What a difference a year makes. Unfortunately for the Ford Motor Company (F ), the difference has been bad.

After the recession, Ford seemed to have its act together. As the only automaker that didn’t receive a bailout, Ford managed to grind forward on its lineup of award-winning cars and trucks. Sales remained swift and those hefty sales gains culminated last year with a record boost in total worldwide sales.

Then they proceeded to fall off a cliff.

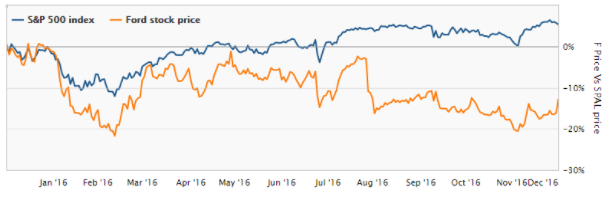

And investors have not been pleased with the lack of sales. The worries about declining global sales have resulted in a major decline in Ford stock. F has managed to lose roughly 16% year to date. The positive in all this: Ford is now trading at a forward P/E of 5 and a dividend yield of nearly 5%. Check out “The Complete History of Ford: Income, Price and Dividends” for more information.

The real question is if F is the ultimate value or the ultimate value trap. The answer may not be so simple.

Goodbye Boom Times

The last six years have been great for Ford. Since the recession, auto sales in the U.S. have risen steadily upwards as consumers took advantage of new deals, new models, and cheap credit. Nearly every month of report, vehicle sales figures showed a meaning increase. Then the cracks started to form. Whatever pent-up demand that existed because of the recession was spent, and then auto sales began to nose-dive. (Earlier this year, Ford announced a $1 billion special dividend. Check out our analysis here.)

During August, Ford managed to realize an 8.8% decline in sales to only 213,000 vehicles sold. Sales of passenger cars fell by more than 25% for the month. In September Ford again realized a sharp decrease in the number of vehicles sold, and October and November also showed sales drops – although November’s was better than predicted. Driving that “beat” was truck and SUV sales. The rest of Ford’s lineup continued to see sales drop-offs.

These sorts of sales missteps are enough to make any investor cringe. But when analysts began saying the end of the auto boom is here, investors started to panic. For Ford, the panic got even larger as it saw market share and sales slip in Europe, as well.

In the end, the downward trend that started midsummer has only accelerated in recent months. Just take a look at this chart comparing F to the broader S&P 500. No “Trump bump” here.

That sheer drop and poor return in F stock does have a silver lining. Ford is now very cheap and yielding quite high. Even with the sales declining, Ford is still profitable. As such, it has a P/E ratio. In this case, that P/E is a rock-bottom 7. It’s only 5 on a forward earnings basis. But Ford still has the ability to pay and cover its dividend, which is now yielding close to 5%.

These are tantalizing numbers for any value investor. But there is the potential for Ford to be a so-called value trap. There needs to be some growth ahead. And there may be some places where it can find that needed boost.

You can check out our special dividends page to get a list of all stocks that recently announced a special dividend. To learn how to make sense of the table, check out our analysis of special dividends, which will explain why the order of the various dividend dates is not that important when special dividends are announced.

Asia and Trucks

For Ford, the secret to its future success could be the dueling economies of China and India. It’s no secret that China and India are fast-growing emerging markets with large, growing consumer basis. Ford has managed to get a foothold in these markets and has really begun to see real results from its efforts.

Ford’s China sales are still up by double digits this year as its citizens have followed their American counterparts and begun buying SUVs. Just looking at trucks and other multi-passenger vehicles, sales in China have increased by 18% year to date. India has also seen its sales rise. However, in India it was all about cars rather than SUVs. Looking year over year, revenues in the Asia-Pacific region managed to grow by 16% during the third quarter to reach $3 billion in sales. While that number is much smaller than Ford’s total North American revenue, it is growing much faster.

Translating Back to Share Price Increases

As mentioned above, sales of SUVs and trucks are the only segment in the U.S. that is increasing, which is actually not such a bad thing, as they come with a much higher profit margin than smaller cars. Even though total vehicle sales are lower, Ford is making more per car.

So Ford does have some growth and additional profit potential. The key is trying to figure out how it can translate that potential into real share prices. With such a low P/E, many investors have basically left the stock for dead.

The problem is that Ford may be too cheap. Solid dividend stocks need to trade at the valuation that the broader market gets in general. This helps on a total return basis. Too low and it signals that the market doesn’t think anything of Ford. But given its poor earnings outlook for next year, the low P/E and share price might be justified. It’s going to take some really big gains to move the needle at F. Unfortunately, China, India and SUV sales aren’t enough. Investors may just be stuck with that high dividend.

The Bottom Line

After big declines amid sales issues, Ford is trading for peanuts. The problem is that there’s not enough “oomph” to pull shares out of the doldrums. That firmly puts F sock in the “don’t buy” camp. However, if you have a very long timeline, scoring a 5% dividend may not be that bad. Just don’t expect too much share price appreciation.

Track the dividend yields, ex-dividend dates and pay dates of all auto manufacturers on our dedicated page.