other technology giants have been recovering strongly. Indeed, Cisco stock has lost 12.3% so far this year, while the S&P 500 is up by more than 5%.

For the fourth fiscal quarter, Cisco said its revenues declined by 9% to $12.2 billion, still higher than analysts’ estimates. Meanwhile, profits came in at 80 cents per share, down 4% from a year ago but higher than Wall Street’s forecast of 74 cents. However, investors were disappointed to hear that Cisco expects another revenue decline of 9% in the current quarter ending October, as well as profits of 69 to 71 cents a share, well below expectations of 76 cents.

The announced retirement of Chief Financial Officer Kelly Kramer has further dented investor sentiment. Cisco is largely dragged down by its legacy enterprise hardware business, where revenues are continually falling year-over-year. The bright spot has been its services business, including video conferencing tool Webex, a competitor of Zoom Communications, a market darling in the current coronavirus pandemic. However, the growth in the services has failed to offset revenue falls in hardware.

Cisco has received some heat from analysts for failing to restructure its business completely by focusing more on enterprise software. Around 60% of the revenues still come from the legacy hardware business, including its switches and routers, which are down 80% from 15 years ago.

Source: Barchart.com

Cisco pays an annual dividend of $1.38 per share, yielding 3.26%.

Check out our latest Best Dividend Stocks List here.

Chevron

Oil major Chevron (CVX) has taken the third spot in the list with a 12% rise in viewership, as the company made headlines with an unexpected acquisition.

At a time when oil mergers are rare due to the global uncertainty about oil prices, Chevron announced it will be acquiring Noble Energy for $5 billion in stock. Considering Noble’s debt, the deal values Noble at $13 billion. Chevron CEO Mike Wirth said Noble’s assets have low operating costs and need little imminent investments. As such, Chevron will maintain its ability to withstand the challenges posed by the COVID-19 pandemic.

The deal gives Chevron access to assets in West Texas and New Mexico, as well as the eastern Mediterranean and West Africa, with Chevron estimating a cost savings of $300 million.

Chevron’s deal comes a year after the company walked empty-handed from a bidding war for Anadarko Petroleum. Chevron lost to Occidental, which paid $38 billion for the company but has been saddled with debt and faces difficult times.

Source: Barchart.com

At the same time, Chevron’s deal means the company is doubling down on oil, just as other oil majors, such as BP, are moving toward renewable energy. However, Chevron outperformed BP over most recent periods.

Chevron pays an annual dividend of more than $5.16 per share, which represents a yield of 5.9%.

Microsoft

Microsoft (MSFT) is last in the list this week with a rise in viewership of 11%. Microsoft, which saw its stock rally by 37% this year, has made the headlines with a potential deal to acquire TikTok’s assets in the U.S.

TikTok has been banned by the U.S. administration, the latest casualty in an ongoing trading war with China. As such, ByteDance, the Chinese owner of TikTok, has been rushing to sell its U.S. operations. Yet analysts have been skeptical about the deal, arguing that Microsoft’s track record in consumer products has been spotty at best. Meanwhile, a potential acquisition will have a minimal impact on the company’s revenues and profitability, although it could be a platform for growth.

Microsoft said it expects to complete discussions with President Donald Trump and his administration by mid-September, in an attempt to soothe security concerns.

Source: Barchart.com

The Bottom Line

Nordic American Tankers has again hiked its dividend as the oil storage provider has benefitted from stronger rates. Cisco has posted disappointing results, prompting analysts to question whether the company failed to make its transition to software with enough urgency. Chevron bought Noble Energy, in the first major oil deal since the coronavirus pandemic struck. Meanwhile, Microsoft is trying hard to acquire the U.S. assets of TikTok, the viral video-sharing social networking service.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.