As far as retailers go, Wal-Mart Stores (WMT ) is pretty much in a league of its own. With thousands of stores across the globe, a monster logistics base and billions of dollars in sales, it really is the king of the retail shopping crown.

Except when it comes to online shopping.

Like many of its brick-and-mortar peers, WMT continues to get smoked when it comes to e-commerce and online shopping. That’s a huge hurdle to retail dominance. It simply can’t have upstarts taking away its sales or market share.

So what is Wal-Mart doing about it? Tackling the problem head-on through buys and investment in e-commerce. In the end, WMT has the goods and the scale to be the next Amazon.com (AMZN). And now, it’s building out the tools.

A Flop In Sales

One of the reasons investors are drawn to Wal-Mart is that its huge store and customer base pay big benefits. There’s a steady stream of sales coming from in its 5,230 Walmart stores throughout the United States. Its super-center model also helps, as it offers both discretionary and essential items. And then also take into account its vast worldwide reach of local specialty stores and Wal-Mart branded locations.

But even mighty Wal-Mart is not immune to various threats. It seems that the whir of modems and consumers filling their digital shopping baskets are having an effect on Wally World’s sales.

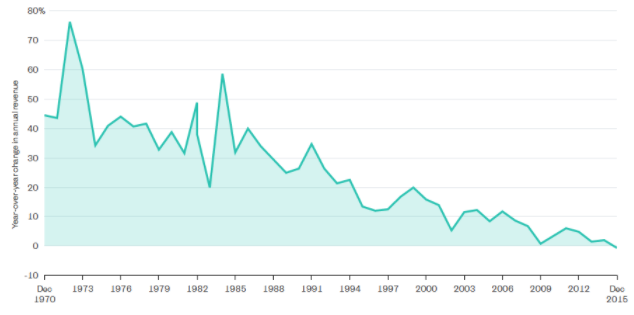

Back in January of this year, Wal-Mart did something it hasn’t done in 45 years as a public company. It saw its overall sales shrink. The retailing giant reported that for all of 2015 sales declined by 0.70% to $482 billion. While that may not seem that significant, it is part of a larger trend downwards. The wonderful chart from Bloomberg’s GadFly below illustrates that point trend beautifully.

Find out how Trump’s victory is going to affect Wal-Mart here.

That drop in sales growth is pretty telling, but what’s really scary is Wal-Mart’s drop in market share in the United States. According to retail-focused research firm Conlumino, WMT has seen its percentage of all retail sales in the U.S. drop from nearly 10% down to just 9.2% in less than five years. The problem continues to get worse, as recently WMT missed expectations for sales growth in the latest quarter.

The reason is simply that more non-core shoppers have fled to online rivals.

Wal-Mart will always have its core cadre of shoppers. However, increasingly, those shoppers who look for deals at the retailer have fled to Amazon, Target (TGT ) or other low-cost websites. And while the threat of online shopping has been widely publicized and reported by other retailers, Wal-Mart has been thought to have been immune to the threat – thanks to its size and asset base.

But it’s clearly becoming an issue and that’s a huge problem for Wal-Mart’s dominance as the world’s biggest retailer. Continued slippages will eventually result in continued valuations for the firm. The reported decline in sales was enough to drop the stock by its biggest intraday decline ever.

Stay up to date with dividend yields, ex-dividend dates and payout for all discount variety stores on our Sector page.

Building Out Its E-commerce Ventures

Luckily, Wal-Mart has recognized the problem and has seriously begun tackling the issue in recent quarters, which has included billions of dollars’ worth of investment on its website.

WMT has unveiled a bigger assortment of products online, beefed up its online grocery ordering system to better compete with Kroger’s (KR ) ClickList service and even unveiled a new Amazon Prime-styled subscription service. These upgrades, plus new tech initiatives such as its Walmart Pay mobile app, are designed to blend the brick-and-mortar and e-commerce experience for consumers.

In addition to its own internal efforts, Wal-Mart has gone on a shopping spree of its own. First, it snagged Jet.com for a cool $3.3 billion. Jet is famous for using an algorithm that encourages bulk buying and reduces prices based on shipping location and quality. More importantly, it’s headed by Marc Lore, who has sold several businesses to Amazon over the years. Lore has been given the task of rebuilding WMT’s online businesses to better compete with rivals.

Wal-Mart has also looked overseas for e-commerce growth. This includes taking a stake in Chinese online retailer JD.com (JD ) and being in talks to buy India’s Flipkart. India’s e-commerce market is growing by leaps and bounds at a rate of 51% annually. By the time 2020 arrives, it’ll be a $120 billion market. Buying Flipkart would give WMT inroads into that growth.

These efforts seem to be working. Wal-Mart’s e-commerce growth jumped by 11.8% last quarter.

Find out why e-commerce companies don’t pay dividends.

Future Growth to Drive Dividends

Now, Wal-Mart is not going away anytime soon. It’s just too big of a force in retail. But the rising e-commerce threat does raise concern for its future earnings and dividend growth. Right now its payout ratio is a low 46%, but payout ratios are relative to earnings. Slipping earnings and sales aren’t exactly doing it any favors. If it doesn’t execute on its e-commerce initiatives, the pace of dividend increases could start to slip.

Luckily, it seems Wal-Mart has found the recipe for rising online growth. Upgrades here in the U.S. as well as buyouts in key international markets, such as China and India, should help to keep the Amazon threat at bay.

For investors, that means Wal-Mart’s status as a Dividend Aristocrat is pretty safe. In the end, WMT is taking online shopping head on – and it should win.

Wal-Mart is a Dividend Aristocrat. With our 25-year Dividend Increasing page, you can stay updated with the latest stocks that get added to the list and the stocks that get removed. You can even download the list in a spreadsheet. You can find out our DARS rating on these Dividend Aristocrats by going Premium.