Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

CVS Health is first in the trends list this week as the pharmacy benefit manager hit the headlines with its underwhelming financial results. Target, meanwhile, is on a tear as the retailer reported strong earnings. Annaly Capital Management made the headlines with its unusually high dividend, while cigarette-maker Philip Morris International is facing a probe in India.

Check out our previous edition of trends here.

CVS’ Poor Results Signal Challenges Ahead

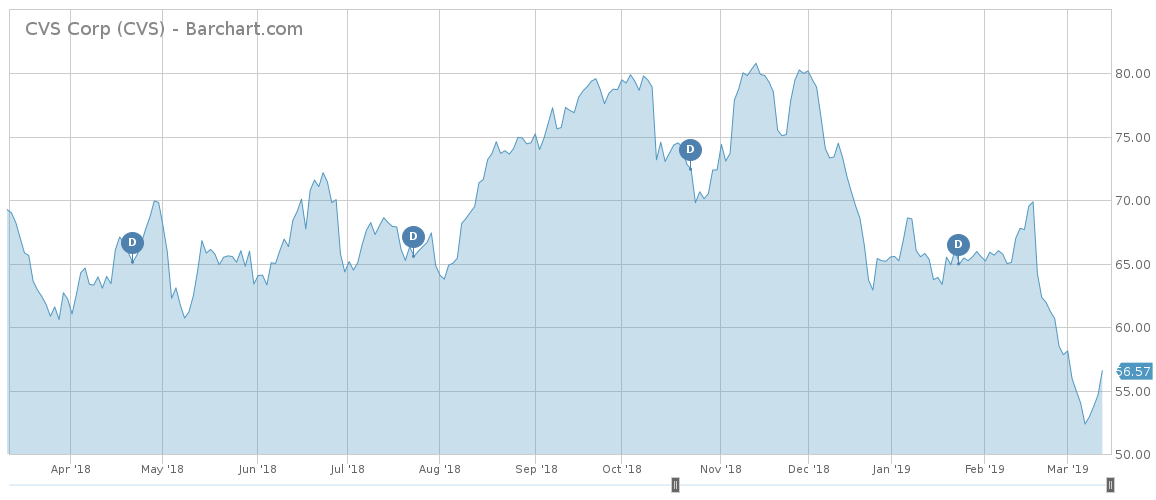

CVS Health (CVS ) has reported a disappointing forecast for 2019 earnings, as the transformative acquisition of Aetna will take more time than expected to bear fruit. As such, CVS has seen its viewership surge as much as 29%. CEO Larry Merlo said 2019 will be a year of “transition” as the integration of Aetna takes place. Shares in the company have declined 16% over the past month as investors assessed the impact of the company’s guidance.

For the full year 2019, the company said it will earn between $6.68 to $6.88 per share, well below the $7.41 per share expected by analysts. Revenues are expected to come in at between $249.86 billion and $254.29 billion versus the $247 billion forecast by pundits. The company expects to spend up to $350 million in incremental investments in 2019 and will incur $550 million in integration costs.

CVS’ acquisition of Aetna is believed to be a defensive move as the environment is deteriorating with the Trump Administration seeking to clamp down on price increases of generic drugs. The new regulation will take effect from 2020, but the negative effects on CVS’ results are already visible. A high debt load as a result of the acquisition is also weighing on the company’s prospects, although the combination of a pharmacy retailer and an insurer promises increased profitability as well as lower costs for customers.

CVS pays an annual dividend of 3.52% and has a payout ratio of 28.4%.

You can use the Dividend Screener tool to explore dividend-paying securities that fit your investment criteria.

