Intel Corp. (INTC ), which runs global computing, is the world’s leading hardware company.

Recent years have been challenging for the company as corporate results failed to excite investors and the company had to reduce its headcount significantly. This article will explore if Intel can still make your portfolio future tech proof.

Threat from Competition

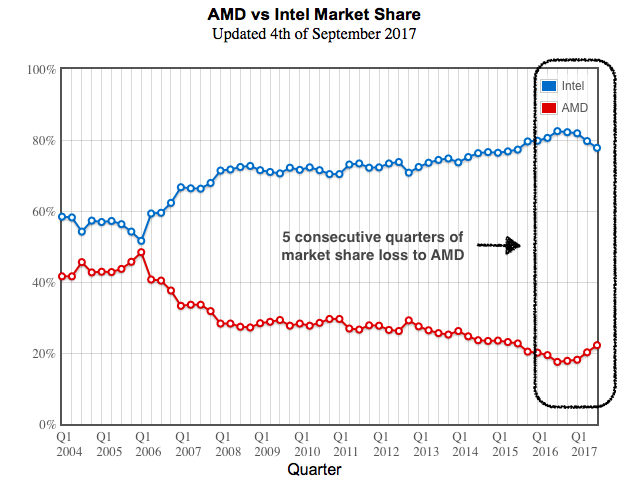

Intel has had issues with maintaining its lead in market share. For the first time in more than a decade, the company has lost market share to AMD for five consecutive quarters.

Disclaimer: The graph below is based on benchmark and not actual sales numbers, but it is still a reliable indicator.

The rise in market share, among other things, can be attributed to AMD’s new Ryzen processors, which have been hugely popular with PC gamers who are on a budget. They occupy a few top spots on Amazon’s best-selling CPU list and the reception has even surprised the company as they have struggled to keep up with the motherboard shipments. John Taylor, corporate vice-president, worldwide marketing at AMD, acknowledged the shortfall earlier this year.

This shouldn’t come as a surprise since AMD is familiar with execution failures, which have cost them dearly in the past (losing 50% of its market share in the last decade). Bank of America (BAC ) also acknowledged Intel’s growing challenge in dealing with competition from AMD and Nvidia (NVDA ).

Will Intel Maintain Its Leadership Position?

Recent quarter results from Intel show that the company was able to increase its operating and net income, and as a result, the diluted earnings went from 27 cents to 58 cents compared to the previous year. The company has also raised its guidance for 2017 from $60 billion to $61.3 billion. This is in large part due to restructuring costs winding down. The company’s restructuring costs accounted to a total of $1.9 billion in 2016, which is 3.2% of net revenue (the number was around 0.5% of net revenue in the previous years). The restructuring has led to a global head count reduction of up to 12,000 jobs (or 11% of its workforce) by 2017 and is estimated to save the company $1.4 billion.

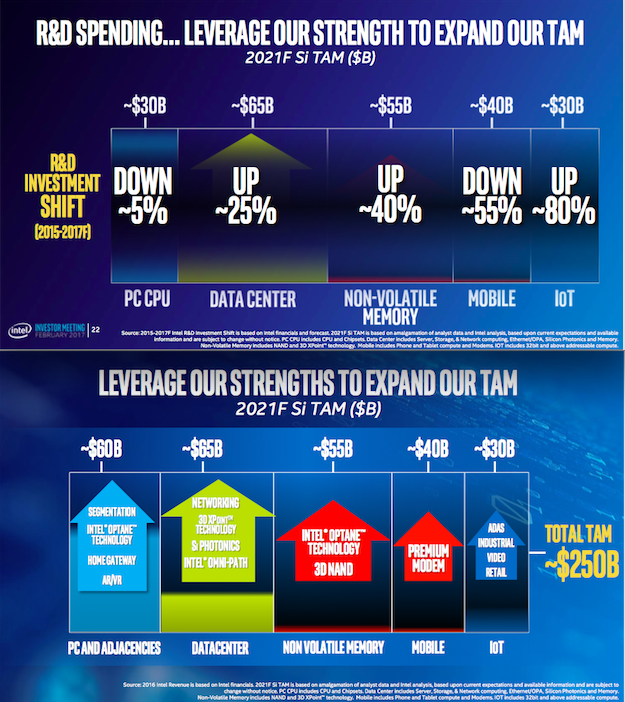

Another drag on 2016’s EPS was the acquisition of Alterra (aimed at growing its position in Internet of Things (IoT)), which was accounted for in the 2016 results. The results are interesting for investors because of the success of its largest segment: client computing, which contributes 55% of revenue and 79% of operating income. The company attributed the outcome to the increase in volume and average sales price of notebooks. The company also delivered positive results in its data-center segment, which is highly profitable and is seen as a source of long-term profitability. As indicated by the screenshots from investor presentations, the company expects the maximum addition to TAM (total addressable market) from the data-center segment. Intel has realigned its R&D spending toward areas where it expects future growth to occur i.e., data center, non-volatile memory, and IoT.

Intel’s recent acquisition of Movidius (a neural computer stick used to train AI devices) and use of its field programmable gate arrays (FPGAs) in advanced driver assistance systems (ADAS) are designed to counter Nvidia’s lead in AI. The recent acquisition of Mobileye is likely to bolster its position in ADAS and autonomous driving even further.

To counter AMD’s recent success in multi-threaded applications with Ryzen pre-processors, Intel has refreshed its U-series lineup, making it 40% faster than the previous Kaby Lake series. One thing often missed in analyst discussions is the fact that Intel’s R&D budget ($12 billion, or around 35% of its net revenues) is much larger than its competitors like Micron (MU ), AMD and Nvidia. In fact, it is the industry’s highest R&D spender, beating even the likes of Qualcomm (QCOM ), Broadcom, Samsung and Toshiba. This gives the company a definitive advantage that others can’t match.

Click here to learn why there might not be much to fear for Intel Corp., despite declining PC sales.

Intel as an Investment

Intel stock has barely moved significantly in the previous three years since Sept. 2014. Micron has had a similar story, but AMD (>200%) and Texas instruments (TXN ) (>70%) have done better than Nasdaq (40%) and Dow Jones (29%) in the same period. Its current P/E of 13.45 stands cheaper than most of its peers and pays better dividends.

Micron and AMD are not known for paying dividends, and Texas Instruments has a current yield of 2.4% compared to Intel’s 3.05%. While Intel doesn’t grow its dividends every year, it has been paying dividends from the early 90s. With a low payout ratio of 36% and a robust free cash flow of $12 billion (2016), investors can feel safe about receiving better-than-industry dividends in the near future.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold.

The Bottom Line

Intel has made some structural changes to its business, which dragged its earnings and market share in the last few years. However, the company is poised for a turnaround in its corporate results, and recent quarter results are an indicator of that. Investors are advised to keep an eye on the competition from AMD in its CCG segment and Nvidia with its growing IoT segment.

Check out what the investors are currently most interested in by visiting our Most Watched Stocks Page. Start your free trial to Dividend.com Premium account here.