Just two years back, everything seemed to be going wrong for the biggest retailer in the world.

The stock was tanking, employees were protesting and Buffett decided to sell his holdings. Today, the stock is back up, employees are back to work and they have regained momentum in e-commerce sales. Is Warren Buffett wrong about Walmart (WMT )?

Read on to find out more.

A Directional Shift

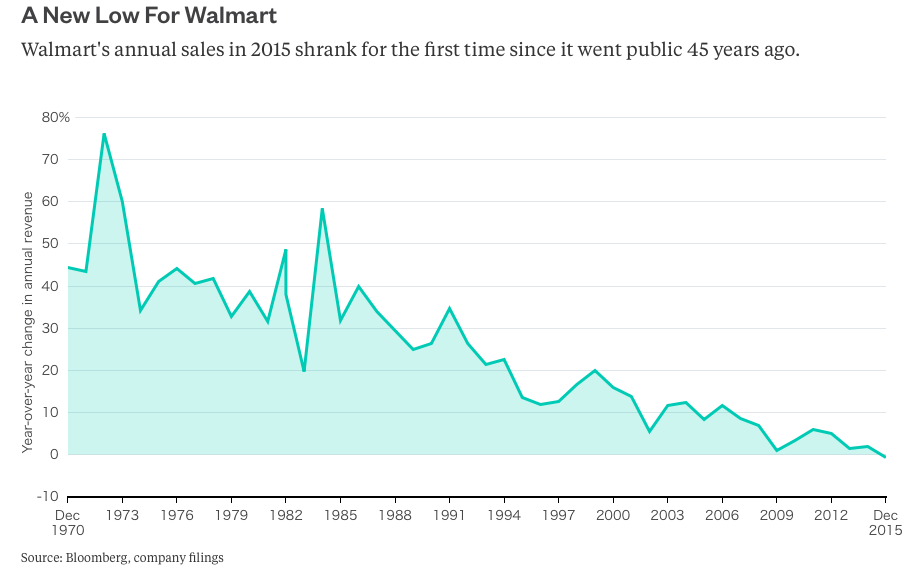

2015 & 2016 have been a time of massive changes for Walmart. The company did what it has never been known for before: it lifted its employee morale. They did that by raising its minimum wage (costing $2.7 billion), investing in training and refreshing its benefits program. And, it seems to be working. This is remarkable considering the 2015 performance when Walmart drew a lower revenue compared to the year before (a record-breaking first since the company went public 45 years ago). While it may be a “record,” it shouldn’t come as a surprise to anyone watching their corporate results. I couldn’t help but use a pleasant-looking graphic from Bloomberg that is in direct contrast to the story of distress it is telling. It is not possible to miss the fact that the yearly change in revenue has been declining from the early 80s.

But all that is old news. Doug McMillon spoke to more than 1 million Walmart employees in early 2015 and admitted “sometimes we don’t get it all right,” before announcing a massive shift in corporate mindset towards its employees. The company has also announced a plan to open 200 training centers for its managers and supervisors. A direct impact can be seen in its performance, as by early 2016 almost 75% of the stores seemed to be hitting their targeted customer service goals.

Is Walmart recession proof? Click here to learn more.

But What About Amazon?

Before we get into the details, it is important to note that it is not a 1:1 comparison (yet). Amazon (AMZN) is a technology company that happens to be in retail. Walmart is a retail company that happens to utilize technology. That is not to say that their future will not be intertwined. However, they will compete on more fronts as Amazon builds its traditional brick-and-mortar fulfillment infrastructure and Walmart develops its online commerce assets. That is why comparisons need to be made in the right context.

Walmart has stores within 10 miles of 90% of American shoppers, and it is hard to imagine Amazon opening 1000s of stores in suburban or rural America. It is even harder to imagine Walmart attracting the best silicon valley technology talent to compete with Amazon’s might in cloud, big data, machine learning and hardware/software automation. On a typical Amazon order, employees spend about a minute to take the item off the shelf, boxing it and shipping it off to you (robots do the rest). You probably spend more time trying to find scissors and opening the box. If that doesn’t underline how different the two companies are, read on further.