Target Posts Strong Results as Risky Strategy Pays Off

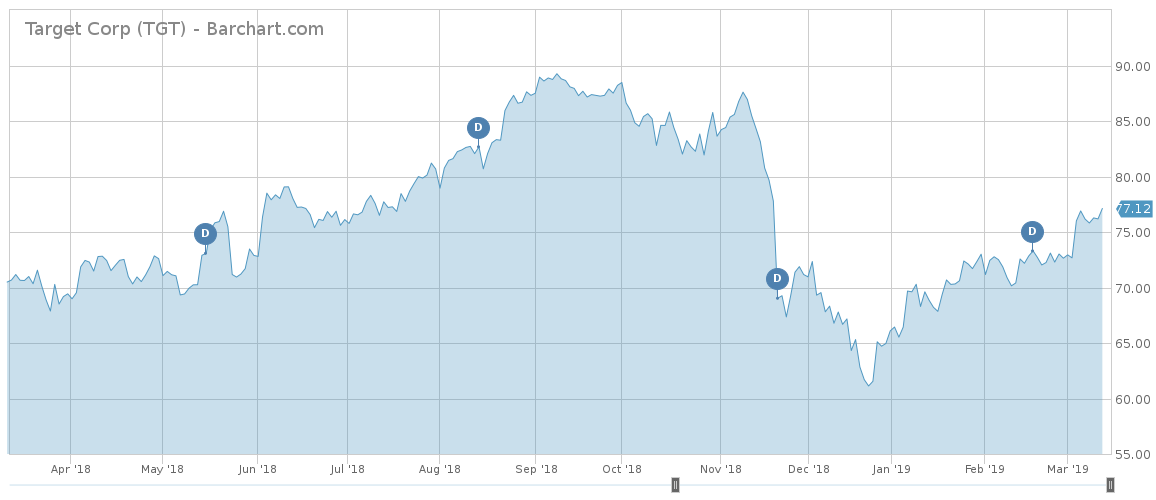

Target (TGT ) has taken the second place this week with an 18% rise in viewership as the brick-and-mortar retailer reported its strongest annual sales since 2005. Sales increased by 5.3% in the past year, while traffic was up 4.5%.

The retailer’s results come as other industry participants, including Payless, Gymboree and Victoria’s Secret, are closing stores at a fast pace. However, generalist retailers such as Walmart (WMT ) and Target have managed to withstand the challenges.

Target’s results are a sign that CEO Brian Cornell’s strategy is bearing fruit. Last year, Cornell announced a project to overhaul Target by remodeling stores, revamping supply chains, and opening smaller stores in suburban locations. Over the holidays, Target benefited from strong demand and hired 100,000 in temporary staff to cater to the increased needs of shoppers.

Target pays an annual dividend of 3.35% and returns nearly half of its earnings to shareholders. The company’s stock is up nearly 9% for the rolling month and nearly 18% for the year.

Check out our complete list of Best Dividend Stocks.

Annaly Capital

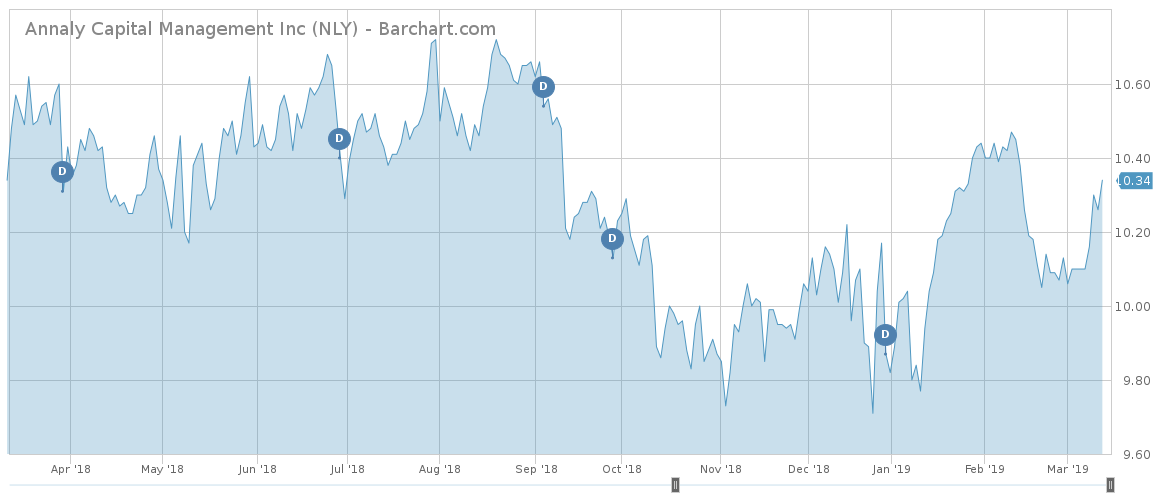

Annaly Capital Management (NLY ) is mostly known for its high dividend than stock performance. The firm’s shares have declined around 6% for the past two years and were largely flat over the past 12 months.

