Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, readers have shown an interest in the banking stocks, with two lenders present in our list of trends for contrasting reasons. While Bank of Montreal (BMO ) has been paying a healthy dividend and experienced a rising stock price, HSBC Holdings (HSBC ) has suffered lately, with its turnaround efforts and high dividend failing to boost investor confidence. Meanwhile, Target (TGT ) has topped our list as it stirred controversy with its bathroom policy, while Residential REITs took the third place for their mixed performance.

Traffic Rise over this Past Week (%)

Target: Under Pressure

Our page tracking giant retailer Target (TGT ) saw its traffic rise as much as 60% in the past week, as the company hit the headlines with an earnings report that confused investors and a controversy over its bathroom policy.

Although the company beat earnings estimates by $0.10 for the quarter ended April 30, a weak guidance and slowing sales has battered the stock, down nearly 7% since the report was released on May 20.

The weak earnings report could be largely blamed on two factors: Amazon (AMZN) and its bathroom policy. Firstly, Target is the brick-and-mortar retailer mostly exposed to competition from Amazon, given that it gets the bulk of its revenue from commercializing non-perishable items. And Amazon reported a bumper earnings report for the first quarter, with sales increasing 28%. By contrast, Target’s overall sales fell 5%, although that could be attributed to the company’s disposal of its in-store pharmacies to CVS. Still, evidently that was not a good enough reason to soothe investors’ concerns, particularly given management’s lowered outlook for the next quarter. It now expects growth in comparable sales to be in a range between 0% and 2%.

But that was not the whole story. More than one million customers signed a pledge to boycott the retailer after it instituted a policy to welcome transgender customers to use any bathroom or fitting room that matches their gender identity. Following this incident, the retailer’s popularity fell 6% among customers, according to a report by Business Insider . However, management made clear that the weather was to blame for the poor results, not the new policy. That explanation lost its credibility after Wal-Mart Stores (WMT ) posted strong sales and profits on the back rising sales.

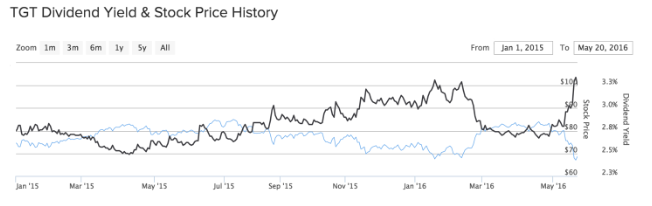

As can be seen from the chart, Target’s annual payout has increased 3.3% following the stock’s recent decline. The company is also trading at a lower earnings multiple (13) than many of its peers, including Wal-Mart (15) and Costco Wholesale (COST ) (27).

HSBC Holdings: No Bottom in Sight

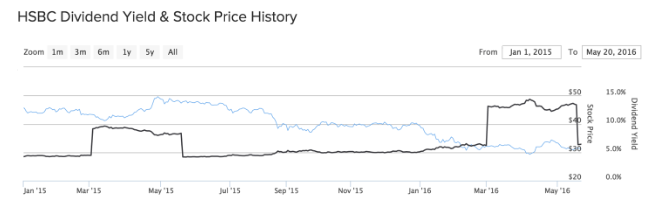

HSBC Holdings (HSBC ) garnered readers’ interest in the past week, with the page tracking the Asia-focused bank seeing its traffic increase about 55%. The bank, along with the entire banking sector, has been battling bad publicity, falling revenues, and investors’ discontent with cost-cutting measures and turnaround efforts. HSBC’s stock has fallen about 20% since the beginning of the year, while its annual dividend payout has steadily risen to 6.4%. In the first quarter of the year the company maintained its tradition of paying a higher dividend than in other quarters – $1.05 per share. For the next quarterly periods it is expected to pay $0.50.

The company posted better-than-expected earnings results in the latest quarter, with pretax profit of $6.1 billion comfortably beating estimates of $4.3 billion. Still, these figures were down compared to the same period last year, when the bank reported $7.1 billion, and revenue also fell by 6%. The bank beat expectations largely because its cost-cutting initiatives announced last year are beginning to prove their worth. The company fired about 6,000 employees as part of its plan to cut 8,000 jobs by the end of 2017.