At the end of 2015, Amazon had 30,000 robots and 230,000 humans in its workforce. By the end of 2016, the number of robots had risen to 45,000, and they announced earlier in January of this year plans to add 100,000 ‘humans’ to its U.S. workforce by mid-2018. While Walmart has been maneuvering workforce rollbacks, Amazon is one of the top recruiters in the world (robots and humans).

So is the comparison invalid? Not really.

Walmart announced the $3.3 billion acquisition of jet.com in August last year and Amazon announced the $13.7 billion purchase of Whole Foods. This shows that both companies are gradually starting to walk into each other’s space. Amazon has hinted at price corrections at Whole Food, and if Amazon continues on this path, it will be in direct strategy face-off with Walmart. Vendors have reason to worry if both companies start on a price war. Walmart has expressed its intention to directly compete with Amazon by acquiring online assets Shoebuy ($70 million), ModCloth ($45 million) and MooseJaw ($51 million) in quick succession. In Q1 2017, the company announced a 63% increase in its e-commerce sales and the interesting part is that most of the growth came from organic sales via walmart.com. Walmart is now the third-largest online retailer in the U.S., while Amazon remains the third-largest overall retailer. The comparisons fade away a little if one were to compare the revenues, but Walmart vs. Amazon is definitely starting to shape up. However, there is a long way to go before we see any winners. Also, given how different the core competencies are, there may not be a winner-takes-all scenario. They may end up grabbing market share from other companies and coexist as world-dominating retailers.

A quick distraction and to spice things up, it is interesting to see that Walmart has placed Marc Lore in charge of the company’s domestic e-commerce operations. Seven years back, Walmart lost out to Amazon in acquiring Lore’s first e-commerce venture called Quidsi Inc. The acquisition didn’t work as planned as Lore and Bezos ended up feuding. The drama reached its peak recently as Amazon shut down Quidsi and Lore now finds himself sitting on the other side of the table competing with Bezos.

Can Walmart be the next Amazon in Online Retail? Click here to learn more.

Walmart as an Investment

Walmart is a dividend aristocrat and part of an elite club of companies that have been raising dividends for more than 40 years. It currently holds a healthy yield of more than 2.5% and sits on a comfortable payout ratio of under 50%. Free cash flows have also grown almost 65% from $12.6 billion in 2012 to $20.9 billion in 2016. There aren’t many foreseeable issues as far as future dividends are concerned. Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold.

Wall Street didn’t buy into Walmart’s strategy of spending $2.7 billion on its employees at a time when sales had just taken a beating. The stock took a plunge and lost 35% of its value in 2015. The Bentonville company was quick to announce a two-year $20 billion share buyback program towards the end of 2015. That too was widely dismissed in the mainstream financial media and we saw a much publicized sellout from Warren Buffett’s Berkshire during the last quarter of 2016. It turns out, there was fire behind the smoke and analysts were proven wrong. The stock is now getting close to its all-time high. The P/E ratio is still lower than Costco (COST ) but higher than that of Target (TGT ).

The Bottom Line

Walmart has hit the right note by addressing customer service and employee motivation issues (which affects its core retail business). Its online commerce growth seemed to be wavering last year, but it has come back strongly as shown in recent quarter results. It remains to be seen if Mark Lore can create a culture of continuous technology innovation that will drive the company closer to being future proof. Investors can continue to take comfort from consistent dividend payouts that the firm is known for.

You can find an updated list of companies that recently announced changes in their payout policies, along with their ex-dividend dates, in our Dividend Payout Changes and Announcements tool. Check out our Best Dividend Stocks page by going Premium for free.

The views expressed in the article are my own and do not represent the views of my clients. Follow me on Twitter @tanmoyroy for more frequent updates.