Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Drugmaker Merck and natural gas and crude oil pipeline-maker Enterprise Products have seen their viewership rise by the same percentage amount these past two weeks. These companies were followed by Starbucks and Alphabet, both making headlines after reporting earnings.

Don’t forget to read our previous edition of trends here.

Merck

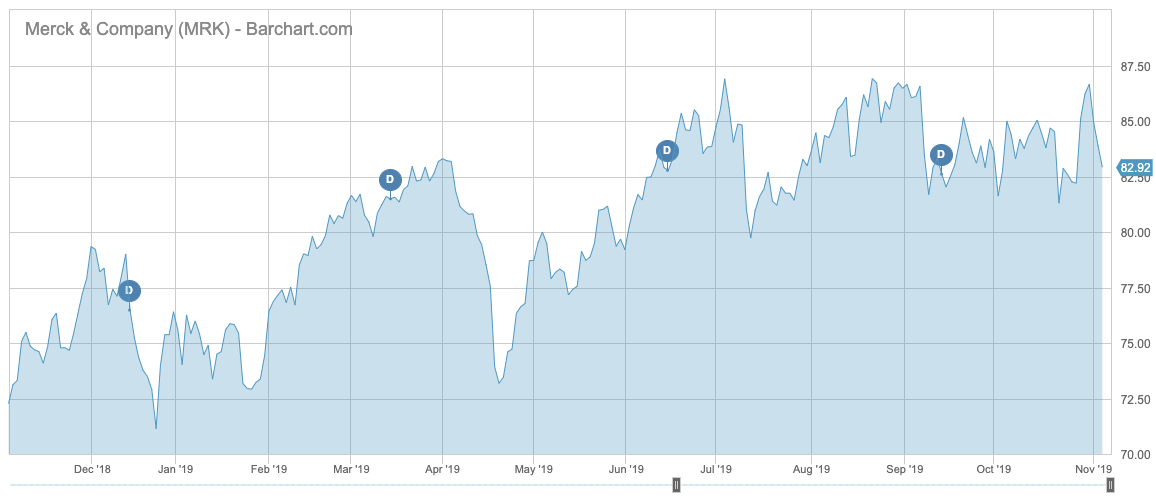

Drugmaker Merck (MRK) has seen it viewership increase by 40% this week, on par with Enterprise Products Partners. Merck reported its third-quarter results on Tuesday, revealing that its hit drug Keytruda, a lung cancer therapy, booked sales of more than $3 billion, up more than 62% year-over-year. Merck’s total sales for the quarter came in at $12.4 billion, up 15% compared to the same period last year.

The company’s stock has risen 8.5% this year, underperforming the S&P 500 by more than 12 percentage points, but its performance is roughly in line with First Trust Nasdaq Pharmaceuticals ETF (FTXH). The healthcare sector has been under pressure recently as political scrutiny over drug price hikes has intensified.

Whether Merck will be able to maintain its growth and stock valuation in the upcoming quarters is up for debate, particularly since the company is already richly valued compared to its peers. In addition, drugmakers’ valuations tend to decline as they rely on only one drug to drive growth. Keytruda’s patents will not expire until 2028, although the firm already faces competition from the likes of AstraZeneca (AZN) and Bristol-Myers Squibb (BMY).

Yet Merck has also seen strong growth in its human papillomavirus vaccine Gardasil, which saw sales edge up by 26% to $1.3 billion – largely thanks to high growth levels in China. In addition, the company can use its free cash to make acquisitions and diversify its growth drivers.

Merck pays a dividend yield of 2.54% and its payout ratio stands at 43%. The company has been growing its dividend for the past seven years.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Enterprise Products Partners

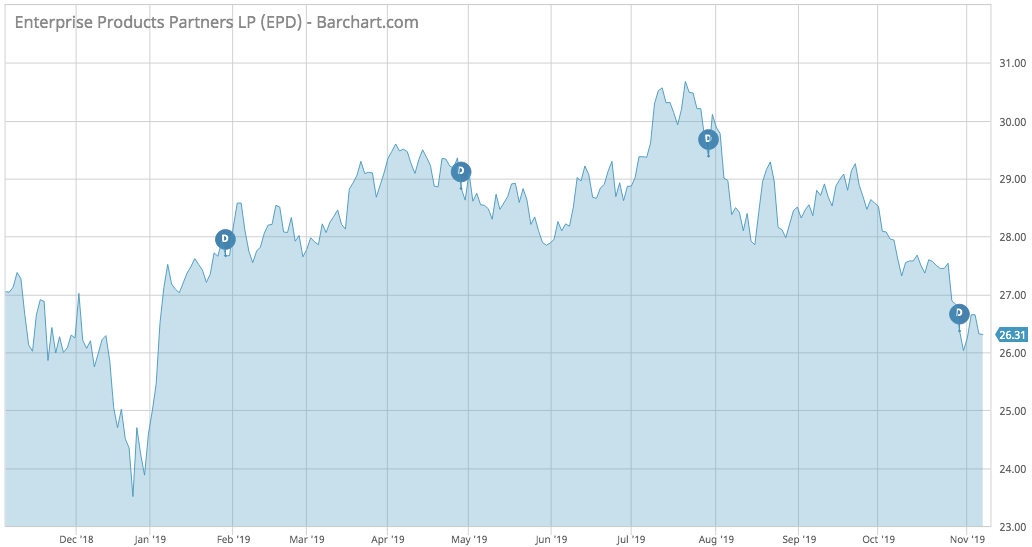

Enterprise Products Partners (EPD) has seen its viewership advance 40%, as the company reported a weak earnings report for the third-quarter due to falling commodity prices. Profit fell by 20% during the quarter to $1 billion, while revenues tumbled by 17% to just under $8 billion. The company’s CEO, Jim Teague, dismissed concerns over falling revenues and earnings, noting that the company can ramp up its transportation capacity from 1.3 billion barrels to 1.8 billion barrels per day at no additional cost.

