Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Stable utility companies and gold stocks have dominated our weekly list after Britain’s decision to leave the European Union took the markets by surprise. AT&T (T ), utility companies, and water utilities are all present in the list, along with safe haven gold companies. However, the first spot has been claimed by real estate company New Residential Investment Liquid error: internal.

New Residential Investment: Provider’s Woes Bite

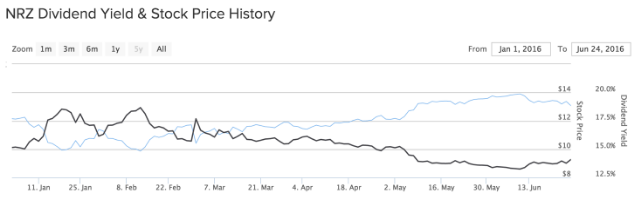

New Residential Investment has been visited by 75% more visitors this past week than the same period a week ago, likely attracted by the real estate operator’s hefty dividend payout and low valuation. The company’s shares have fallen nearly 5% in the past five days, but they are still up more than 5% since the beginning of the year.

The mortgage firm’s low valuation is not surprising. A large part of its portfolio consists of excess mortgage servicing rights (MSR) acquired from Ocwen Financial (OCN), which has seen its shares drop 77% since the beginning of the year on the back of investigations into the company’s business practices by the US Securities and Exchange Commission. Despite the headwinds, New Residential’s revenues and dividend payments have not taken a hit so far, but investors worry that it may not be like that for long if Ocwen hits the skids. New Residential confirmed its $0.46 per share quarterly dividend on Monday. Annually, the mortgage firm yields an astonishing 14.4% dividend.

The real estate company is expected to gain from a rising interest rate environment because homeowners are less likely to refinance their mortgages, keeping stable its income stream from excess MSRs. At the moment, however, a new rate hike seems remote in the United States, given the shocking result of the UK referendum on staying in the European Union. Britain’s voters elected to leave the bloc last Thursday, sending the global stock markets into a tailspin and bringing uncertainty in the medium term.

Utilities Sector: Brextending Gains

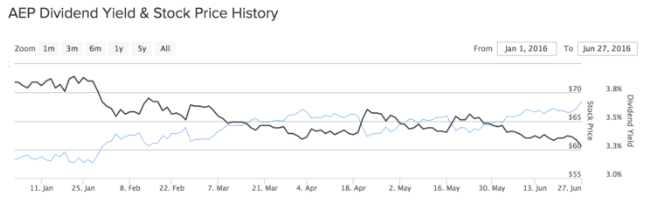

Our page covering top dividend utility stocks has seen its traffic rise 36% this past week, as many of these stable companies have performed well in the post-Brexit turmoil. For example, the Dow Jones Utility Average has jumped 1.5% in the past five days, while the Dow Jones Industrial Average has tumbled nearly 4% in the same period. One of the main Dow Jones Utility components, $34 billion market capitalization American Electric Power (AEP ), has risen nearly 3% following the Brexit debacle, extending year-to-date gains to more than 17%.

Many of the high-quality utility stocks have been boosted by Britain’s decision to leave the European Union on Thursday, as other risky assets slid down considerably. Investors have been in search for stocks that do not face the risk of deteriorating businesses in a challenging macroeconomic environment. However, not all utility companies gained from the mayhem. Energy infrastructure companies have tumbled, given oil’s decline in the past five days on expectations of lower demand following the Brexit referendum. For example, American Midstream Partners (AMID), an oil and gas storing and transportation company paying a 14% annual dividend, edged down 3.5% last week.

Water Utilities: Thirsty for Stability

Water utility companies have risen over the past few days for the same reasons electric infrastructure companies posted good performance: investors have been in search of stable dividend-yielding companies in the aftermath of the Brexit sell-off. Our page covering 10 dividend water utility companies has seen its viewership jump 35% this past week compared with the last one. This is hardly surprising. Unlike the broad utilities sector, which posted disparate performance post-Brexit, water companies have all risen in the past week. For instance, Artesian Resources (ARTNA ) has jumped more than 5% over the past five days, extending year-to-date gains to as much as 19.4%.

Artesian Resources pays an annual dividend of $0.89 per share or 2.68%, which is the highest among the top 10 water companies.

Gold Dividend Stocks: Seeking Shelter

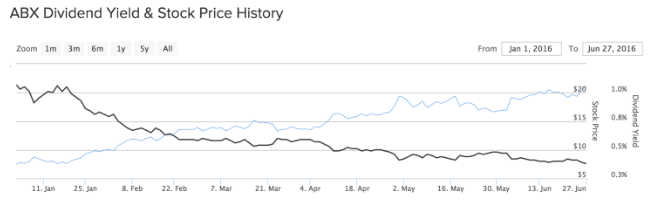

Our page tracking companies digging gold out of the ground has seen its traffic rise 35% this past week for obvious reasons. The precious metal soars in times of turmoil, and the surprising decision by UK voters to exit the European Union has provided a propitious environment for the shiny metal to log a great performance, boosting companies extracting gold. Barrick Gold (ABX), the Toronto-based mining giant, has risen more than 7% since the beginning of the year, extending year-to-date gains to as much as 180%.

The increasing demand for gold comes amid a fragile global economy, which has been further undermined by uncertainty caused by the Brexit referendum. Britain’s already slowing economy is facing the prospect of recession following the vote, while the euro area’s tepid recovery could be put at risk. The eurozone’s GDP grew by 0.6% last quarter compared with the previous one, and Britain’s economy rose by 0.4% over the same period.

AT&T: Brexit Helps

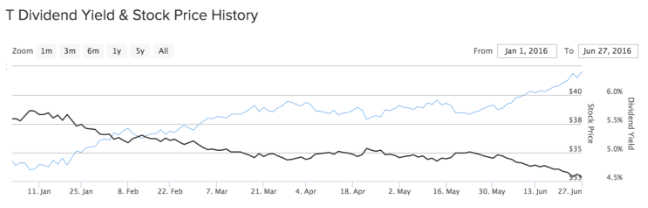

Telecommunications giant AT&T (T ) has taken last place in our weekly list with a 28% increase in viewership. The company has weathered the Brexit mayhem, unlike other telecommunication companies mainly exposed to Europe. AT&T has risen about 3% in the past five days, bringing year-to-date performance to 22%.

The company looks attractive for its healthy dividend yield of 4.6%, which is slightly above the technology average. But the telecommunication giant is grappling with fleeing customers at its core wireless business, while it has yet to integrate its recent $49 billion acquisition of pay-TV provider DirecTV. Investors are optimistic for now, and the company must prove in the coming quarters that their cheering was not in vain.

The Bottom Line

This week has been all about Britain’s shocking decision to leave the European Union. Many assets have fallen precipitously in the aftermath of the vote, but our readers maintained focus on those that are less volatile during periods of uncertainty. Utilities, water utilities, and gold dividend companies are all present in this list and have logged gains in the past week. Telecommunication company AT&T has also risen, as its lack of exposure to the European countries proved a boon this time around. But first in our list is a high-dividend mortgage company, New Residential Investment, which appears extremely undervalued because one of its providers is being investigated by the US authorities.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.