Before the opening bell on Wednesday morning, Wells Fargo (WFC ) reported its fourth quarter results, posting slightly higher earnings and revenue compared to last year’s Q4.

WFC's Earnings in Brief

- Wells Fargo reported fourth quarter revenues of $21.4 billion, which is up from last year’s Q4 revenues of $20.7 billion.

- Net income for the quarter came in at $5.7 billion, or $1.02 per share, up from last year’s Q4 figures of $5.6 billion, or $1 per share.

- WFC met analysts’ EPS estimates of $1.02, while revenues beat the $21.2 billion expectation.

- For the full-year, WFC reported revenue of $84.3 billion and EPS of $4.10, which are both up from 2013’s figures.

CEO Commentary

Wells Fargo Chairman and CEO John Stumpf had the following comments: "Wells Fargo had another strong year in 2014, with continued strength in the fundamental drivers of long-term performance: growing customers, loans, deposits and capital. As a result of this performance, we were able to return more capital to our shareholders during the year. Our success is the result of our 265,000 team members remaining focused on meeting the financial needs of our customers in the communities we serve. As the U.S. economy continues to build momentum, I’m optimistic that our diversified business model will continue to benefit all of our stakeholders in 2015.”

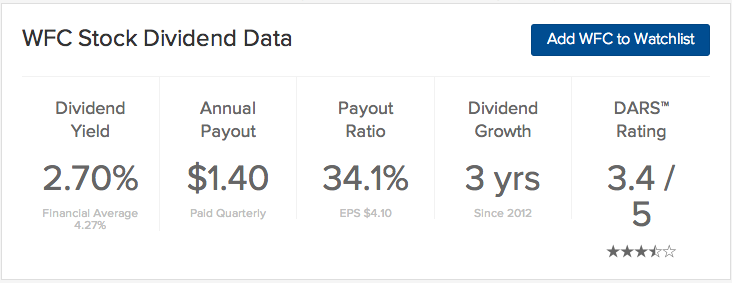

WFC's Dividend

Wells Fargo paid its most recent 35-cent quarterly dividend on December 1. We expect the company declare its next dividend in the coming month.

Stock Performance

WFC stock was down 61 cents, or 1.18%, in pre-market trading.

The Bottom Line

Wells Fargo (WFC ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here