Stress. Everyone suffers from it, at one time or another. So, too, does your portfolio. From central bank dealings and global economic growth concerns to company-specific events, stocks can suffer from stress just as much as we do. And while that may not be a problem for those in it for capital gains, for those who need income from their portfolios that stress can put a damper on their plans.

To that end, many dividend investors put plenty of stock in the so-called “payout ratio”.

However, a humble payout ratio may not be enough to protect one’s income when things take a turn for the worse. For that sort of scenario, you need a different kind of stress test.

Focusing on Dividend Coverage

Investors generally focus on the payout ratio when evaluating dividend stocks. Essentially, a stock’s payout ratio is the measurement of the amount of profits a firm hands back to investors as dividends. So, if a firm has a payout ratio of 45%, it’s basically sending 45 cents of every dollar it makes back to investors as dividends. The concept of shareholder yield is similar, as it also adds buybacks to the mix.

Dividend investors tend to like payout ratios, because they show how much wiggle room a firm has to raise its dividend. The previous example shows that a stock still has 55 cents of cash coming in as profits to play with.

The problem is that a payout ratio assumes either a stock’s earnings will stay static or will grow every quarter. Even the best firms can’t make that happen. Especially when the stresses of operation take place. All it takes is a well-timed recall, lawsuit, failed merger or environmental issue to wreak havoc on a quarterly report. Under that scenario, a comfortable payout ratio of 45% may jump to a high and scary 75%, simply because it earned less from a few one-off charges.

With that in mind, the favored payout ratio may not be the best – and certainly not the only – metric to use.

For a true stress test, investors may want to familiarize themselves with the meatier dividend coverage ratio.

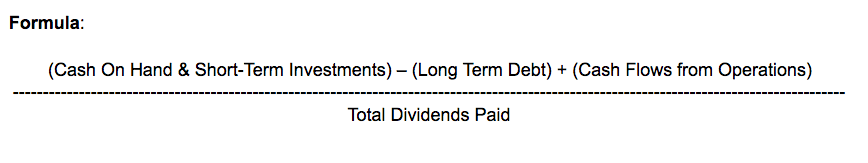

A dividend coverage ratio shows how secure a dividend is based on the cash flows generated by the company. The simple way to calculate it is to divide cash flows per share by dividends per share. A more complete version of the metric can be done by adding up cash and short-term investments on its balance sheet, then subtracting out long-term debt. Adding this net cash to free cash flows and dividing by dividends paid.

Either way, the higher the number, the better. Most analysts point to dividend coverage ratios of 1.2, or even 1.5, as being in the “safe” category.

A Dividend Coverage Example

With iPhone and other device sales exploding, Apple (AAPL ) continues to be a favorite among investors. But what about that 2.11% dividend yield? Can Apple keep the goods coming? Let’s check its dividend coverage ratio to see.

Looking at AAPL’s latest annual report, we see that cash-on-hand and short-term investments totaled nearly $41.5 billion. Remember, we’re just looking at readily available cash, not long-term investments. Apple’s debt totaled $53 billion and it’s generating roughly $81 billion in cash flows from operations. Adding it all together, we get roughly $69.5 billion. When divided by the amount of dividends paid ($11 billion), we see that Apple’s coverage ratio is a very healthy six times its dividend. There’s no need to worry about Apple if it runs into trouble.

But, what about the rest of the Dow Jones Industrials?

Four More That Passed

Microsoft (MSFT ): Mr. Softy’s dividend coverage ratio provides it with ample room to keep paying its dividend. Like Apple, that high coverage ratio comes courtesy of its enormous cash balance and low CAPEX spending requirements. For tech firms, there really isn’t much overhead, except for labor costs. In the case of Microsoft, it’s mostly salary for programmers and other software engineers.

Cisco (CSCO ): Notice a trend here? Like its fellow technology Dow components, CSCO scores high on the coverage front. The firm more than covers its dividend and debts, CAPEX requirements and other needs by roughly 12x when including its liquid short-term investments. And that should only rise further as CSCO continues to offer services other than networking gear.

Pfizer (PFE ): Drug development is like tech in that ongoing CAPEX spending is predictable and quite small. As a result, PFE reaps large operating cash flows. That coupled with its large cash balance enables the pharmaceutical firm to cover its debts and dividends by 1.29×. It isn’t a massive coverage ratio, but it is enough to help it get by if things got rough.

Visa (V ): It’s amazing what zero debt can do for you. With a long-term debt balance of zero, Visa more than covers its dividend payout and CAPEX spending with cash on hand. However, when you add operating cash flows back into the equation, V is able to cover its total dividend payout by over 13 times.

Five That Failed

Walmart (WMT ): WMT may be the world’s largest retailer, but in terms of its dividend coverage ratio, it’s a bit lacking. The firm’s cash on hand and operating cash flows just barely covers its high debt and dividend payout. The combination actually gives Wal-Mart a negative dividend coverage ratio of 0.36×.

Travelers (TRV ): On the surface, Travelers scores pretty low on the dividend coverage ratio front, with a negative score of 3.4×. That’s mostly due to TRV’s very low cash balance. However, as an insurance company, the firm has the bulk of its cash tied up in long-term investments via its large float. Adding those back into the equation, TRV easily covers its dividend and debts. But, only looking at cash, it comes up short.

General Electric (GE ): The good news is General Electric has nearly $70.48 billion in cash and short-term investments on its balance sheet. The bad news is it has nearly double that in long-term debt. Adding in the firm’s double-digit operating cash flows, GE still manages to have a high negative coverage ratio.

Chevron (CVX ): It’s no secret that oil prices have hit energy stocks hard, and Chevron is no different. However, CVX is still a cash-flow machine. Based on its last annual report, Chevron is barely covering its debts, CAPEX spending, and dividends from its operating cash flows and cash on hand. CVX is only covering them by a negative 0.35×. Not too shabby considering how far oil has followed.

Coca-Cola (KO ): For beverage giant Coca-Cola, the problem isn’t that it is not covering its debt and dividend payments, but rather that the firm is only covering 35% of its dividend payments. Unlike the others, Coke is at least able to meet some of its dividend requirements under a coverage ratio metric.

Should You Be Worried?

With many dividend stalwarts on the list of firms that didn’t make the grade, should investors be worried? The answer is maybe. The real downer for these firms (and many others in the Dow and S&P 500) comes down to their hefty debt balances. Those balances could come back to bite if circumstances take a turn for the worse, or if there’s another financial crisis. Their low, or in some cases negative, coverage ratios highlight the problem.

Does that mean they are going to cut today? Or even tomorrow? Most likely not. The firms listed here are still relatively profitable overall. Investors, however, should not be surprised if they do cut their dividend payments.

The Bottom Line

The dividend coverage ratio is another tool dividend investors should be using in tandem with the more famous payout ratio. The metric is an ideal way to tell if your stock can keep its dividend going, if there are off-charges, or other negative events. All in all, it’s another window into a stock’s dividend health.