Apple Inc. (AAPL ) spent $23.5 billion on buying back shares in the first quarter of 2018, marking the biggest quarterly buyback program in U.S. history. Naturally, income investors are curious about what a share buyback entails and whether it’s the best option for companies with surplus cash.

Let’s have a look at the motive behind share buybacks and explore the implications of buyback activity on investors.

Why Companies Engage in Buyback Activity

Share buybacks are used by corporations to return capital to shareholders. In this way, they are similar to dividend payments, which are the primary vehicle for distributing profits to shareholders. But there are important differences as well.

A dividend is effectively a cash bonus amounting to a percentage of total stock value held by the shareholder. However, a buyback requires the shareholder to surrender stock to the company to receive cash. These shares are pulled out of circulation and effectively taken off the market.

Buybacks allow companies to reinvest in themselves by reducing the number of outstanding shares available. Buybacks benefit shareholders because they usually enhance future earnings per share (EPS), arguably the most important variable in determining share prices. Restricting the supply of outstanding shares also leads to higher payouts and share prices – provided that the company maintains the same level of profitability.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

Apple is one of the biggest proponents of share buybacks, but it isn’t the only company that uses this strategy. Large caps like Amazon.com Inc. (AMZN) and even smaller companies like SolarWinds Inc. (SWI) also deploy buybacks.

Bloomberg estimates that 2018 saw $800 billion in gross buybacks, up from $530 billion in 2017. Buybacks have grown in popularity following the dot-com crash (interestingly, the bulk of the companies using buybacks are concentrated in the technology sector). Bloomberg also notes that more than half (56%) of corporate profits in the U.S. go toward share buybacks.

Moreover, between 2003 and 2012, 449 publicly listed S&P 500 companies allocated $2.4 trillion to buybacks.

Click here to learn more about share buybacks.

Buyback ROI

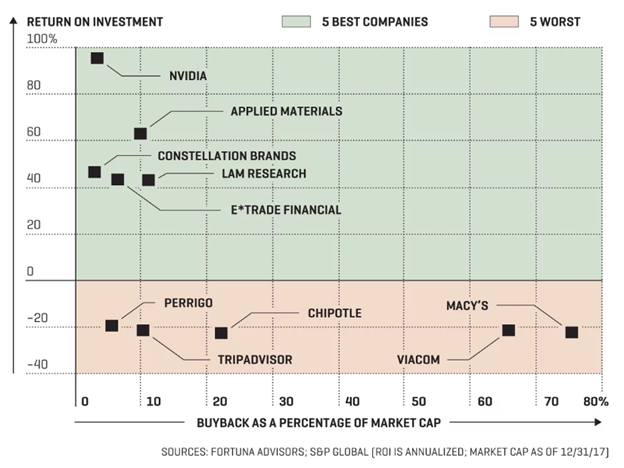

Although share buybacks work in theory, they don’t always translate into higher earnings and overall returns for the investor. One way to determine if buybacks are worth your time is to look at a metric called ‘buyback ROI.’ Developed by Fortuna Advisors, this measure tracks return on investment for stocks after buybacks have taken place.

Between 2011 and 2017, Fortuna tracked 353 companies that spent considerable sums on buybacks. It found that these companies underperformed the market average with a median ROI of just 13.8% including dividends. The S&P 500’s median return was 15.8% over the same period.

As the following chart illustrates, some of the worst performers over that period included Macy’s Inc. (M ), Chipotle Mexican Grill Inc. (CMG) and Viacom Inc. (VIAB ).

Be sure to check here on why companies tend to pair-share buyback with dividends.

Opportunity Costs

There are other, less obvious drawbacks associated with stock repurchases – namely, the money that goes to shareholders could have been reinvested into the company or used for maintenance. Fixed assets and consumer durable goods in the United States are getting older and much harder to maintain. It is estimated that fixed assets are now older than they’ve been at any point since the 1950s. As such, buybacks may take money away from much-needed upgrades

The pace and scale of buybacks since the financial crisis is also becoming an issue, especially among value investors who worry that companies would rather reward shareholders than invest in the future. The problem is that these companies are still spending money – it’s just that they’ve cut capital expenditure and increased their debt load to boost buybacks.

Buybacks are also a useful ploy for executives who are more interested in quarterly earnings statements than the long-term health of the company. It’s well known that buybacks increase demand for a company’s shares and open-market repurchases automatically boost share prices. Temporary or not, this is a useful strategy for executives who are paid in stock options.

It’s no secret that investors like buybacks. After all, these programs boost share prices and lead to improved shareholder value. However, investors need to look beyond the buyback hype before deciding to invest in a company.

If confronted with a company that has a long track record of buybacks, investors should closely monitor whether the share price offers more room to grow. Companies like Foot Locker (FL), Boeing Co. (BA) and Micron Technology Inc. (MU ) are all examples of companies that have employed repurchase strategies without sacrificing long-term growth.

Given the current state of the bull market – rife with overvaluation risks – investors may want to simply avoid repurchases and focus on solid dividend plays with a proven history of payouts.

The Bottom Line

Under the right circumstances, buybacks can improve shareholder value, boost stock prices and translate into useful tax benefits. However, they shouldn’t be viewed as a standalone indicator for a company’s future success. As the case of ‘buyback ROI’ demonstrated, companies that deploy this strategy aren’t necessarily better off in the long run.

Check out our Best Dividend Stocks page by going premium here.