Still, whether the stock has hit bottom is a matter of debate, particularly given the bank’s focus on Asia. The company faces an increasing risk of hitting the skids, with the Chinese economy showing signs of weakness. Particularly worrying is the country’s rising debt combined with a growth slowdown.

REIT Residential: New York Bites

About 13% more users visited our page tracking Residential real estate investments trusts in the past week compared to the week-ago period. The growth in viewership has taken place in a context in which many REITs issued mixed earnings reports.

Buoyed by a recovering residential market, a large swathe of REITs have seen their shares rise since the beginning of the year, with New Residential Investment Liquid error: internal and New York Mortgage Trust (NYMT ) rising 10 and 5%, respectively. But America’s largest multifamily landlord, Equity Residential (EQR ) , has been hit by a weak luxury market in New York. As a result, its shares have dropped more than 17% year-to-date.

Bank of Montreal: A Rare Bright Spot

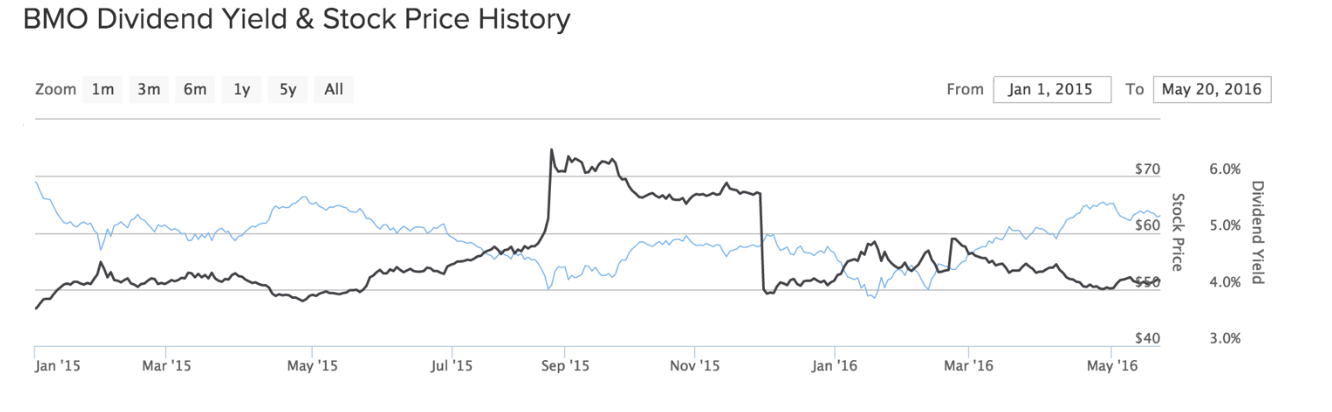

Arguably, Bank of Montreal (BMO ) has been one of the few bright spots in a banking industry that has been grappling with weak investor confidence and a bad economic environment. The company has recently reported excellent earnings, which helped propel its stock to near two-year highs. In light of this performance, viewership of our page tracking the stock increased 12% compared to the past week.

The bank’s net income increased 13.2% in the first quarter, despite fears that its results will suffer because of Canada’s weak oil industry and feeble housing sector. But the lender has been resilient in the face of these headwinds on the back of its relatively diversified revenue streams. Bank of Montreal pays an annual dividend of 5.3%.

The Bottom Line

Banking stocks Bank of Montreal and HSBC Holdings both pay a healthy dividend, but their prospects vary considerably. While the former is poised to benefit from a recovering Canadian economy, the latter is expected to suffer because of uncertainty plaguing the Asian economies, particularly China. Target, the giant US retailer, has been inflicting unnecessary wounds on itself with a bathroom policy that got many worried about their security, in addition to facing a serious competition threat from Amazon. Finally, Residential REIT’s have been boosted by a recovering housing sector, but those exposed to the luxury New York market were hurt by a supply glut.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.