Casinos are not very complicated to understand. You don’t have to be an industry analyst to know how they work. Of course, these days casinos are more like resorts, with plenty to do for the whole family; from the shopping and the Cirque du Soleils, to the David Copperfields, the lavish hotels, and the synchronized fountains. And, of course, daddy gets to sneak out late to get rich (yeah right!).

All of those opportunities for consumer spending makes the gambling industry an interesting place for dividend investors.

The Gambling Saloon

That’s not how it used to be back in the day, though. In fact, the word “casino” has nothing to do with gambling; it just means a villa or a summer house. Gambling houses were actually called “saloons” in the 1700s! Barring the convenient but soulless electronic betting counters, the games have pretty much stayed the same since then. The legal and societal acceptance, however, is a fairly recent phenomenon. What used to be a social menace slowly turned into an economic contributor to civil projects and an artistic contributor to our cultural sophistication.

The House Edge

Since people go to casinos to “gamble away their money”, you’d think these companies would have sky-high profit margins. After all, do you know anyone who beats the house every time? I don’t. And you’d be wrong if you thought so.

In reality, many of these companies have fairly modest margins. Take Melco Crown Entertainment (MPEL) and Wynn Resorts (WYNN ), for example: both are fairly large, established companies and yet they clocked in less than 10% profit last year. Breaking down the business it’s easy to understand why; many are not actually gambling companies but rather real estate companies that own and rent out properties (meaning large interest payments and long-term debt). They are also entertainment companies that often produce spectacular shows that are not only very risky but also costly. Las Vegas Sands (LVS ) spent more than $1.4 billion on "SG&A” (read: sales, marketing, administration) last year alone.

Even so, such companies still earn billions of dollars (bottom line) because of their multi-billion dollar top lines, and they have gigantic cash reserves (e.g. WYNN: $2 billion, LVS: $3.5 billion). This means they always have the option to dip into reserves to declare healthy dividends if they need to. Further, casino-related publicly traded companies are often known to be decent dividend payers, which is especially important because “casino stocks” have taken a bit of a beating in the last year or so.

Let’s do some numbers (circa mid-August 2015) to shed some light and see if our assumptions are true:

- Las Vegas Sands (LVS ): $46 billion market cap, with $3.5 billion in cash reserves, an 18% profit margin and a 4.6% forward dividend yield (4.98% trailing).

- Wynn Resorts (WYNN ): $10 billion market cap, with $1.8 billion in cash reserves, a 9% profit margin and a 2% forward dividend yield (2% trailing).

- Melco Crown Entertainment (MPEL): $12 billion market cap, with $3 billion in cash reserves, $4 billion in revenue, a 7% profit margin, and a forward dividend yield of 0.6% (0.23% trailing).

- Churchill Downs (CHDN ): $2.4 billion market cap, with $95 million in cash reserves, $1 billion in revenue, 4.31% profit margins, and a forward dividend yield 0.7% (0.73% trailing).

- Gaming and Leisure Properties (GLPI ): $3.8 billion market cap, with $35 million in cash reserves, $643 million in revenue, 29% profit margins, and a forward dividend yield of 6.6% (6.50% trailing).

- International Game Technology (IGT ): $3.9 billion market cap, with $3.6 billion in revenue, -6.5% profit margins, and a dividend yield 4.5% (4.11% trailing).

Note: Forward dividend yield is an annualized estimate (not a guarantee) based on a company’s most recent actual dividend paid. Trailing number shows how much companies have previously paid.

Calculating Your Odds

Obviously, almost all of the above companies have set good dividend expectations and certainly have the cash reserves to dip into in case they don’t meet their profit target (which has not been the case for many of them). However, making investment decisions based on one factor in isolation is no different than gambling (the core business of the companies we are talking about: wink wink, nudge nudge).

Investors definitely need to evaluate whether or not the future holds bright for the stock price. You don’t want to make 3% on dividends when a stock falls 10% in the same period. And to judge that you must consider such elements as the performance of the industry, whether or not the stock is undervalued or overvalued (e.g. comparing P/E ratios), read the investment sentiment, understand the current business cycle (since this sector serves “wants” rather than “needs”), and more.

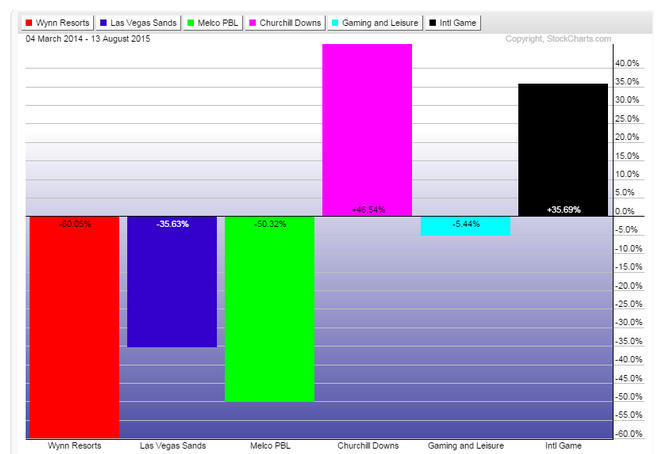

Let’s see how investors did last year. The below graph show how the above stocks performed:

This definitely changes the view of dividends, doesn’t it? CHDN might have given the lowest dividend returns but its capital gains far outperformed any other stock’s return from our consideration set. LVS and WYNN might have given more than 4% dividends, but they pale in comparison to what investors would have lost by owning those stocks in the past year.

An interesting thing to note here is how the industry has expanded out of Las Vegas, and as a result, is not as dependent on business cycles as it used to be. At least, that’s what the general agreement seems to be. As laws are loosened, more and more casinos are coming up closer to big cities. Middle class families can drive down instead of flying down to get to their “Vegas vacation”. Of course, this has been happening for the last 20-30 years and has finally reached what many are calling a saturation point. Gambling revenues have fallen not just in Vegas, but also in other states like New Jersey. In fact non-gambling revenues have long overtaken their gambling cousins even in Las Vegas.

The Bottom Line

As gambling revenue declines and companies diversify, it’s not fair to judge them as purely gambling stocks. Investors must read through income statements to see how these companies are making their money and what kind of investments they are making for the future. In the end, as the harsh investment world often reminds us, logic doesn’t always prevail in the investment sector. So, I will leave you with this question: since some gambling stocks have fallen more than 35% in the last year, is it a good time to buy them back? (Don’t forget they are good dividend stocks too).

Image courtesy of Mister GC at FreeDigitalPhotos.net