However, the company’s dividend compensated for the sluggish stock performance with an annual yield of 11.7%. Annaly, a diversified real estate manager that invests and finances residential and commercial real estate assets, pays out all earnings to shareholders as expected from a REIT. Its dividend also compares well with the financial average of 3.17% and is the fifth biggest in a universe of companies tracked by Dividend.com.

Orchid Island Capital (ORC ), American Capital Agency (AGNC ), Dynex Capital (DX ) and Western Asset Mortgage Capital (WMC ) are the four other REITs that currently have dividend yields higher than that of Annaly. Orchid Island, for instance, has an annual dividend of nearly 14.30%.

The company makes money by borrowing at short-term interest rates and investing in long-term mortgage-backed securities. As a result, it is exposed to a flattening of the yield curve.

Philip Morris International

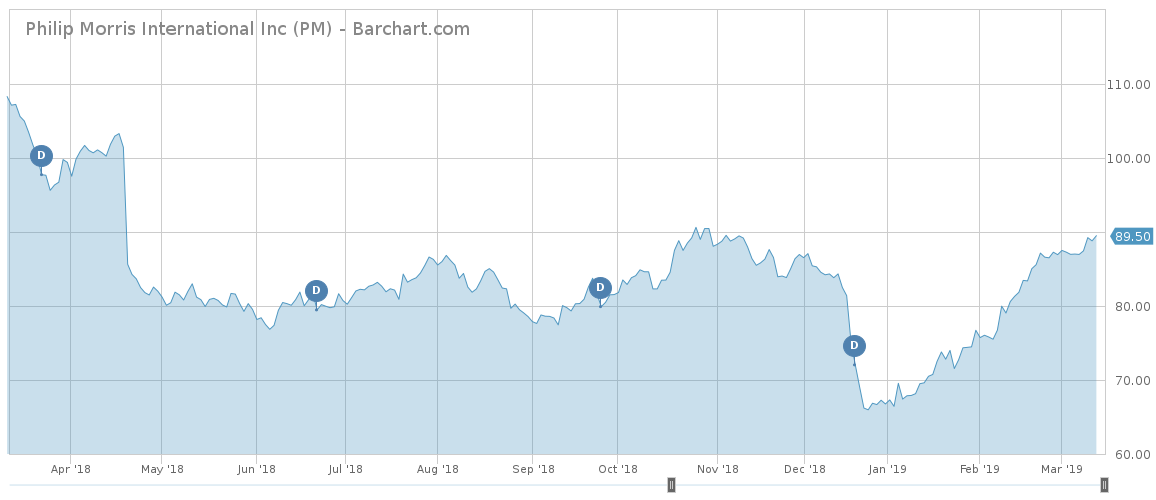

Cigarette-maker Philip Morris International (PM ) has taken the fourth spot in the trends list with a timid advance in viewership of 3%. The cigarette-maker has been in the news after a report by Reuters has demonstrated the company circumvented a 9-year ban on cigarette manufacturing in India by continuing to pay its partner in the country to manufacture Marlboro cigarettes.

The company is now facing an investigation from India’s financial crime-fighting agency Enforcement Directorate, according to a Reuters report.

The revelations have failed to slow the stock’s advance. Philip Morris shares have risen more than 2% for the past five days, extending year-to-date gains to as much as 32%. In part, shares benefited from the resignation of Food and Drug Administration Commissioner Scott Gottlieb, who had a very strong stance on reducing smoking among youth.

Philip Morris pays an annual dividend yield of 5.10% on a payout ratio of 91.2%.

The Bottom Line

CVS’ first earnings results since the transformational merger with Aetna disappointed investors, although the deal could still prove its worth over the long-term. Target reported blockbuster results as its CEO’s bold strategy of revamping hundreds of stores is paying off. Annaly Capital has a high dividend yield but its business is exposed to an abrupt rise in short-term interest rates. Philip Morris is facing an investigation in India over violations of the country’s laws, although investors dismissed the news.

Be sure to visit our News section to catch the latest on dividend investing.