Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

While 2016 may be winding down, the financial markets are still heating up. News from the energy markets made headlines this week after Russia and other major oil-producing nations agreed to join OPEC in cutting crude production.

Just three days later, Exxon CEO Rex Tillerson was named the next U.S. Secretary of State. Meanwhile, bank stocks continued to offer plenty of upside in the wake of Donald Trump’s election victory last month. These combined forces helped the S&P 500 soar to new records.

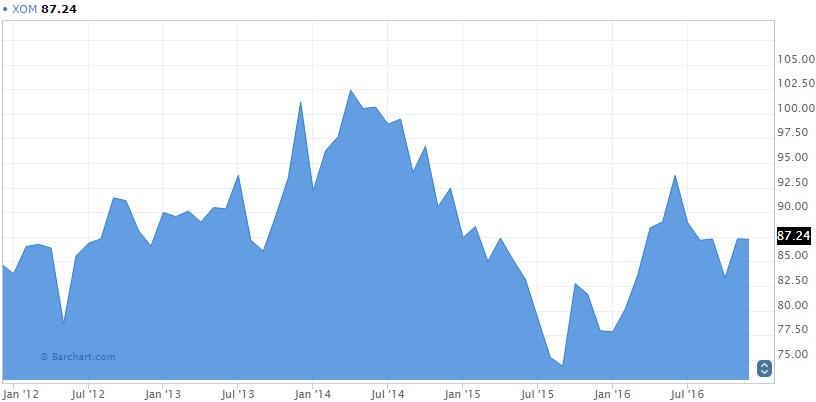

Exxon Mobil Nears Five-Month High

Exxon Mobil Corporation (XOM ) takes the number one spot on our list with a 57% spike in viewership after President-elect Donald Trump named the company’s CEO Rex Tillerson Secretary of State. Trump’s transition team described Tillerson as an “international deal-maker” with the world’s biggest energy company. His strong ties with Russia also boosted optimism that the two countries can cooperate around key geopolitical issues.

The multinational energy company and Dow blue-chip was already on the uptrend after Russia and other major energy producers joined the Organization of the Petroleum Exporting Countries (OPEC) in a global pact to reduce crude output. On December 10, a total of 12 countries agreed to cut crude output by 558,000 barrels per day, joining the OPEC cartel in efforts to stem the multi-year oil price collapse. The agreement sent crude oil futures to 18-month highs, as investors cheered tangible efforts to rebalance the market.

Last month, OPEC reached an accord to curb crude output by 1.2 million barrels per day beginning in January. A sustained rally in crude prices is expected to help Exxon and other energy producers recoup massive losses incurred over the past two years. Exxon’s share price rose to nearly five-month highs this week, surpassing $93.00. It has a dividend yield of 3.30%.

To find out Exxon’s next ex-dividend date, check out our Ex-Dividend tool.

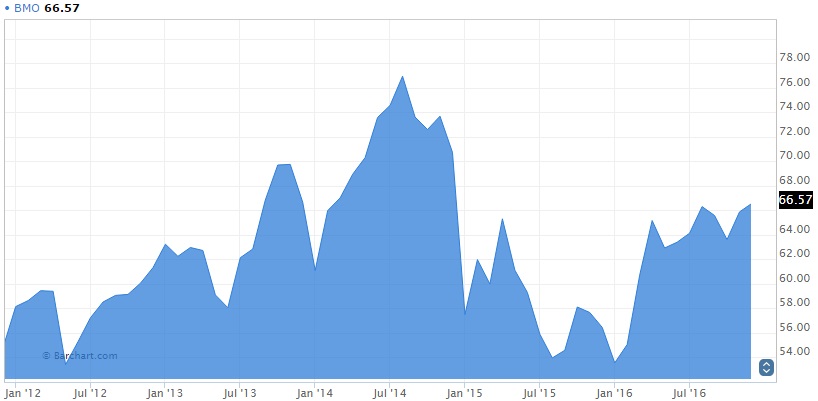

Bank of Montreal Offers Strong Dividend Value

Bank of Montreal (BMO ) comes in at a close second this week, with traffic climbing by an average of 52%. The Canadian bank achieved important milestones this month, positioning itself as a strong dividend player for years to come. Last week, BMO reported quarterly earnings of $2.02 per share, or $2.10, when adjusted to exclude certain items. That squashed analysts’ median estimate of $1.85. Its primary strength came from its capital markets division, which grew 64%.

