Toronto-Dominion Bank (TD ) reported its first quarter results before the opening bell on Thursday morning, posting slightly higher earnings than last year’s Q1.

TD's Earnings in Brief

- Toronto-Dominion Bank reported first quarter adjusted net income of C$2.12 billion, up from last year’s C$2.02 billion.

- Adjusted EPS for the quarter came in at C$1.12, compared to last year’s Q1 EPS of C$1.06.

- Q1 revenue came in at C$7.6 billion, which is up slightly from last year’s Q1 revenue of C$7.57 billion.

- TD matched analysts’ EPS estimates of C$1.12, while revenues came in above the C$7.13 billion estimate.

CEO Commentary

TD CEO Bharat Masrani had the following comments: “We are pleased with our start to 2015, with adjusted earnings of $2.1 billion , up 5% from the same quarter last year. Our results reflect strong retail earnings on both sides of the border and strong fundamentals.”

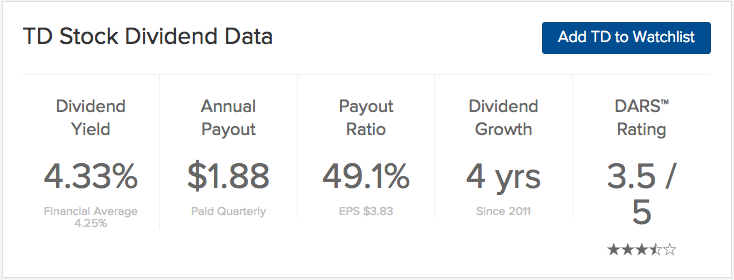

TD Raises Dividend

TD Bank raised its quarterly dividend to C51 cents per share from its previous payout for C47 cents per share. The dividend is payable on and after April 30, 2015, to shareholders of record at the close of business on April 7, 2015.

Stock Performance

TD stock was up 73 cents, or 1.68%, in pre-market trading. YTD, the stock is down 9.08%.

The Bottom Line

Toronto-Dominion Bank (TD ) is recommended at this time, holding a Dividend.com DARS™ Rating of 3.5 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.