Target (TGT ) reported its fourth quarter results before the opening bell on Wednesday morning, posting higher adjusted earnings than last year, despite its $5.1 billion pre-tax loss related to its discontinued Canadian operations.

TGT's Earnings in Brief

- Target reported fourth quarter sales of $21.75 billion, marking a 4.1% gain over last year’s Q4 sales of $20.89 billion.

- The company posted a net loss of $2.64 billion, or $4.10 per share, due to its discontinued Canadian operations, but on an adjusted basis, TGT’s EPS came in at $1.50, up from last year’s Q4 adjusted EPS of $1.31.

- TGT beat analysts’ estimates of $1.46 EPS on revenues of $21.64 billion.

- Looking ahead to Q1, Target sees EPS between 95 cents and $1.05, while analysts expect $1.04.

CEO Commentary

Target’s chairman and CEO Brian Cornell had the following comments: “We’re pleased with our fourth quarter financial results, which were driven by better-than-expected sales and particularly strong performance in our signature categories-style, baby, kids and wellness. We’re seeing early momentum in our efforts to transform Target, and our team is entering the new fiscal year with a singular focus on continuing to differentiate our merchandise assortment and shopping experience while controlling costs by reducing complexity and simplifying the way we work. We’re confident that these efforts will allow us to grow our earnings while returning cash to our shareholders in 2015 and beyond, driving improvements in Target’s return on invested capital and creating long-term value for our shareholders.”

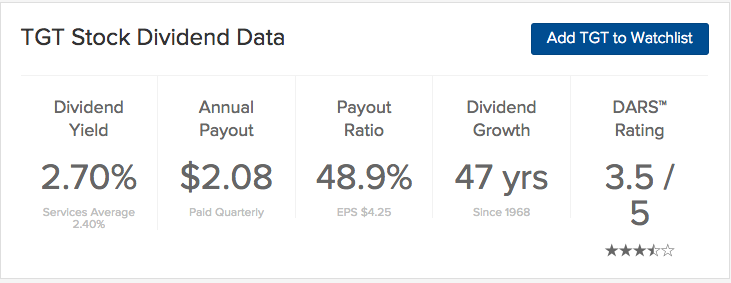

TGT's Dividend

Target will pay its next quarterly dividend of 52 cents on March 10. The stock went ex-dividend on February 13.

Stock Performance

TGT stock was down 5 cents, or 0.6%, in pre-market trading. YTD, the stock is up 1.37%.

The Bottom Line

Target (TGT ) is recommended at this time, holding a Dividend.com DARS™ Rating of 3.5 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.