Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Oil storage provider Frontline Ltd. is first in the list this week, as the company recently hiked its dividend in an environment in which many companies are doing the contrary. Real estate firm Brookfield Property Partners is second in the list, as the firm has partly suffered from lower rent collections. Third in the list is Bank of America, which recently pledged $1 billion to tackle racial inequality. Last in the list is mortgage real estate investment trust Annaly Capital Management.

Don’t forget to read our previous edition of trends here.

Frontline

Frontline (FRO) has taken the first place in the list with a rise in viewership of 42%. Frontline provides oil storage services to the oil industry and saw its revenues surge in the first quarter of this year as tanker rates increased due to a supply glut. As such, the firm increased its dividend by 75%, to $0.70 per share. This represents a forward annualized dividend yield of around 31%.

In the first quarter of the year, the firm reported the highest net income since 2008 of $165 million. This compares with around $126 million in the last quarter of 2019. However, such strong results are not going to last. As the economy recovers and demand for oil increases, oil storage prices have dropped. “The tanker market has corrected downwards in recent weeks and faces pressure in the short term, both from [crude] production cuts and inventory draws,” Frontline CEO Robert Macleod said on a conference call on May 20.

Despite the strong results, the company’s share price has largely suffered this year. Frontline shares have fallen nearly 30% year-to-date. It remains down nearly 90% since its all-time high achieved June 2008.

The dividend is payable on June 22 to shareholders of record June 4.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters.

Brookfield Property Partners

Brookfield Property Partners (BPY) has taken the second place in the trends list with an advance in traffic of 18%. Brookfield, a diversified real estate company, has seen its stock lose 43% following the COVID-19 pandemic as its retail portfolio was hit by a dramatic fall in rent collections.

Brookfield said its April retail collections were just 20%, roughly in line with expectations. However, its office and multifamily portfolios fared much better, with average rent above 90%. Brookfield’s investments in offices and retail are largely equal. The company reported commercial property and hospitality revenues in the first quarter of $1.77 billion, down from nearly $2 billion a year ago. Meanwhile, net revenue declined from $1.5 billion to $1.1 billion.

Brookfield said its liquidity buffers are enough to withstand the storm. It ended up the year with $7.2 billion of group-wide liquidity, which includes cash-on-hand and credit facilities.

Brookfield pays an annual dividend of $1.33 per share, which represents an yield of about 12.8%. The company is set to pay its next quarterly dividend on June 30.

Check out our latest Best Dividend Stocks List here.

Bank of America

Bank of America (BAC) has taken the third place in the list, with an increase in viewership of 11%. The bank has suffered recently due to the low interest rate environment as well as expectations that it might be facing many non-performing loans as a result of the COVID-19 pandemic and the ensuing lockdown. Shares have lost nearly a third of their value since the start of the year and currently trade at lows not seen since 2016.

So far, the firm has succeeded in withstanding the storm. Credit card delinquency rates were 1.55% in April compared with 1.6% in March. Net charge-offs rose to 2.81% from 2.78%, with the three-month average at 2.71%.

The bank recently pledged $1 billion to tackle racial and economic inequality following nation-wide protests at the killing of African-American George Floyd by a Minneapolis police officer. Bank of America said the money will be deployed over the next four years and will include programs such as virus testing and other health services.

Bank of America pays an annual dividend of $0.72, which yields nearly 3%. Its next dividend will be paid out on June 26.

Annaly Capital

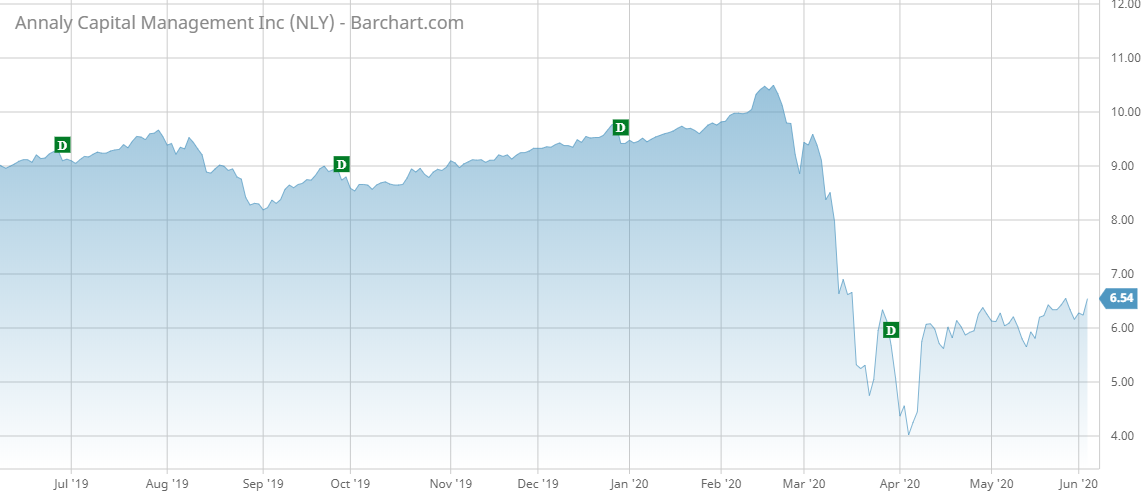

Annaly Capital Management (NLY) trended fourth this week with a rise in viewership of 10%. Annaly has been hit by lower mortgage rates following the Federal Reserve’s decrease in interest rates. Meanwhile, high unemployment rates have triggered fears that many homeowners will be unable to pay their mortgages. Shares in Annaly have declined 33% since the start of the year.

Annaly pays an annual dividend of $1 per share, equivalent to a yield of nearly 16%. Although the firm confirmed its quarterly dividend recently, it still remains at risk if the banking system deteriorates further. For now, the firm’s mortgage backed securities are delivering steady yields as they are backed by the U.S. government.

The Bottom Line

Oil storage provider Frontline increased its dividend due to an upsurge in revenues stemming from high demand for storage, even as most companies have cut payouts to shareholders to preserve cash. Brookfield Property has seen its retail portfolio hit by weak rent collections, offset by normal collections in offices and residential locations. Bank of America stock has shed a third of its value on expectations that it will face delinquencies. Finally, Annaly Capital maintained its dividend despite a high unemployment rate and extremely low interest rates.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.