The company appears to be so optimistic about the industry that it confirmed plans to build additional pipelines that are expected to deliver another one billion barrels per day. The new routes are expected to be ready by the third-quarter of 2020. It remains unclear how much the new pipelines will cost, but the company said it will spend between $3 and $4 billion on new projects.

Enterprise Products boasts a strong annual dividend yield of 6.6% and its payout ratio is more than 80%. The company has been hiking its dividend for the past 20 years. Shares in the company have jumped by more than 8% since the start of the year.

Check out our latest Best Dividend Stocks List here.

Starbucks

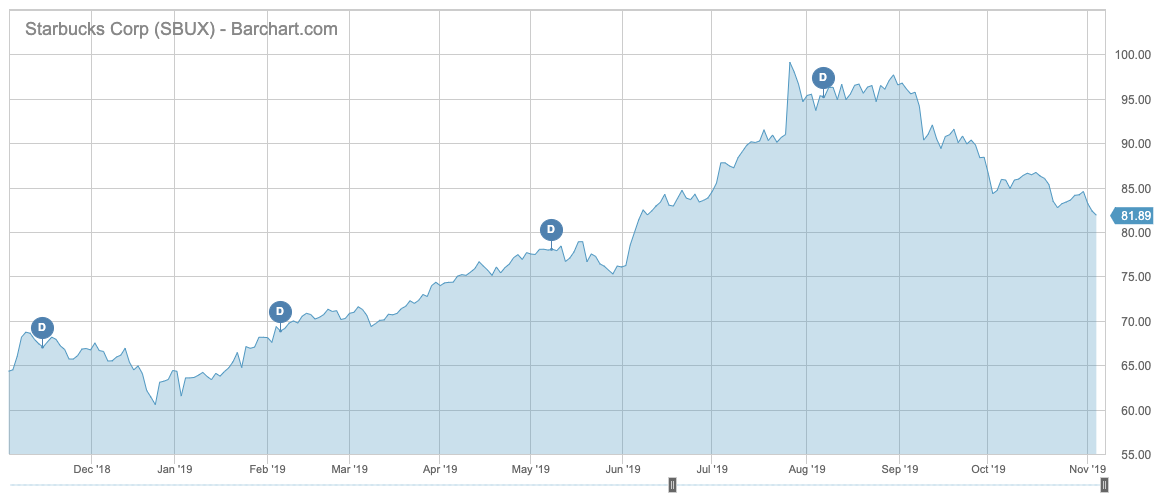

Starbucks (SBUX) has taken third place in the list with a 27% rise in viewership.

The coffee chain has seen its sales for the fiscal fourth-quarter lifted by iced coffee and other cold drinks. Worldwide, comparable-store sales advanced 5% during the quarter, beating analyst expectations of 4%. In the U.S. division, comparable sales increased by 6%, largely due to strong revenues from its newly launched cold coffee and pumpkin-flavored cold beverage.

Cold coffee is increasingly popular with the younger generation, with many viewing it as a healthier alternative to soda. However, Starbucks faces stiff competition in the sector, with McDonald’s (MCD) already selling cold coffee and Wendy’s (WEN) expected to launch a line of cold beverages next year. Starbucks is also seeing increasing competition in China, its second-largest market after the U.S., with local chain Luckin Coffee expanding rapidly.

Starbucks, which has a dividend yield of 2% and a payout ratio of 58%, is also expanding in the delivery sector, after reaching a deal with Uber’s UberEats division earlier this year. However, the company said delivery is more expensive to provide and this segment is eating into the company’s margins.

Shares in Starbucks have risen 27% since the beginning of the year.

Alphabet

Google parent Alphabet (GOOG) has seen its traffic rise by 21% over the past two weeks, as the company has been in the news with its acquisition of Fitbit. Alphabet acquired the smartwatch-maker for $2.1 billion in cash, effectively starting a competition with Apple on the smartwatch front. Alphabet is already competing with Apple in the smartphone category with its high-end Pixel phones.

Yet the company’s key driver of revenues and earnings still remains its search engine Google. For the third-quarter, the company reported revenues of $40.5 billion and earnings of $7.1 billion, or $10.12 per share. Analysts had expected earnings of $12.42 per share.

Google’s traffic acquisition costs, which are the fees the company pays to device manufacturers to have its search engine as the default browser, came in slightly ahead of expectations at $7.49 million. The company said it will focus its efforts on cloud computing, an area in which it lags behind Microsoft (MSFT) and Amazon (AMZN).

Alphabet stock has increased by 25% this year.

The Bottom Line

Merck sales have been boosted by cancer drug Keytruda, but the company would have to sweat through upcoming quarters to maintain its rich valuation. Enterprise Products Partners reported falling sales and revenues, but the company is still moving ahead with the building of new pipelines. Starbucks has seen its sales invigorated by cold coffee sales, while Alphabet signaled it will focus on cloud computing and wearable devices.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.