After Tuesday’s closing bell, the Walt Disney Company (DIS ) reported a strong earnings beat, causing its shares to skyrocket in after-hours trading.

DIS Earnings in Brief

- Disney reported earnings of $1.27, easily beating analyst estimates of $1.07 and increasing 23% year-over-year.

- Revenues came in at $13.39 billion, topping the Street’s mark of $12.85 billion.

- Parks and Resorts revenues jumped 9% for the quarter to a total of $3.9 billion.

CEO Commentary

Chairman and CEO Robert Iger had the following comments: "This was yet another incredibly strong quarter for our Company, with diluted EPS up 23% driven by record revenue as well as significant growth in segment operating income. Our results once again reflect the strength of our brands and high quality content and demonstrate that our proven franchise strategy creates long-term value across all of our businesses.”

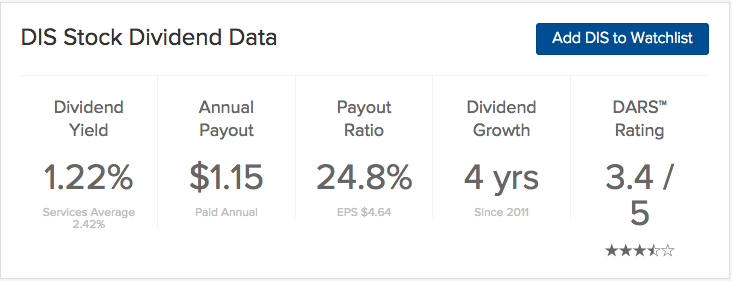

DIS's Dividend

No mention was made of the company’s dividend. The company pays an annual dividend, which we expect to be declared in late November or early December this year.

Stock Performance

Shares of DIS jumped as much as 3% in after-hours trading after an already strong trading session.

The Bottom Line

Disney (DIS ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.