The impressive gains allowed BMO to raise its quarterly dividend, which is already well above the financial average. In terms of overall assets, BMO is Canada’s fourth-largest bank and among North America’s top ten. To review BMO’s dividend yield and stock price history, click here.

The company has also benefited from the general uptrend in financials since the election of Donald Trump on November 8. Trump’s pro-growth policies are expected to boost the U.S. economy, which so happens to be Canada’s largest trading partner. Renewed strength in the U.S. dollar could also make Canadian tourism, shopping and even real estate more attractive to American visitors.

Vanguard S&P 500 ETF Reaches New Pinnacle

It has been another record-setting week for the S&P 500 Index, and by extension, the Vanguard S&P 500 ETF (VOO). VOO takes the No. 3 spot on our weekly list with a 51% rise in viewership. The ETF reached a fresh record high on December 13, as investors continued to rally behind the promise of stronger economic growth under a new Trump administration. VOO closely tracks the underlying S&P 500, which is the primary gauge of the U.S. equities market.

Stocks appear poised to continue higher for the rest of the year on strong seasonality and historically low volatility. The rally has extended across all of the S&P 500’s main sectors, with financials, energy and telecommunications among the strongest performers.

To review individual stocks within the S&P 500, check out our Dividend Stock Screener, where you can sort companies by industry, market capitalization and category.

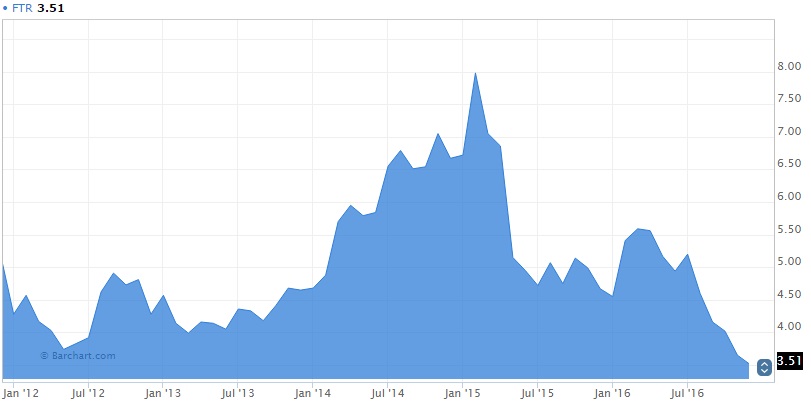

Frontier Communications Continues to Draw Negative Headlines

Frontier Communications Corporation (FTR ) is tied for third on our exposure list, with a 51% rise in weekly viewership. The Stamford-based telecommunications provider has been in the news for all the wrong reasons amid consumer complaints and transition challenges following FTR’s property acquisitions from Verizon Communications Inc. (VZ ). Despite the transaction being announced two years ago and closing this past April, the hand-off has been less than smooth. To learn more about FTR’s company profile, navigate to the following page.

The stock, which has emerged as a strong dividend play, was recently listed as the fifth-most-shorted S&P 500 company, based on settlement data collected through November 30. While the company has joined in on the post-election rally, its performance has dwindled this week despite new record highs for the S&P 500.

For the latest dividend news and analysis about FTR or other dividend stocks, visit our News section.

The Bottom Line

Improving fundamentals in the energy markets and seasonal exuberance have kept the equity markets red hot in recent weeks. The macroeconomic outlook is unlikely to change before the new year, giving strong dividend plays in key sectors scope for further gains.

For more dividend news and analysis, subscribe to our free newsletter.